Accounts

Accounts and sub-accounts

Using the Setup application, you can configure risk at the account level and have those risk settings apply to any sub-accounts. In this section and throughout the help system, the terms "parent account" and "child account" may be used when describing how risk is managed among tiered account and sub-account hierarchies.

Sub-accounts are created using the Settings tab on the Accounts screen. A sub-account can only be associated with one parent account, but each parent account can have multiple "child" sub-accounts.

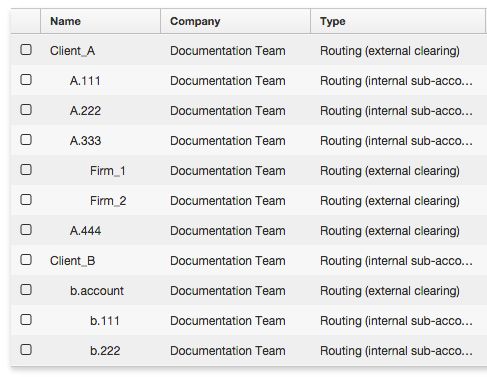

When sub-accounts are created, they are nested under their parent account. In this help system for the Setup application, the term account tree is used to describe a parent account with nested child sub-accounts as shown below:

Configuring Tiered Risk

Risk and order routing are independent of each other at the parent account level. For example, you can set up an account hierarchy with sub-accounts (child accounts) for internal use only that are assigned to individual traders in a firm. The risk is controlled at the parent account level and orders are routed to the exchange via the parent account. However, the trading activity and risk is tracked and managed per sub-account even though these accounts are never routed to the exchange. The parent account is assigned to the firm.

You can also set routing at the sub-account level while controlling risk at the parent account level. If configured, the risk limits apply to the aggregate trades of each sub-account (child account), as well as to any trades made using the parent account itself. In this case, you can allow the sub-account to route orders but use the product risk limits of the parent account. This also allows, for example, a proprietary trading firm to create sub-accounts and limits for each of their end users and map those sub-accounts to one or more FCM-created accounts with exchange connections for order routing.

Users assigned to parent accounts and child sub-accounts can also have their own maximum order quantity and price control risk limits configured for an additional level of risk management. For example, you can assign two users to the same account, but may want to limit one of the users to a lower maximum order quantity than the other by setting two different risk limits per user. The risk limits on the account are still enforced by the TT platform, but this works in conjunction with the limits set for each user assigned to the account.

Clearing Account Override Support

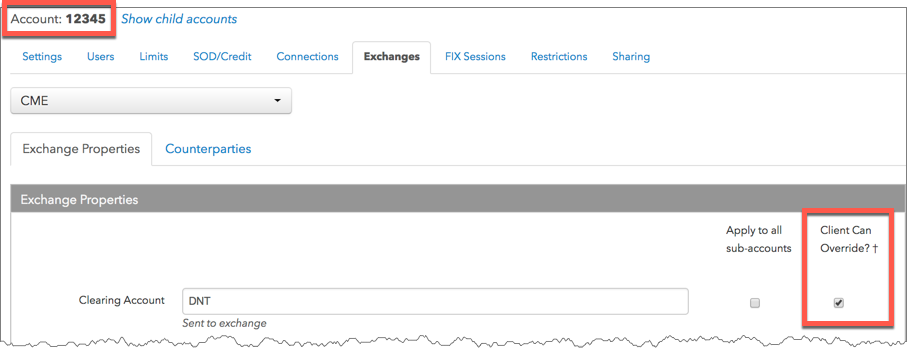

The Client Can Override setting on the Accounts | Exchanges tab allows you to give traders permission to enter an order with a clearing account that is independent of the assigned account name. When this setting is enabled, traders can change the clearing account "on the fly" before submitting their order.

