TT Order Types

TT With A Tick order

A With A Tick (WAT) order is a limit order that is automatically repriced one tick towards the market based on the price and quantity of the opposite inside market as follows:

- When best available price is more than one tick away from the limit price, the WAT order is repriced.

- If the best available price is one tick away and the available quantity drops below a specified threshold, the WAT order is repriced.

The WAT threshold is a parameter set by the user in one of two ways:

- Qty: The threshold is an absolute value. For example, you could place a buy order and join the best bid with a WAT threshold of 100. When the best ask quantity drops below 100, the buy order price will be repriced one tick higher.

- %: The threshold is a percentage of the WAT order quantity. For example, if the quantity on the opposite side of the market drops below 20% of your order's quantity, then your order will aggress into the market by one tick.

TT also allows you to add With A Tick behavior to all child orders of other TT Order Types, except for TT Trailing Limit.

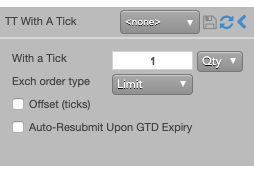

TT With A Tick order parameters

- With a Tick: Sets the threshold to reprice the order.

The quantity can be specified as:

- Qty for an absolute number of contracts

- % for a percentage of the initial quantity for this order

- Exch order type: The order type for the child order. (Currently, only Limit orders are supported.)

- Offset: The number of ticks away from the specified price to submit the order, based on the following price:

- LTP

- Ask

- Bid

- Auto-Resubmit Upon GTD Expiry: Valid only when the child order TIF is Day (GTD). If any child orders are not completely filled by the session close, the exchange will expire the child orders; when the market reopens, the parent order will then resubmit the child orders with the same parameters as when they expired.