Accounts

Configuring SOD settings and credit limits

To configure position settings and credit limits:

- Click Accounts in the left navigation pane and select an account in the data grid.

- Click the SOD/Credit tab for the selected account.

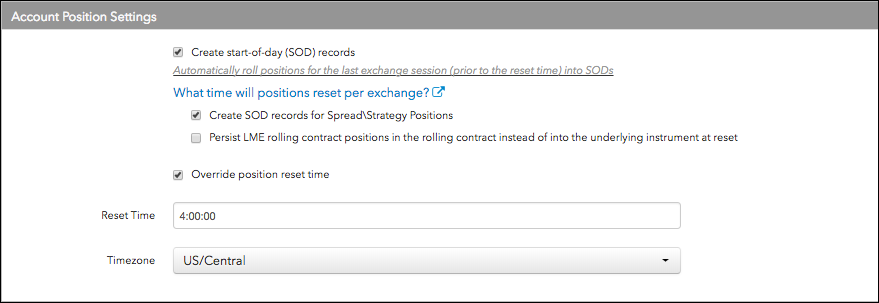

- In the Account Position Settings section, you can configure the following settings:

- Create start-of-day (SOD) records — Determines whether position records (SODs) are generated for the prior exchange session at the daily reset time. This setting applies even if credit risk is disabled. At the account-level, this setting is enabled (checked) by default. Uncheck to disable this setting.

- Create SOD records for Spread\Strategy Positions — Determines whether position records (SODs) are generated for spreads/strategies for the prior exchange session at the daily reset time. When this option is checked (enabled), a separate SOD is generated that shows the position of the spread/strategy itself and not just the outright legs. This setting is configurable and applies even if credit risk is disabled. At the account-level, this setting is disabled by default. If enabled on the account, traders assigned to this account must enable the Display spread/strategy positions option in the Global Settings | General tab in the Trade application in order to view their spread/strategy positions. Check to enable this setting.

Persist LME rolling contract positions in the rolling contract instead of into the underlying instrument at reset — Determines whether LME rolling contracts are rolled into their underlying positions or into their new rolling contract at the daily reset time.

By default this option is unchecked, and a position in an LME rolling contract is listed in its underlying contract after the daily reset. When checked, a position in an LME rolling contract is rolled forward into the new LME rolling contract.

By default this parameter is unchecked. It can only be checked when Create start-of-day (SOD) records is checked, and is cleared when Create start-of-day (SOD) records is unchecked.

Override position reset time — Determines your own reset time for the account. Uncheck this option to automatically use the exchange's position reset time. To choose a single time for position reset, check the override option and set a time and timezone.

Note: The parent level override setting applies to all child accounts. If Override position reset time is enabled for a parent account, then the child account cannot be set to a reset time that is different from the parent account's position reset time.

- If override is enabled, enter your own specific Reset Time and Timezone for the account's position reset.

This sets the required position reset time. Positions reset regardless of whether credit limits are applied to the user or whether the Create start-of-day (SOD) records option is checked.

By default, the reset time is 0:00:00. The timezone is not set by default, but is required before you can save any changes. This allows for a seamless, 24 hour trading cycle that doesn't have to align with the exchange rollover times by region where matching occurs. The position reset time is configurable and adhered to even if the credit risk setting is disabled for an account or user.

When a session resets, the following occurs:

- Fills from the previous exchange session are removed. Historical fills are retrievable but not part of the current session's position fills.

- If the “Create start-of-day (SOD) records” and/or "Create SOD records for Spread\Strategy Positions" option is checked, fills are replaced with SOD records per contract priced at the previous exchange settlement. Otherwise, no record or a record of zero is generated.

- Fills that occurred since the current exchange session remain.

- Working orders remain.

- If “Credit Check” is enabled and the Rule is to apply P&L, then P&L from previous exchange sessions is added to the credit check; and orders, fills, and SODs are considered in the credit check.

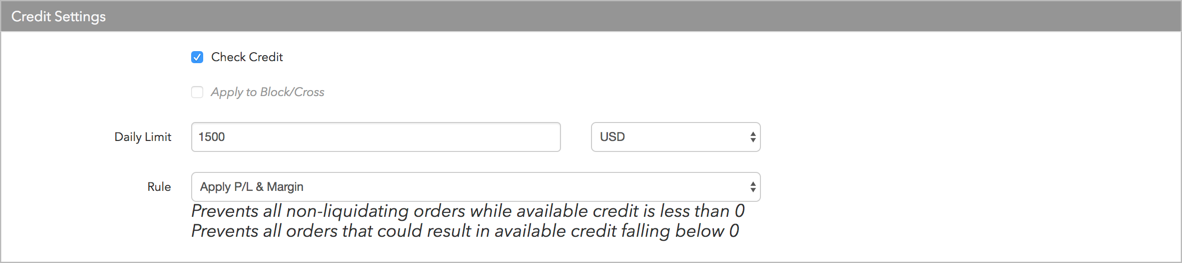

- In the Credit Settings section, configure the following:

- Check Credit — Check (enable) this checkbox to apply credit limit checks to all orders.

