Accounts

Account sharing

From the company's perspective, sharing an account allows a company to create and manage risk in an account that they own while sharing that account with an external client that they do not manage. For example, an FCM can control and manage the risk settings for an omnibus account that is then shared with a buy-side firm. That buy-side firm can create sub-accounts beneath the FCM account which the buy-side then assigns to it's own traders. In this scenario, the FCM company administrator is only responsible for account creation and management, while the buy-side is responsible for creating and managing users and assigning accounts to those users.

Account sharing rules

When sharing an account as a company administrator, consider the following:

- As an owning administrator you can choose whether it is your name or the client's name that will appear to the trader routing an order on the account and any sub-accounts accounts. This white-labeling of accounts is sometimes requested by clients.

- You can allow or restrict account permissions for your client. For example, you can restrict the account from being used from the TT mobile application.

- Clients cannot override your risk settings or restrictions or edit your account in any way.

- Shared parent account restrictions (e.q., synthetic orders) are enforced on the child accounts. If needed, the shared-with company can further restrict their own child accounts. For example, if all synthetic orders are allowed on the parent, the child account can restrict TT Iceberg orders.

- You can share accounts with users in other companies via the Accounts | Sharing tab in Setup. You do not have to use the Setup invitation process to share your firms accounts with users in other companies.

- You cannot share an account that has been shared with you by another company.

Account sharing: client impact

As a client, account sharing allows you to manage your own users and control which traders are assigned to an account. Although your traders cannot exceed the risk limits set by the sharing company, you can assign additional risk limits to accounts you create under the sharing companies parent account.

Account sharing: trader impact

As a trader, account sharing allows you to trade with multiple banks or FCMS, etc., while remaining a member of a "company" in the TT system. However, the risk limits are created by the firm who owns the account, so you cannot exceed the risk limits in the shared account as determined by the account owner (e.g., an FCM). You can continue to use the same Trade application workspaces, order book, audit trail, etc. Your user risk limits are configured by your own company.

When sharing accounts between companies and users, both have to be defined in the TT system via the Setup application. Users can trade in the production environment once they have accepted an invitation to join their company in the TT system.

Account sharing: company administrator impact

As a company administrator, you can share accounts with users in other companies via the Accounts | Sharing tab in Setup. You do not have to use the Setup invitation process to share your firms accounts with users in other companies.

If the company that you will share the account with will be acting as an introducing broker, click Introducing Broker.

For example, if the account should appear to traders with the shared-with company's name, while your company still maintains full ownership and risk controls, check the Introducing Broker option when sharing the account. This allows the introducing broker (shared-with) company to set additional limits and permissions for their own sub-accounts assigned to your shared parent account, while still being subject to limits set on the shared account.

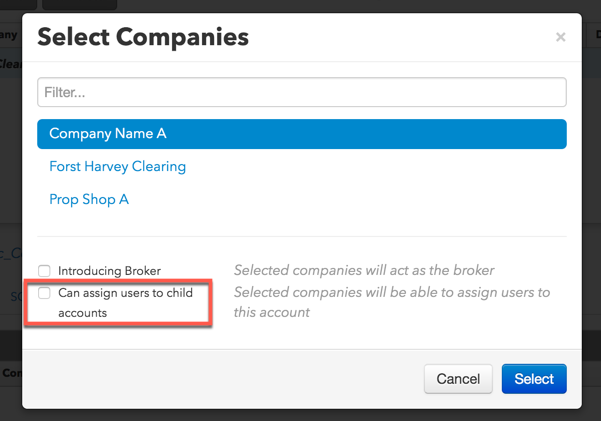

To prevent the shared-with company from assigning users to the shared account, uncheck Can assign users to child accounts.

Shared account and user interactions

In order to provide their client with access to a market, companies may need to share a user with another company. In this case, the shared-with company will assign an account with the market's credentials to the shared user, then share that account "back" to the shared user's company.

