Options Chain

Configuring Common Strategies from the Options Chain (new)

Using the Options Chain widget, you can create some common options strategies, such as:

Example: Creating a Butterfly strategy

If you know the structure of a particular type of strategy, you can add the legs with the appropriate ratios by clicking them in the correct order. The following example shows how to create a butterfly options strategy.

-

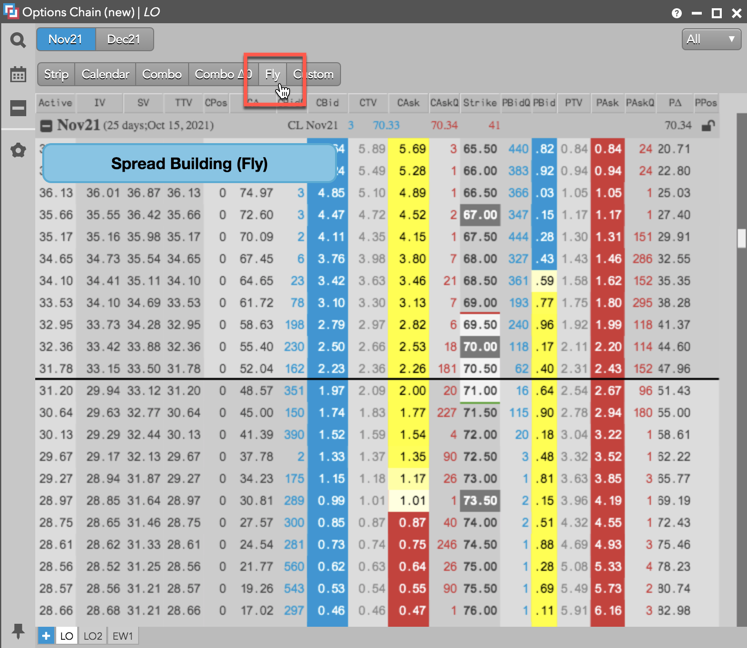

In the Options Chain widget, click Fly to enter Spread Building mode.

-

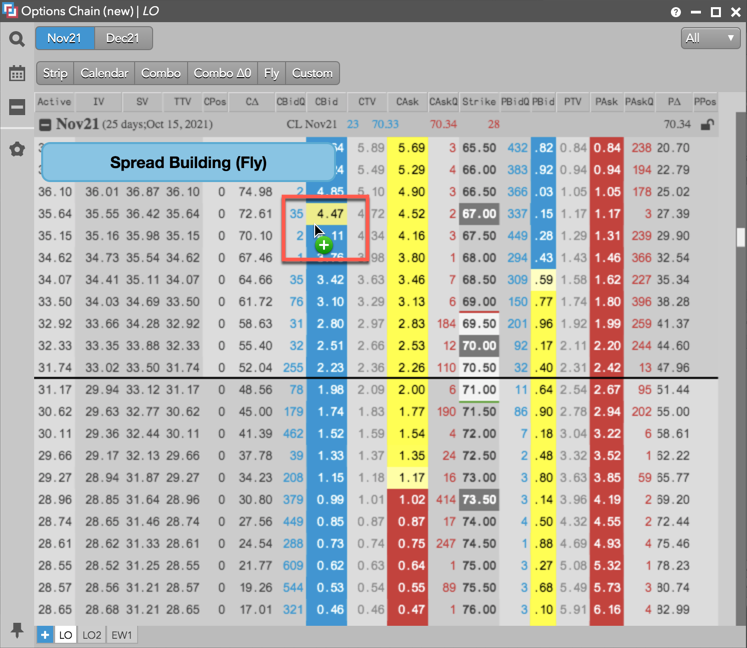

Click a Bid or Ask price to add the first leg of the strategy.

-

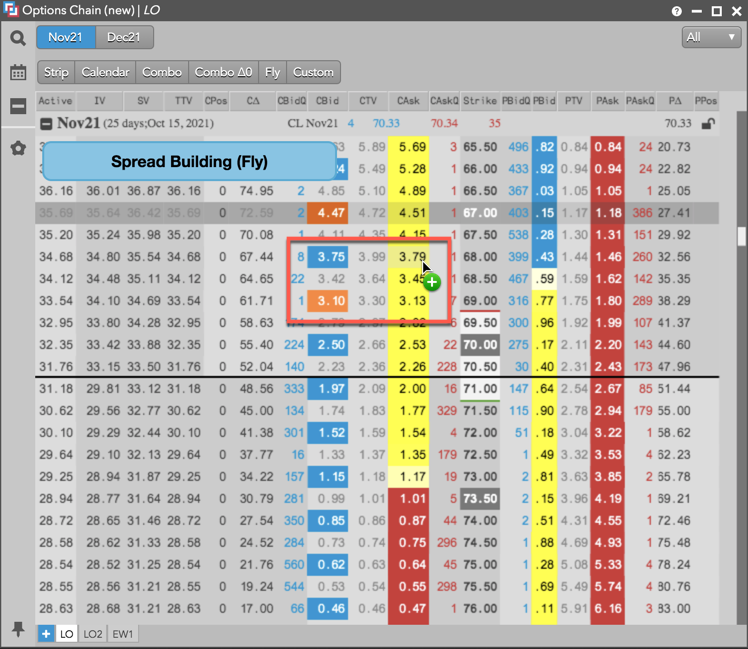

Click the price for either the second or third leg of the butterfly strategy.