- Apply to Block/Cross Orders — Check this checkbox to apply the credit limits to all Block or Cross orders. If unchecked, user credit does not apply to these orders.

- Daily Limit — Determines the daily credit amount the account can have during a given trading session. Enter a number (zero or greater). Select a currency for the credit limit from the drop down menu next to this field.

- Rule — Select one of the following methods for calculating available credit:

- Apply P/L — Uses the P/L formula to determine available credit. If selected, then any profits or losses (realized and unrealized) that accrue during the day are added or subtracted from the account's available credit. If this is checked, then the credit limit acts as a pure daily loss limit. Prevents all non-liquidating orders while available credit is less than 0.

- Apply Margin Limit — Considers product margin limits set by the company when determining available credit per trading session. This setting deducts product margin from the account's available credit based on the worst case net positions in various products. Prevents all orders that could result in available credit falling below 0.

Apply P/L & Margin — If margin and P/L are both included in the credit check per trading session, then available credit = daily credit +/- P/L - margin. Select this option as a balance if credit is updated daily in one of two ways: Manually by your firm, or automatically marking-to-market by adding yesterday's P/L to today's credit and representing yesterday’s position at the settlement price.

Upon entering an order, margin is calculated on a worst-case basis, applying outright margin to working uneven spreads, outright orders, and worst-case outright positions. Spread/strategy margin is applied to working even spreads and synthetic spread positions (e.g., a 1-lot long position in Sep 16 and a 1-lot short position in Dec 16 only requires one times the current spread margin value). If a new order would cause available credit to drop at or below zero, then the order is rejected unless the only possible result of the order being filled would be to reduce the position in all affected contracts without increasing the gross or net position of any products (requires Trade out allowed enabled).

- Apply pre-trade SPAN margin — Incorporates both P/L and margin where margin values are calculated via portfolio risk calculation using values supplied by the exchange. Requires Cash Balances values to be set. Does not support all exchanges. For more details please see Pre-Trade Portfolio Risk.

- Click Save Changes

Configuring credit loss adjustments and account liquidation

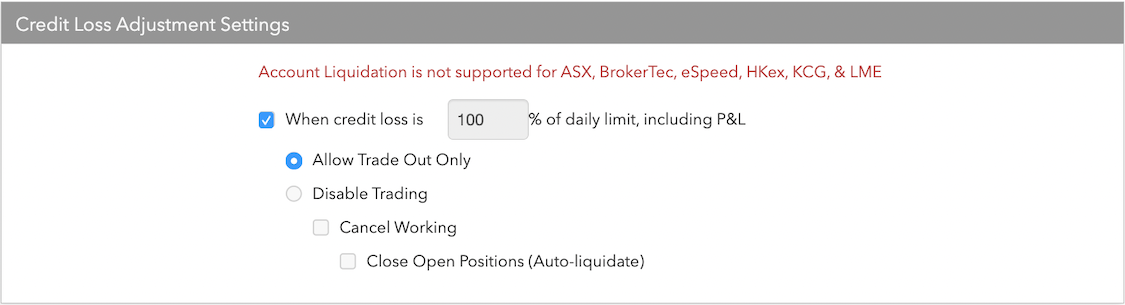

In the Credit Loss Adjustment Settings section, configure the following:

Check (enable) the When credit loss is setting to set an action when available credit falls below a specified percentage. This feature is disabled by default. If you enable this setting, enter a credit limit threshold as a percentage of daily credit (including P/L) in the text field. When the credit limit threshold is breached, a post trade risk management action will be triggered for the account. The default is 100% (no daily credit remaining).

Note: The auto-liquidate option is not supported for the following exchanges: ASX, BrokerTec, eSpeed, HKex, KCG, and LME

If you enable the When credit loss is setting, you can select the following post trade risk management options:

- Allow Trade Out Only — When checked, if a trader's credit loss is greater than or equal to the P&L daily percentage limit, trading activity is limited to Trade Out Only. This constraint is similar to the standard daily limit behavior, except it is calculated at a percentage of daily limit. For example, given a daily limit of $1000 and a credit loss threshold of 80%, a trader can lose 80% of $1000 (only have $200 credit available) before trading is restricted to trade out only.

