TT Order Types

TT If-Touched order

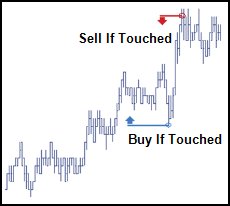

An If-Touched is an order that is triggered when the market has reached or traded through a specified price in the market. If-Touched orders are similar to Stop orders except the trigger price behavior is inverted. An If-Touched trigger price is typically set better than the current market.

Buy If-Touched orders are generally placed below the current last traded price while, Sell If-Touched orders are generally placed above the current last traded price.

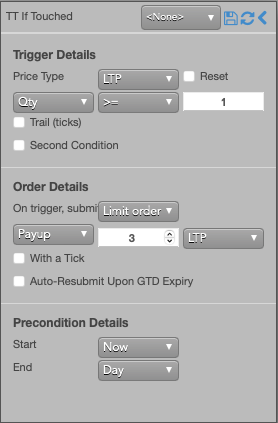

The following is an example of a Trailing If-Touched order that triggers when a trade occurs and there is available quantity at the selected last traded price. Once triggered, the TT If-Touched order submits a child order placed three ticks into the market relative the LTP.

TT If-Touched order parameters

Trigger details parameters

-

Trigger Price: Sets the price at which to trigger the parent synthetic order.

Possible values include:

- LTP: Last Traded Price

- Ask: Best Ask

- Bid: Best Bid

- Same Side: Evaluates the trigger using the inside market price in the Buy/Sell direction of the order:

- Best Bid for Buys

- Best Ask for Sells

- Opposite Side: Evaluates the trigger using the inside market price in the opposite Buy/Sell direction of the order:

- Best Ask for Buys

- Best Bid for Sells

Note: If you click a custom action button (or use a hotkey) for this TT Order Type that also specifies an order template, these two fields will not be displayed, as the template already defines their desired values. Right-clicking on the button displays these parameters. You can also click the edit button to make changes, if desired.

- Executed quantity when the Price Type parameter is LTP

- Quantity of the best ask when the Price Type parameter is Ask

- Quantity of the best bid when the Price Type parameter is Bid

- Trigger Price: Sets the price at which to trigger the parent synthetic order.

Possible values include:

- LTP: Last Traded Price

- Ask: Best Ask

- Bid: Best Bid

- Same Side: Evaluates the trigger using the inside market price in the Buy/Sell direction of the order:

- Best Bid for Buys

- Best Ask for Sells

- Opposite Side: Evaluates the trigger using the inside market price in the opposite Buy/Sell direction of the order:

- Best Ask for Buys

- Best Bid for Sells

- Executed quantity when the Price Type parameter is LTP

- Quantity of the best ask when the Price Type parameter is Ask

- Quantity of the best bid when the Price Type parameter is Bid

- Limit order

- Market order

- LTP: Last Traded Price

- Ask: Best Ask

- Bid: Best Bid

- Trigger: Trigger price

- Same Side: Evaluates the trigger using the inside market price in the Buy/Sell direction of the order:

- Best Bid for Buys

- Best Ask for Sells

- Opposite Side: Evaluates the trigger using the inside market price in the opposite Buy/Sell direction of the order:

- Best Ask for Buys

- Best Bid for Sells

Note: If you click a custom action button (or use a hotkey) for this TT Order Type that also specifies an order template, these two fields will not be displayed, as the template already defines their desired values.Right-clicking on the button displays these parameters. You can also click the edit button to make changes if desired.

- Qty for an absolute number of contracts

- % for a percentage of the initial quantity for this order

Timing parameters

- Start: Sets the date and time to start executing the order.

Values include:

- Now to start the order immediately

- Time to display a date/time picker for you to indicate when to start the order

- Pre-open to enter the order at the pre-open state defined by an exchange

- Open to enter the order when the exchange opens its trading session

- End: Sets the time to stop executing the logic of the order

Possible values include:

- GTC, which leaves the order working until canceled

- Time, which displays a date/time picker for you to indicate when to stop the order

- Day, which leaves the order working until the market closes

- At End Action: Sets the action to take for any unfilled balance when the End time is reached. Visible only for a custom End time.

Possible values include:

- Cancel — Cancels all child orders and stops the order type.

- Go to Market — Cancels the resting Limit order and submits a Market order. When selected, the "Mkt Order Lmt ticks" option is displayed.

- Mkt Order Lmt ticks — Sets the number of ticks from LTP to submit a Limit order through the opposite inside market. If the checkbox is checked: all child orders are canceled, a Limit order is submitted for the unfilled quantity at a price that's a set number of ticks from LTP, and the order type is stopped. If the checkbox is unchecked: all child orders are canceled, a Market order is submitted for the unfilled quantity, and the order type is stopped.