However, a company may want to lock certain user fields (e.g., Operator ID) on the shared account or prevent companies from adding users to the related child accounts. As an administrator, there are two settings you can use when sharing an account with a user who has been shared with your company:

- Can assign users to child accounts — Prevents another company from adding users to the child accounts of a shared account. Uncheck this setting to prevent users from being assigned to the child accounts. By default, this setting is checked and users can be assigned. This option is available on the Accounts | Sharing tab.

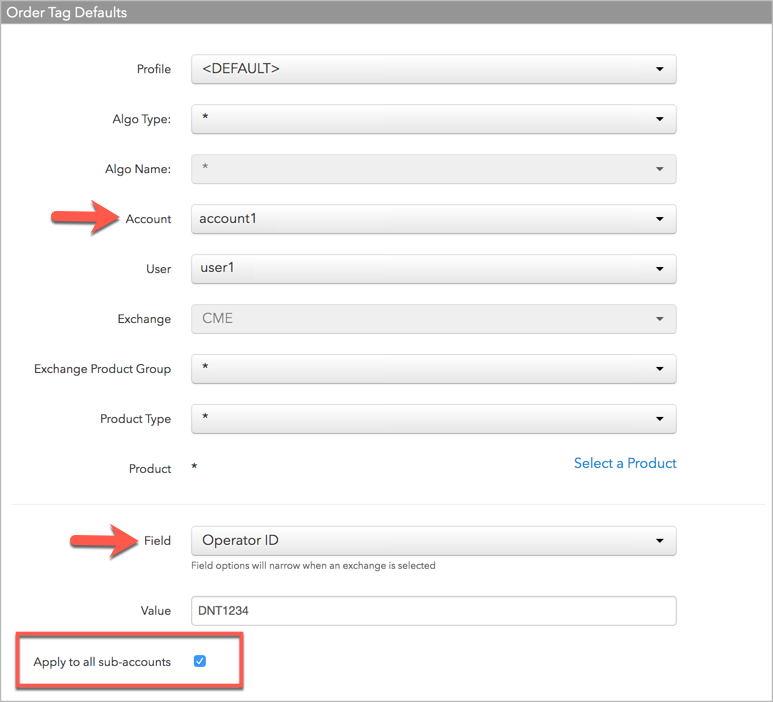

- Apply to sub-accounts — Can be applied to subscriber fields to lock these values on the child accounts of a shared parent account. This setting is available on the Order Tag Defaults tab in the left navigation pane for a selected profile.

Account sharing configuration

When the Can assign users to child accounts setting is unchecked on a shared account, consider the following:

- When acting as the introducing broker when sharing an account (Introducing Broker setting is checked), then Can assign users to child accounts cannot be unchecked. This setting is checked by default.

- The shared-with company cannot assign users to child accounts of the shared parent account. They also cannot move child accounts with assigned users to the shared account tree.

- Risk limits can be set for the child accounts that the shared-with company creates. However, the sharing company maintains full control over users and parent level account limits.

Example: Sharing an account with a shared user

In this example, a client firm (Client-A) shares one of their users (user1) with a broker (Broker-B) in order to provide "user1" with access to CME:

- Client-A shares "user1" with Broker-B, who is the owner of the CME market credentials.

- Broker-B assigns "account1" to "user1".

Note: Using Order Tag Defaults, Broker-B sets the "Operator ID" field on account1 and checks the Apply to all sub-accounts checkbox to ensure that any child accounts created under "account1" will send the Broker-B Operator ID to CME.

- Broker-B shares "account1" with Client-A.

Note: When sharing the account, Broker-B unchecks the Can assign users to sub-accounts setting to ensure that only "user1" can trade with this account.

- Client-A creates child accounts "child1" and "child2" from "account1". The child accounts inherit Client-A's "user1" as well as the CME routing credentials from Broker-B. The Broker-B "Operator ID" is routed to the exchange on all orders submitted with the child accounts.