Risk Limits

Risk Groups

Risk groups allow you to set risk limits across accounts in different account structures or hierarchies. For example, as an introducing broker, you can limit the risk exposure of your customers across different carrying brokers by creating a single risk group for your customer's accounts.

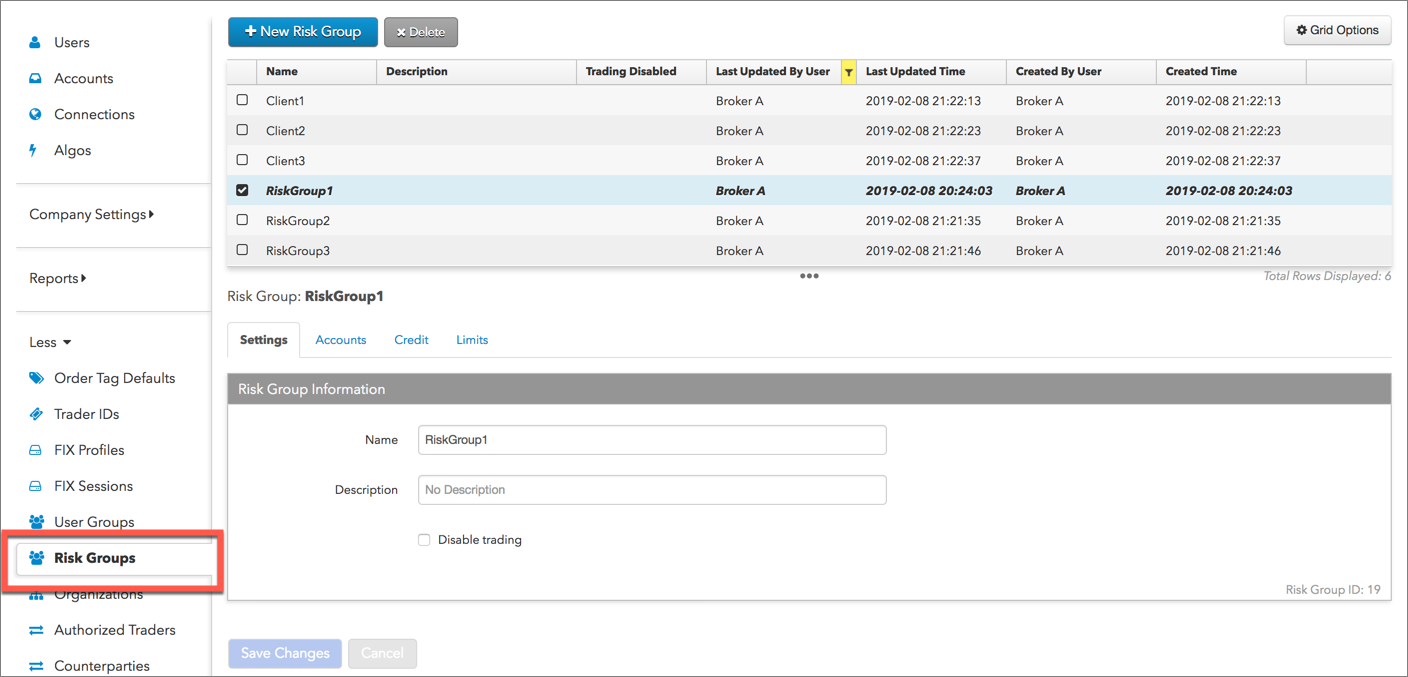

In Setup, you can create and manage risk groups using the More | Risk Groups tab in the left navigation pane.

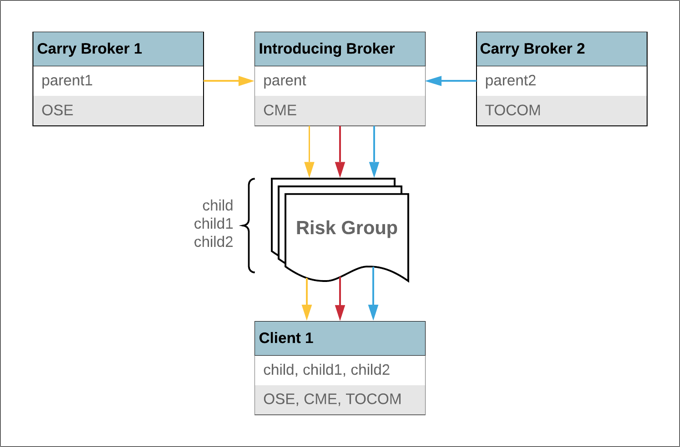

Risk group example

In this example, two different firms acting as carry brokers (Carry Broker 1, Carry Broker 2) share their accounts (parent1, parent2) with an introducing broker, who wants to provide their client (Client 1) with access to OSE and TOCOM. The introducing broker also has a membership with CME and currently provides access to this market with their own "parent" account.

By creating child accounts (child, child1, child2) for each parent account and sharing them with Client1, the introducing broker can create a risk group comprising the child accounts and configure credit and position limits for the group across all three exchanges.

Accounts assigned to risk groups

When assigning an account to a risk group, consider the following:

- Accounts shared with your company cannot be added to a risk group.

- A single account cannot be assigned to multiple risk groups.

- When a parent account is assigned to a risk group, all of its child accounts are also assigned to the group.

- When a child account is assigned to a risk group and then its parent is added to the same group, then the parent will take precedence and the child account is removed from the group.

- If an account is assigned to a risk group and a child account is created for that account, then the child account is automatically added to the same group.

Risk group account management

When managing accounts assigned to risk groups, consider the following:

- When a parent account is removed from a risk group, all of its child accounts are also removed.

- If you clone an account and you select a parent for the cloned account, then the cloned account is also added to the same risk group as the parent account.

- If you change a child account's parent, the child account is removed from any risk group that the old parent was associated with and is mapped to risk groups with the new parent account.

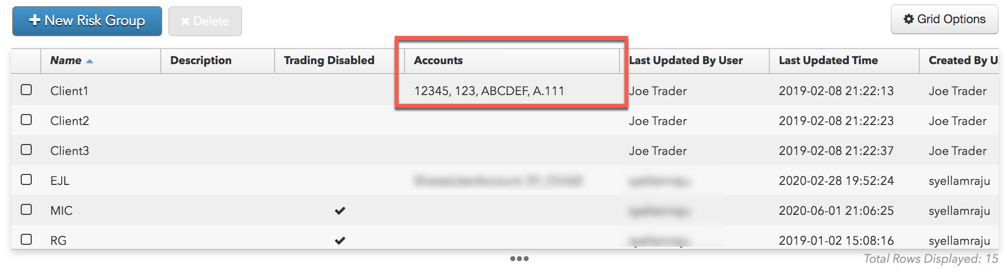

Accounts assigned to a risk group are shown in the Accounts column in the More | Risk Groups data grid.

Credit limits for risk groups

Risk settings are checked for the risk group independently of the accounts assigned to the group. A credit limit set for the group is also applied to its individual accounts.

For example, if the credit limit is $150 for a risk group with three accounts and one of the accounts used the full $150, the other two accounts could not submit orders. Or, if one account used $100 and another used $30, the credit balance in the third account would be $20.