Risk Limits

Pre-Trade Price Controls

The price control features allow an administrator to configure and check how far from the market price a user may enter an order for a spread or outright. Orders submitted outside the defined price band will be rejected.

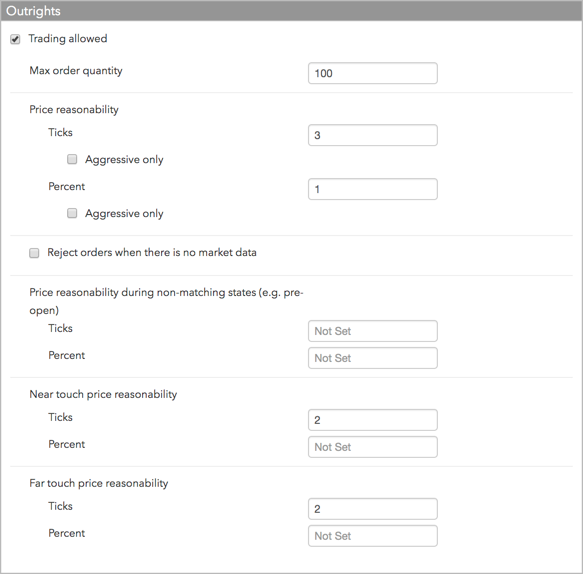

The User | Limits tab for a selected user contains the pre-trade price controls. During matching or non-matching states, you can set a number of ticks away from the market using the Ticks field, and set a percentage away from the current price using the Percent field. You can also reject orders when there is no market data in either state.

Note: The Price Reasonability settings apply only to matching states (e.g, Open Trading) at the exchange and do not include Market orders. To apply price controls during non-matching states, you must configure the separate Price Reasonability during non-matching states (e.g. pre-open) settings.

If you only want to enforce price reasonability for buy orders above the limit and sell orders below the market, check the Aggressive only option. As an administrator, you can set the percentage or number of ticks to a static range or a directional range by checking or unchecking the Aggressive only checkbox:

- Static range (uncheck the option) — Buy and sell orders must be within the configured price band (Ticks or Percent). Orders submitted outside the defined price band will be rejected in all TT order routing applications.

- Directional range (check the option) — Buy orders must be below the maximum price, and sell orders must be above the minimum price (Ticks or Percent). Orders submitted outside the defined price band will be rejected in all TT order routing applications.

Price reasonability example

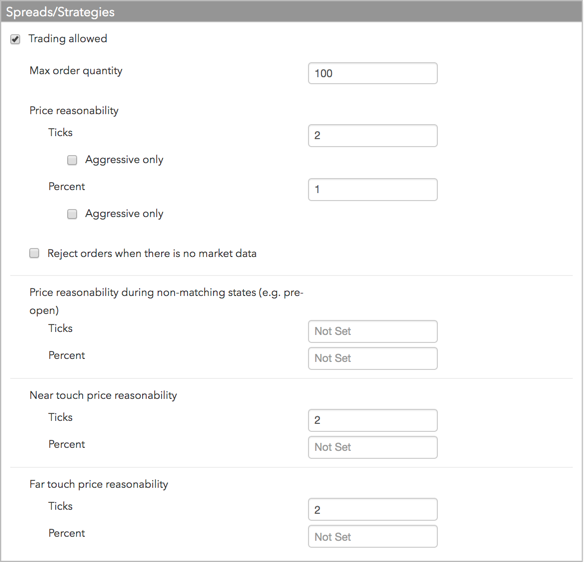

The Aggressive only setting is enforced per account regardless of the account hierarchy. The limit on the child account isn't simply the parent account limit.

For example, if Aggressive only is unchecked with Ticks set to "4" on child account "12345", this static range is enforced even though the parent account "ABCDEF" has a directional range configured with Aggressive only checked and Ticks set to "2".

Buy orders in the parent account can be placed +2 ticks and below the market, and Sell orders in the parent account can be placed -2 ticks and above the market. Orders in the child account must be within the static range of 4 ticks above or below the market.

Price Checking

The price check uses the last traded price as the market price, as long as it falls between the bid and ask. Otherwise, the price check uses the midpoint of the bid and ask. If the bid and ask are not both available, then the price check will use the first available price from the ask, bid, settlement, or close, in that order.

The price check is performed as follows:

- The price check is performed on all real orders, both new and changed, at the time the orders are executed.

- The price check is not performed on synthetic or parent orders.

- For exchange traded spreads and/or strategy orders, the price check is applied based on the spread/strategy price. If the order contains multiple legs, the check is applied to each individual leg.

- The price check does not apply to Euronext Block orders sent via X_Block.

- The price check applies to exchange prices only, not to implied price functionality.

