Risk Administration

Position Management

As a company administrator, use the settings on the Accounts | SOD/Credit tab to:

- Automatically roll positions and create SOD records after a position reset at the exchange per trading day.

- Override the exchange reset time for the account.

Position Reset

The "position reset" functionality in the TT system provides a seamless 24-hour trading period that automatically resets with the exchange session roll times or at a specific time defined by an administrator. At position reset time per trading day, fills from the previous trading day are removed from the order book and optionally turned into start-of-day (SOD) records that are priced at settlement.

Note: The position reset functionality in TT calculates a user's position in an account based on the fills for the exchange session that has already closed, and not for fills that occur in trading sessions after that time. If using a position reset override, TT recommends setting the position reset time after the close of the last exchange trading session for an account.

How Position Reset Works

By default, new accounts reset positions in each market at each market's session roll time (as set by TT). For example, at 16:37 CST, CME product positions are reset, and at 17:30 CST ICE product positions are reset. This default mode allows users to trade multiple markets without having to worry about setting a single reset time. Additionally, administrators can choose to override the default position reset time by selecting a time and timezone that applies to all accounts in the hierarchy. This allows administrators to choose a specific time to reset, typically because the company resets the account credit setting daily after marking to market.

For accounts at the beginning of a TT Session, "available credit" is set to the account-level Daily Limit setting. If the account has Create start-of-day (SOD) records checked, then any positions from the previous exchange session are converted to SOD records and priced at Settlement. If the account has Create start-of-day (SOD) records unchecked, positions from the previous session are not included.

The Create start-of-day (SOD) records setting is enforced per account regardless of the account hierarchy. If only the parent account has SODs enabled, then SODs from the child account still appear as part of the parent position. If child accounts should also generate SOD records, then as an administrator you can can enable Create start-of-day (SOD) records for these accounts.

Position Reset Times per Exchange

Note: When using Position Reset override, it's a best practice to set the account position reset to occur after the reset times listed below. If using an override, parent and child accounts need to be set to the same position reset time.

ASX

- reset time — 16:50:00

- timezone — Australia/Sydney

B3

- reset time — 18:27:00

- timezone — Brazil/Sao Paulo

BIST

- reset time — 19:15:00

- Europe/Istanbul

BrokerTec

- reset time — 18:00:00

- timezone — America/New York

CEDX

- reset time — 19:10:00

- Europe/Amsterdam

CFE

- reset time — 16:05:00

- timezone — America/Chicago

CME

- reset time — 16:37:00

- timezone — America/Chicago

CME (Bursa Malaysia Derivatives)

- reset time — 20:00:00

- timezone — Asia/Kuala_Lumpur

Coinbase (GDAX)

- reset time — 00:00:00

- timezone — UTC

Coinflex

- reset time — 00:00:00

- timezone — UTC

DCE

- reset time — 15:30:00

- timezone — Asia/Shanghai

DGCX

- reset time — 00:00:00

- timezone — UTC

EEX

- reset time — 22:45:00

- timezone — Europe/Berlin

ERIS

- reset time — 17:05:00

- timezone — America/New York

eSpeed

- reset time — 17:45:00

- timezone — America/New York

Eurex

- reset time — 22:45:00

- timezone — Europe/Berlin

Euronext

- reset time — 23:00:00

- timezone — Europe/Amsterdam

Fenics

- reset time — 00:00:00

- timezone — UTC

FEX

- reset time — 18:45:00

- timezone — Australia/Sydney

HKEx

- reset time — 3:10:00

- timezone — Asia/Hong Kong

ICE

- reset time — 18:30:00

- timezone — America/New York

ICE_L

- reset time — 23:30:00

- timezone — Europe/London

INE

- reset time — 15:30:00

- timezone — Asia/Shanghai

JPX

- reset time:

- JBL, JBLM, JBM, JBS, TOA3M — 15:20:00

- All other products — 16:33:00

- timezone — Asia/Tokyo

JSE

- reset time — 16:35:00

- timezone — Johannesburg

KCG

- reset time — 17:45:00

- timezone — America/New York

KRX

- reset time — 16:00:00

- timezone — Asia/Seoul

LME

- reset time — 21:00:00

- timezone — Europe/London

LSE

- reset time — 21:00:00

- timezone — Europe/London

MEFF

- reset time — 20:35:00

- timezone — Europe/Madrid

MEXDER

- reset time — 15:15:00

- timezone — America/Mexico City

MX

- reset time — 17:00:00

- timezone — America/Canada (EST)

NDAQ_EU

- reset time — 19:30:00

- timezone — Europe/Oslo

NFX

- reset time — 17:01:00

- timezone — America/New York

Nodal

- reset time — 17:15:00

- timezone — America/New York

OSE

- reset time — 15:20:00

- timezone — Asia/Tokyo

SAFEX

- reset time — 18:35:00

- timezone — Africa/Johannesburg

SGX

- reset time — 05:30:00

- timezone — Asia/Singapore

SGX_GIFT

- reset time — 18:50:00

- timezone — Asia/Singapore

TAIFEX

- reset time — 5:30:00

- timezone — Asia/Taipei

TFEX

- reset time — 00:40:00

- timezone — Asia/Bangkok

TFX

- reset time — 20:30:00

- timezone — Asia/Tokyo

TOCOM

- reset time — 16:05:00

- timezone — Asia/Tokyo

ZCE

- reset time — 15:30:00

- timezone — Asia/Shanghai

Position reset override

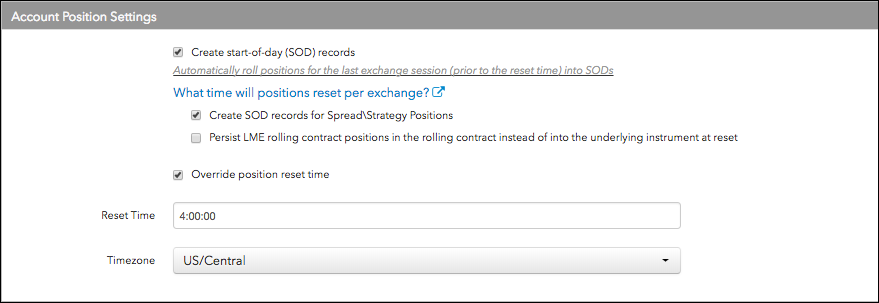

As an administrator, you can choose to override the exchange reset time with a specific time. Position reset is configured in the Account Position Settings section.

Position Reset Override Example

In this example, an administrator enables a position reset override of 7:00 PM Asia/Singapore time for an account trading SGX products. For SGX, the exchange reset time is 4:50 AM Asia/Singapore time.

At each of these times, positions behave as follows:

- 4:50 AM — No position reset occurs. Fills from yesterday remain in a trader's Positions widget as positions in the Trade application.

- 4:50 AM to 7:00 PM — No position reset occurs. Fills from yesterday and fills from 4:50 AM to 7:00 PM remain in the Positions widget as positions.

- 7:00 PM — Because a position reset override time of 7:00 PM is enabled for SGX, positions remain in the Positions widget until this time. At 7:00 PM, any SGX fills received before 4:50 AM will be converted to SODs or removed, and fills received after 4:50 AM will remain as positions until reset the next day.