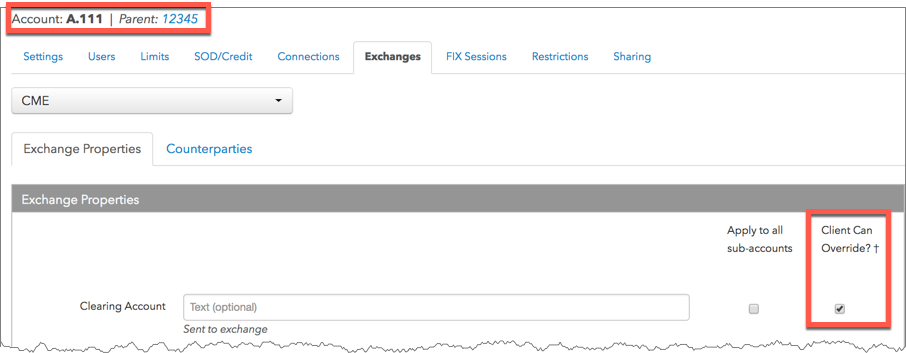

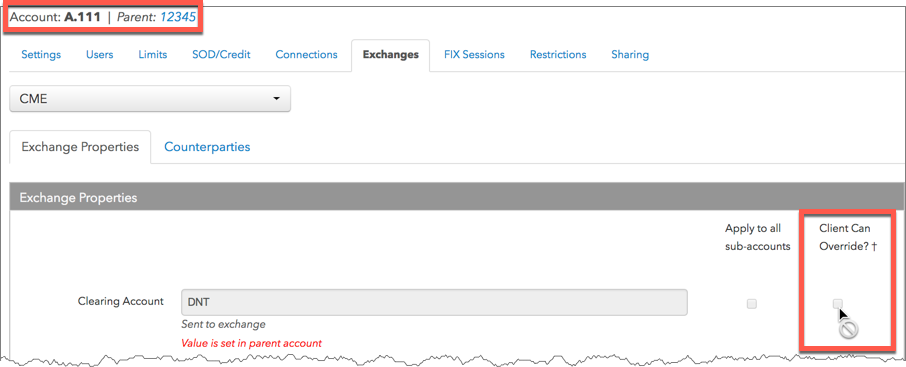

Sub-accounts inherit the Client Can Override setting from their parent unless the parent also has Apply to all sub-accounts checked for the same setting. For example, Client Can Override is checked for the Clearing Account name on sub-account "A.111", which inherited the setting from its parent account "12345".

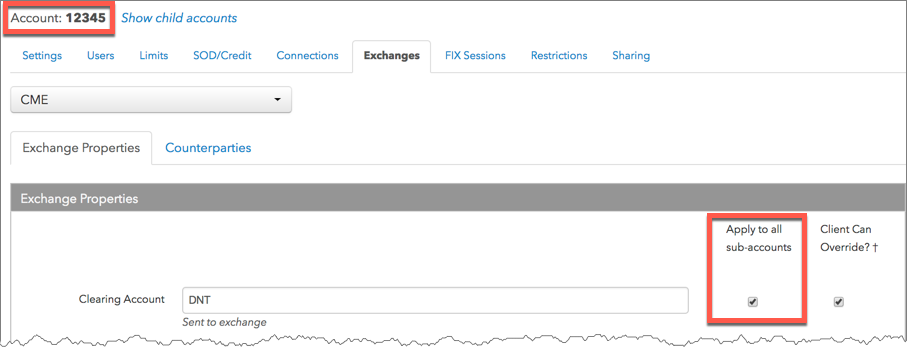

To ensure that the Clearing Account name on account "12345" gets sent to the exchange when trading with any of its sub-accounts, check Apply to all sub-accounts on the Clearing Account field.

Since Apply to all sub-accounts is checked on the parent account "12345", then the Client Can Override setting on the sub-account "A.111" becomes unchecked and is locked.

Note: When moving accounts, an account moved under a parent account will inherit the parent account's Client Can Override setting. If a sub-account is removed from a parent account, the sub-account's previous Client Can Override setting will be enabled.