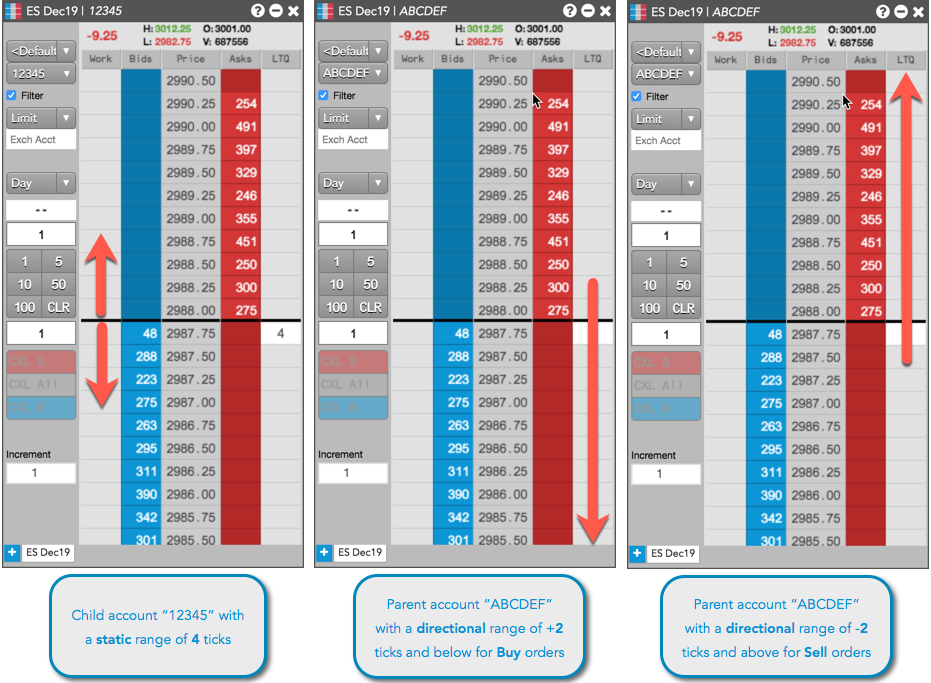

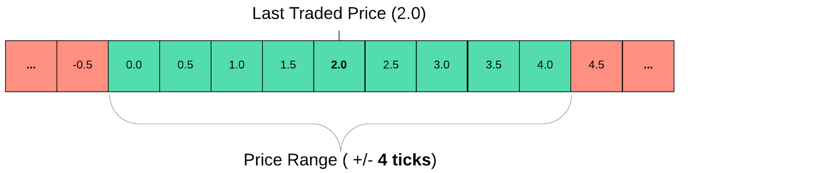

Example: Static Price Range Control (Ticks)

In this example an administrator has configured a user with a price control of 4 ticks and has also specified that the range is not directional. If the current last traded price is 2.0, then the user will only be able to place an order that is above 0.0 (the low point of the price band) and below 4.0 (the high point of the price band). All other orders will be rejected by TT.

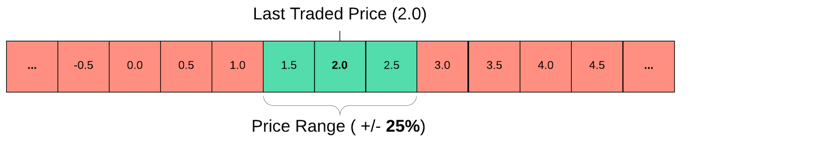

Example: Static Price Range Control (Percent)

In this example an administrator has configured a user with a price control of 25% and has also specified that the range is not directional. If the current last traded price is 2.0, then the user will only be able to place an order that is above 1.5 (the low point of the price band) and below 2.5 (the high point of the price band). All other orders will be rejected by TT.

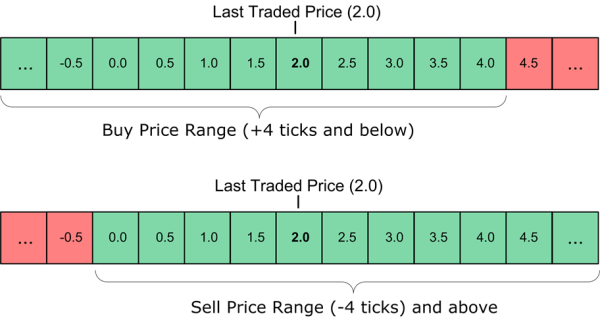

Example: Directional Price Range Control

In this example an administrator has configured a user with a price control of 4 ticks and has also specified that the range is directional. If the current last traded price is 2.0, then the user will only be able to place a buy order that is below 4.0 (the high point of the price band) or a sell order that is above 0.0 (the low point of the price band). All other orders will be rejected by TT.

Enabling and Setting Pre-trade Price Controls

To enable and set the pre-trade price controls, refer to Setting Account Position Limits and Setting User Risk Limits.