Risk Limits

Credit Loss Actions

Credit loss actions are triggered based on your account balance. The account balance is the available credit calculated at the start of a trading session using the Daily Limit setting plus or minus any realized P\L from the previous session. Margin is not included.

Note: When evaluating an account for credit loss actions, TT only considers the account balance at the start of a trading session and does not consider intra-day updates to this balance unless the Daily Limit setting is manually changed.

As a company administrator, use the settings on the Accounts | SOD/Credit tab to determine what actions to take on an account that exceeds its daily credit limit.

The Credit Loss Adjustment Settings section on the SOD/Credit tab includes options to set an action when available credit falls below a specified percentage based on the Daily Limit (plus or minus any P\L). As a company administrator, you can set a percentage of credit loss as well as the following post trade action(s) to take on an account when its credit loss percentage is breached:

- Disable trading

- Disable trading and delete working orders

- Disable trading, delete working orders, and close open positions (auto-liquidate)

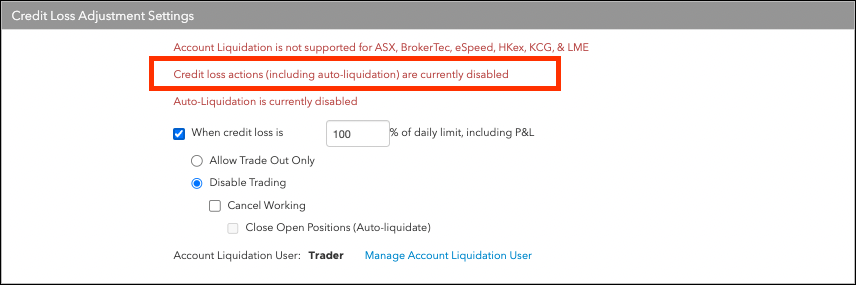

When enabled on an account, these options will be applicable to the account's sub-accounts as well. The option to take these actions based on the credit loss percentage is disabled by default. The automatic liquidation functionality is enabled per account, and is only applied when Credit Check is enabled and when one auto-liquidation user is defined for your company.

How to set up Account Auto-Liquidation

Note: For the auto-liquidate post trade option, enable this functionality for your company by assigning an auto-liquidation user to your company before enabling auto-liquidation on any accounts in your company on the Users | SOD/Credit tab. Auto-liquidation will not start until one liquidation user is assigned. When choosing the auto-liquidate option, you must also set any required exchange settings (e.g., operator ID for example) that are needed to close a position. The exchange will reject liquidation orders without the proper exchange settings.

When enabling the auto-liquidation option for an account, consider the following:

- The auto-liquidate setting can be active only at a single level in an account hierarchy, and is supported only on internal and external routing accounts.

- If auto-liquidate is enabled for an externally routable account and the account is changed later to non-routable, then auto-liquidate is no longer active on that account.

- Auto-liquidate remains enabled and works the same way on shared accounts.

- When triggered on a parent account, the aggregate position is liquidated at the parent account level only.

- If auto-liquidate is enabled on a parent account after it was enabled for a child account, then the child account setting is ignored.

- Ensure that the account with auto-liquidation enabled has the necessary account and connection credentials assigned in order to route liquidation orders to the applicable markets.

- You can enable auto-liquidate for an account owned by another company but shared with your company.

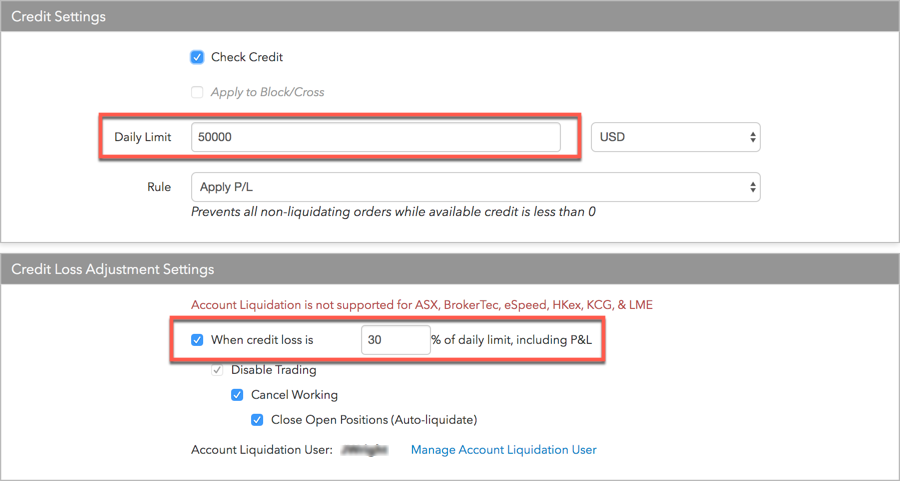

To set up account auto-liquidation:

- Assign an auto-liquidation user.

- Set a credit limit and enable auto-liquidate if available credit falls below a certain limit.

Credit Loss Actions examples

The following examples show how account auto-liquidation is triggered when the account balance falls below a specified percentage based on the Daily Limit plus or minus any P\L.

Example 1: Account Balance = Daily Limit + profit

In this example:

- Daily Limit setting = $50,000

- When credit loss is setting = 30%

- Start of Day (SOD) position = profit of $30,000

Because the Daily Limit is set at $50,000 and the start of day position is a profit of $30,000, the account balance is $80,000 ($50,000 + $30,000). If the account balance loses 30% during the trading session (.3 * $80,000 = $24,000) then auto-liquidate is triggered at $56,000 ($80,000 - $24,000).

Example 2: Account Balance = Daily Limit - loss

In this example:

- Daily Limit setting = $50,000

- When credit loss is setting = 30%

- Start of Day (SOD) position = loss of $30,000

Because the Daily Limit is set at $50,000 and the start of day position is a loss of $30,000, the start of day account balance is $20,000 ($50,000 - $30,000). If the account balance loses 30% during the trading session (.3 * $20,000 = $6,000) then auto-liquidate is triggered at $14,000 ($20,000 - $6,000).

Example 3: Intraday profit and loss

In this example:

- Daily Limit setting = $50,000

- When credit loss is setting = 30%

- Start of Day (SOD) position = profit of 10,000

Because the Daily Limit is set at $50,000 and the start of day position is a profit of $10,000, the account balance is $60,000 ($50,000 + $10,000). If P/L increases by $2,000 during trading, then the intraday "available credit" is now $62,000 ($50,000 + $10,000 + $2,000).

However, if the account balance then loses 30%, then auto-liquidate is triggered based on the start-of-day account balance of $60,000 (.3 * 60,000 = $18,000) and not the intraday available credit of $72,000. So auto-liquidate is triggered at $42,000 ($60,000 - $18,000 = $42,000).

Example 4: Daily Limit updated manually

In this example:

- Daily Limit setting = $50,000

- When credit loss is setting = 30%

If the Daily Limit setting is increased manually from $55,000 to $60,000, and again from $60,000 to $80,000 during a trading session, then the account balance is modified after each increase and is now be recorded as $80,000. If the account balance loses 30% during the trading session (0.3 * $80,000 = $24,000), then auto-liquidate is triggered at $56,000 ($80,000 - $24,000 = $56,000).