Risk Limits

Advanced Pre-Trade Price Controls

Advanced pre-trade price controls on TT allow you to:

- Set near touch/far touch price reasonability limits

- Set price limits based on market depth

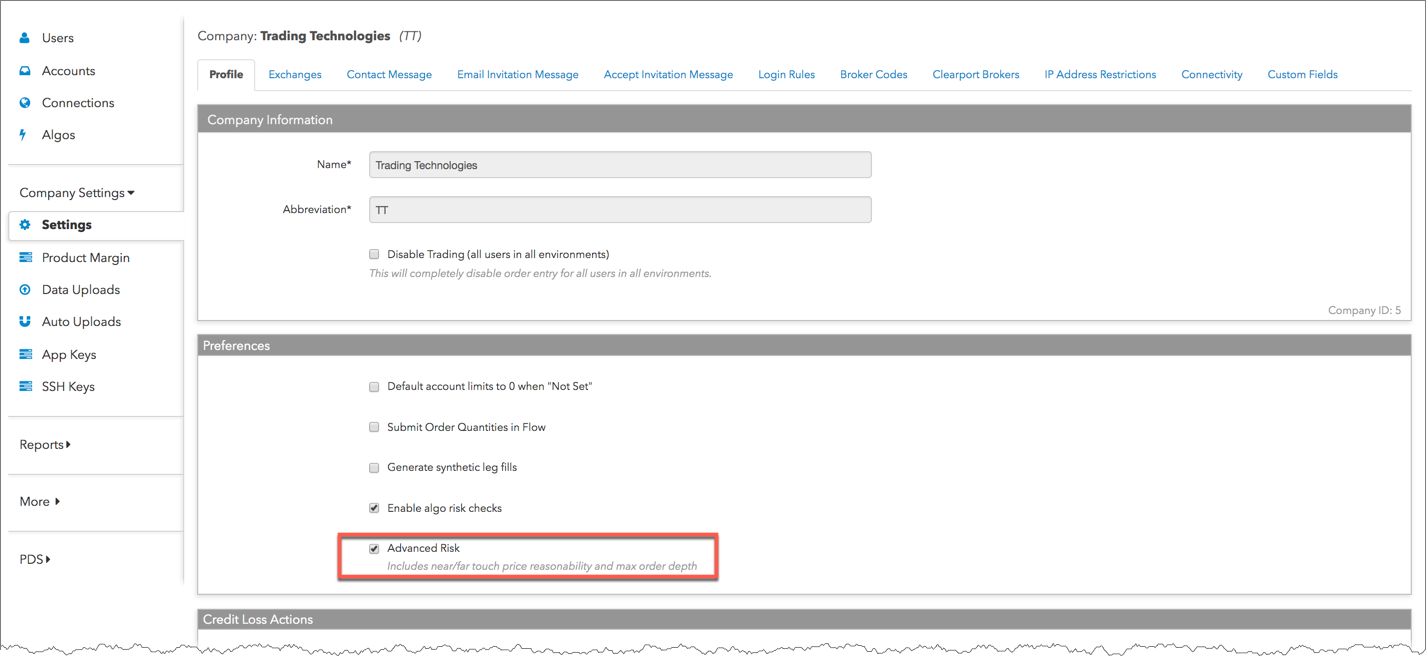

These additional pre-trade price controls can be configured by enabling Advanced Risk in the Preferences section of the Company | Settings | Profile tab.

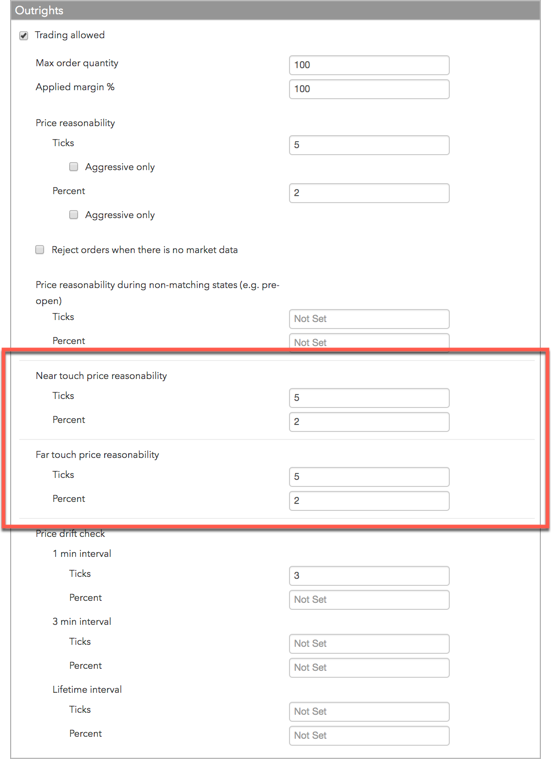

After enabling the advanced risk checks, the near/far price reasonability settings can be configured as part of the account position limits settings or user risk limits settings.