- Disable Trading — When this option is enabled (checked), trading for the account and its sub-accounts is automatically disabled, no new order actions are allowed, and "trade out" (trading that would flatten the position) is not allowed regardless of the Trade out allowed product limit setting on the account. Trading is disabled until the next position reset time or until you manually enable trading and adjust the available credit limit for the account. This is the default behavior when checking (enabling) the When credit loss is setting.

- Cancel Working — In addition to enabling the same behavior as the Disable trading option, this option cancels all working orders, including synthetic orders, for the account and all of its sub-accounts. Check/uncheck the checkbox to enable/disable this option.

- Close Open Positions (Auto-liquidate) — In addition to enabling the same behavior as the Disable trading and Cancel Working options, this option closes the aggregate open position at the parent account level. When this option is enabled (checked), TT automatically submits IOC orders at market to close all open positions. If Market orders are not natively supported, this option will not be available for that market.

Check/uncheck the checkbox to enable/disable this option. This option is grayed out if Cancel Working is unchecked. Once trading is disabled by liquidation, you should add enough credit to resume trading on the account, and then manually uncheck the "disable trading (auto-liquidate)" option on the Account | Settings tab.

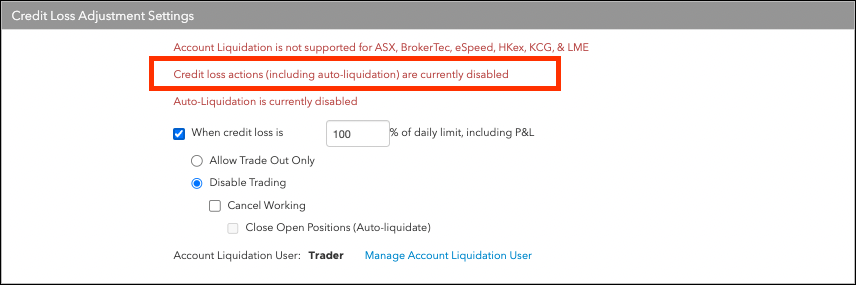

Note: Auto-liquidation will not work if the credit loss actions functionality is disabled and an "account liquidation user" is not assigned to your company. To assign an account liquidation user, click Manage Auto-Liquidation User. If credit loss actions are disabled, you will see the following message:

- Optionally, add or modify the values in the Cash Balance section.

Note: These fields are used for supporting Account Cash Balance uploads in GMI format.

- Click Save Changes

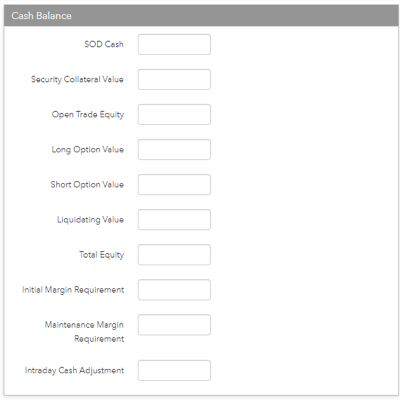

Cash Balance

The Cash Balance values are utilized when the credit rule Apply pre-trade SPAN margin has been applied.

Liquidating Value acts as the credit limit for the account and is required to be set.

The other fields are informational - these are used to form the values displayed in the Balances widget.

Intraday Cash Adjustment can be used for a one-time addition or subtraction credit from an account between any regular updates using file upload or REST API.

- SOD Cash — Total cash account balance at the start of the day.

- Security Collateral Value — The margin value of any securities (e.g. T-Bills) in the account, normally 95% of the face value.

- Open Trade Equity — The open trade equity (marked to market P/L) of non-Options positions, calculated using midpoint.

- Long Option Value — The net value of open long option positions, displayed for supported markets.

- Short Option Value — The net value of open short option positions, displayed for supported markets.

- Net Option Value — The net value of open option positions, displayed for supported markets.

- Liquidating Value — The value of the account if all positions were liquidated based on the estimated fill settlement prices.

- Total Equity — The total trade equity (marked to market P/L) on open positions plus total balance.

- Initial Margin Requirement — The margin equity needed to initiate a position.

- Maintenance Margin Requirement — The minimum margin equity required to be maintained by an account.

- Intraday Cash Adjustment — Used for a one-time addition or subtraction credit from an account.