Risk Limits

This feature is available to preview in the UAT environment. It will be available in the production environment in the near future.

Configuring algo risk settings

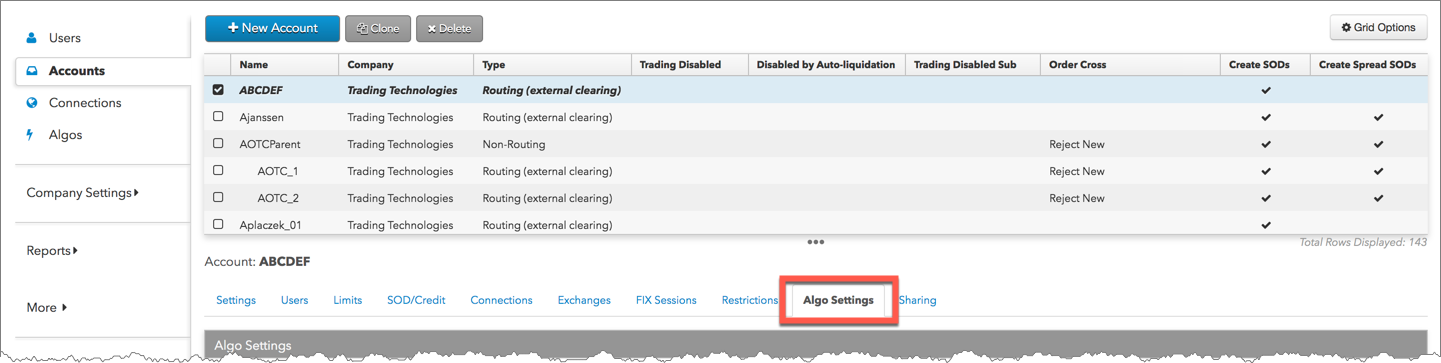

As a company administrator, use the Accounts | Algo Settings tab to manage execution and risk controls for Autospreader and TT Order Type parent orders.

The tab is divided into two sections:

- Algo Settings: Controls the maximum number of order actions (updates and cancels) allowed per millisecond for an algo instance. If the maximum number of actions set for the account is exceeded within the one-millisecond timeframe, the parent order will fail.

- Algo Risk Settings: Configures specific value limits, such as Max Order Quantity (Parent) and Price Reasonability for specific TT Order Types (e.g. TT Iceberg). If the parent order exceeds the allowed Max Order Quantity (Parent) limits, or child orders exceed the allowed Price Reasonability limits, the orders will be rejected

To control this parent order behavior per account, enable the risk settings on the Accounts | Algo Settings tab.

Note: To display and use the Algo Settings tab, you must first check the Enable algo risk checks checkbox on the Company Settings | Settings tab. If this setting is disabled, the tab is hidden and any previously configured limits are not enforced. Additionally, the Apply limits checkbox on the Accounts | Limits tab must be enabled for Algo Risk Settings checks to be active.

Configuring Algo Settings (Order Action Limits)

To configure algo settings:

- Click Accounts in the left navigation pane and select an account in the data grid.

- Click the Algo Settings tab.

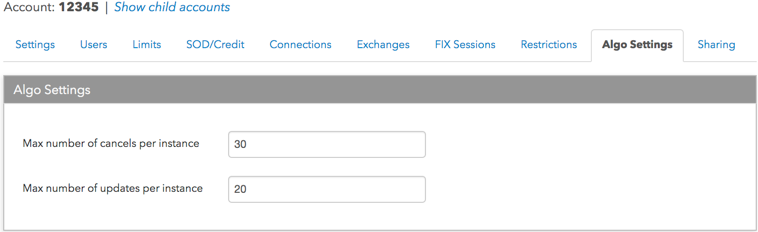

In the Algo Settings section, configure the following parameters

Set one or both of the following risk settings:

- Max number of cancels per instance — Sets the maximum allowed cancels per millisecond that do not originate from a parent order.

- Max number of updates per instance — Sets the maximum number of order updates (add, change) allowed per parent order instance per millisecond.

Note: These checks are applied to a parent order instance for the lifetime of the order. If you modify either of these risk settings, the changes will be applied to subsequent parent order instances.

- Click Save Changes.