Note: The advanced risk price controls are only available at the account level.

Advanced risk price checking overview

If the preferred price is not available, the near/far touch check uses the last traded price as the market price (reference price), as long as it falls between the bid and ask. Otherwise, the price check uses the midpoint of the bid and ask.

If the bid and ask are both not available, then the price check will use the first available price from the ask, bid, settlement, or close, in that order. If no reference price is found, the order is rejected.

Near Touch/Far Touch price reasonability

The Accounts | Limits tab contains additional pre-trade price controls that allow you to set separate limits for near touch and far touch prices. You can set a number of ticks away from the market using the Ticks field, and set a percentage away from the current price using the Percent field.

- Near touch price reasonability — Allows orders a set number of ticks or a percentage above the best Bid or below the best Ask.

- Far touch price reasonability — Allows orders a set number of ticks or a percentage above the best Ask or below the best Bid.

The near/far touch settings are displayed when setting account position limits or user risk limits for outrights (single product or contract or all products and contracts), spreads, options spreads (user level), inter-product spreads, and strategies.

Note: Price reasonability checks are not applied to Market orders.

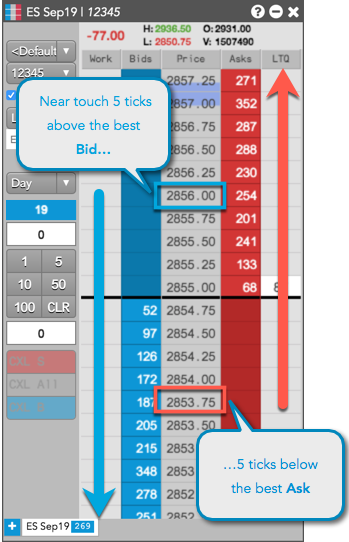

Near/far touch price reasonability examples

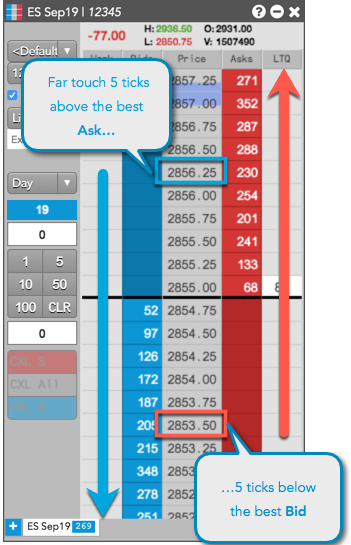

If the near touch price reasonability limit is set to "5" ticks, then a Buy order can be placed up to 5 ticks above the best bid (e.g., 2856.00 for the ES Sep19 contract), or a Sell order can be placed up to 5 ticks below the best ask (e.g., 2853.75).

If the far touch price reasonability limit is "5" ticks, then a Buy order can be placed up to 5 ticks above the best Ask, or a Sell order can be placed up to 5 ticks below the best Bid.

You can also set the near/far touch limits as a percentage of the Bid or Ask price. For example, if the near touch limit is 2 percent, then a Buy order can be placed up to 2 percent above the best Bid, or a Sell order can be placed up to 2 percent below the best Ask.

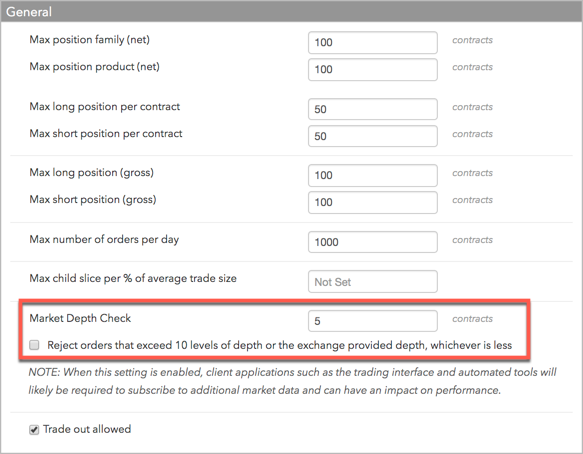

Market depth check

The Market Depth Check setting can be used to prevent users from sweeping the market. When set, orders (including market orders) are rejected if the order quantity cannot be filled in the number of price levels defined by this setting. The check can be set for up to 10 levels of depth.

There may be cases where there are more than 10 levels of depth available, or more levels of depth than what the exchange provided TT. For these cases, there is an additional option that allows or rejects orders that would consume more than the visible levels of depth provided to TT (up to 10 levels).

The Market Depth Check setting and order reject option are available on the Account | Limits tab when setting product limits for all contracts.