Risk Limits

Product family position limit example

When setting account position limits for all contracts or products, you can set the limit per product family and product type. A product family includes all options with a shared underlying futures symbol, and allows you to set one limit for all options in a product family instead of setting separate limits for each monthly, weekly or daily options product.

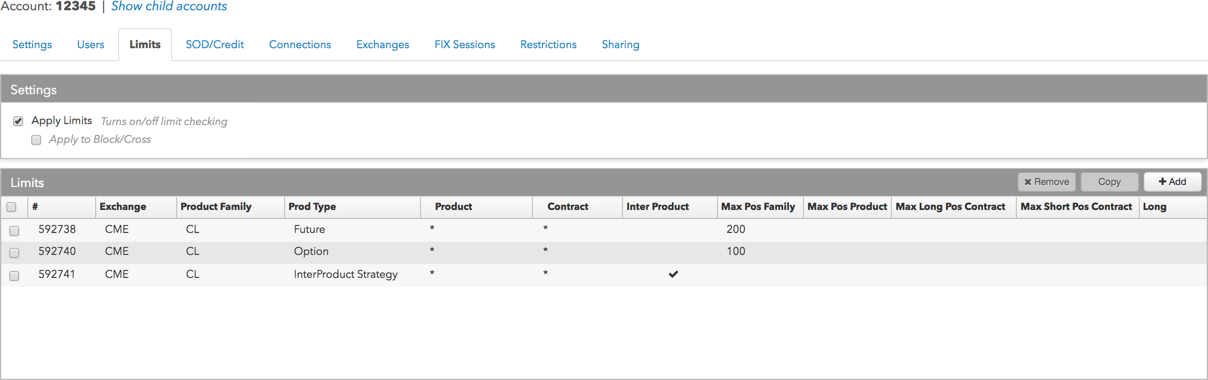

For example, to set position limits for trading the entire CME Crude complex, you'll set an option, future, and interproduct strategy position limit for the "CL" product family:

- Select the "Option" product type for all CL options products (e.g., *), and set a limit in Max position family (net) (e.g., 100). You also need to check Trading Allowed in the "Outrights" and "Spreads/Strategies" sections.

- Select the "Future" product type for the CL product, and set a limit in Max position family (net) (e.g., 200). You also need to check Trading Allowed in the "Outrights" and "Spreads/Strategies" sections.

- Select the "InterProduct Strategy" product type for all CL products (e.g., *), and check Trading Allowed.

To set a limit per product, use the Max position product (net) setting. For example, if this limit is set to "5" for the CL product, and an account is long "2" CL Oct18 contracts and short "4" CL Nov18 contracts, then a sell order greater than "3" or a buy order greater than "7" in any contract month would be rejected as it could potentially result in a long or short position greater than "5".