Configuring Algo Risk Settings

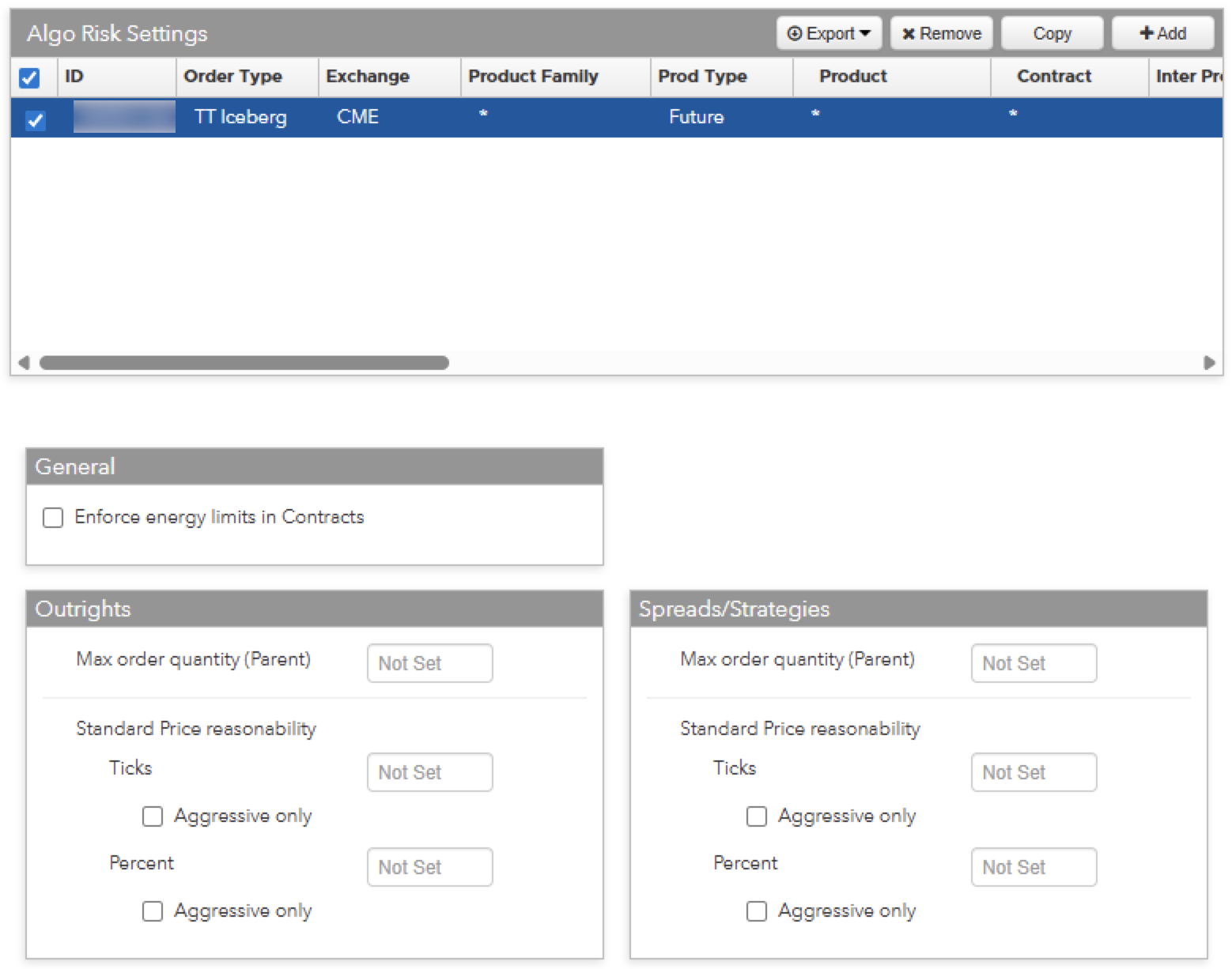

Use the Algo Risk Settings section to configure value-based limits for specific TT Order Types. These limits operate in conjunction with the account's standard risk limits. When an order is placed, the system evaluates both the Algo Risk Limits and the standard Account Limits and enforces the most restrictive value found in the hierarchy.

To configure algo risk limits:

- In the Algo Risk Settings limits grid, click Add.

- In the New Limit dialog box, configure the following settings:

- TT Order Type: Select the TT order type (e.g. TT Iceberg).

- Define the scope for the limit.

- Minimum Requirement: You must select a TT Order Type, Exchange, and Product Type when creating a limit.

- Note: Limits configured without selecting a Product or Contract will apply to all instruments within the Product Type which have not been explicitly configured. For example, a limit set for TT Iceberg | CME | Future will apply to TT Iceberg orders across all CME Futures that do not have their own specific limit configured within Algo Risk Settings.

- Max order quantity (Parent): Sets the maximum total quantity allowed for the parent synthetic order. If a user attempts to submit a parent order exceeding this value, the order will be rejected.

- Standard Price Reasonability: Sets the maximum number of ticks or percent a child order can deviate from the reference price.

- Note: If a value is left blank, the specific check is not applied for this rule; however, any applicable limits found elsewhere in the account hierarchy (e.g. in Account Limits) will continue to be enforced.

- Click Add.

The limit is added to the limits grid. You can edit or delete existing limits by selecting the row and clicking Edit or Delete. - Click Save Changes.