As you hover over a price, the butterfly strategy automatically identifies the missing leg of the spread. In this example, the second leg is selected, so the third leg is automatically highlighted.

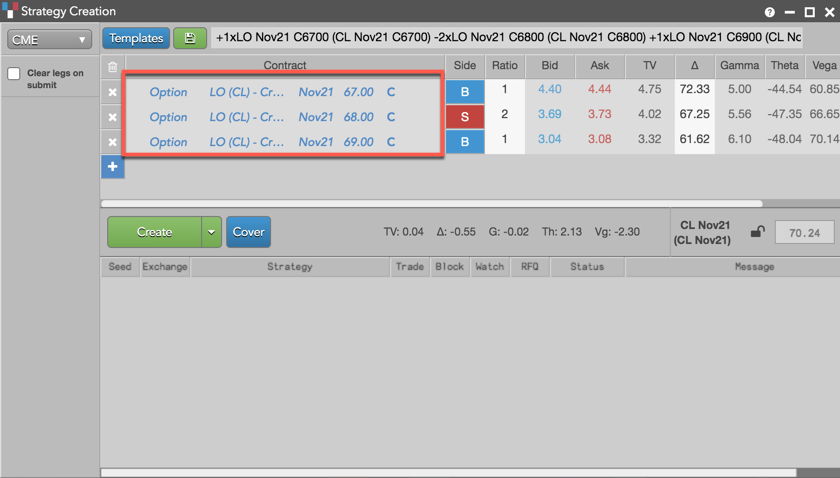

The Strategy Creation widget opens with the legs already added.

Note: To cover your options position with a position in the underlying futures contract, click + to add the futures instrument.

-

In the Strategy Creation widget, modify the strategy as needed and click Create to submit your options strategy to the exchange.

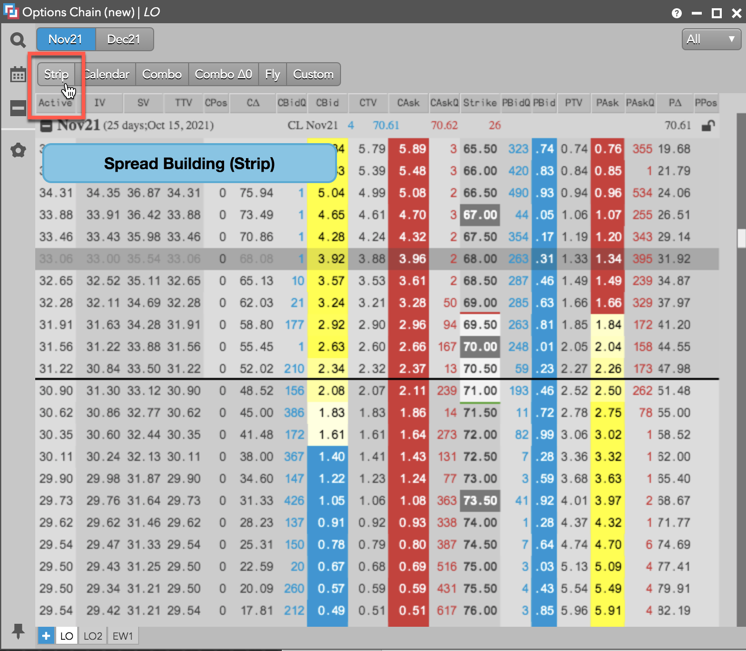

Example: Creating a Strip strategy

The following example shows how to create a Strip spread that sells one Call options contract for each of the expiration months from Nov21 to Jan22.

-

In the Options Chain widget, click Strip to enter Spread Building mode.

-

Click a Bid or Ask price to specify the first leg of the strategy.

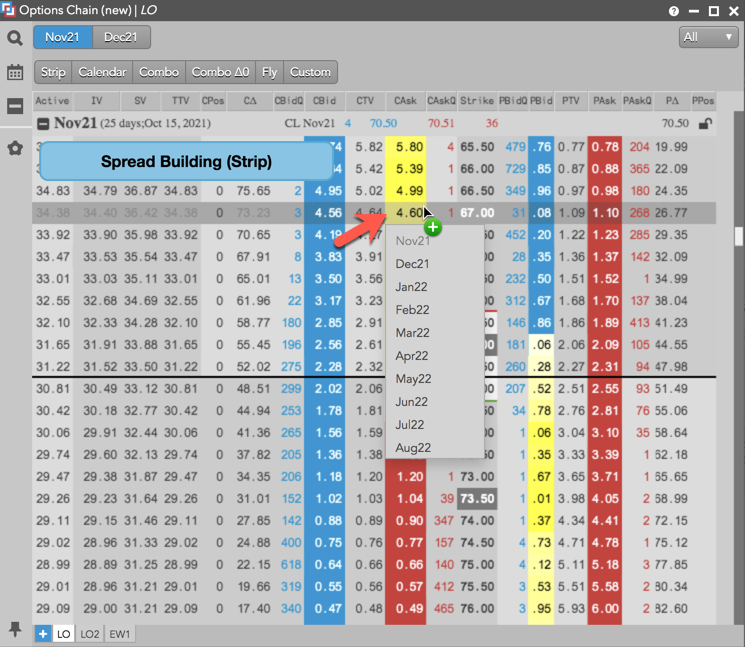

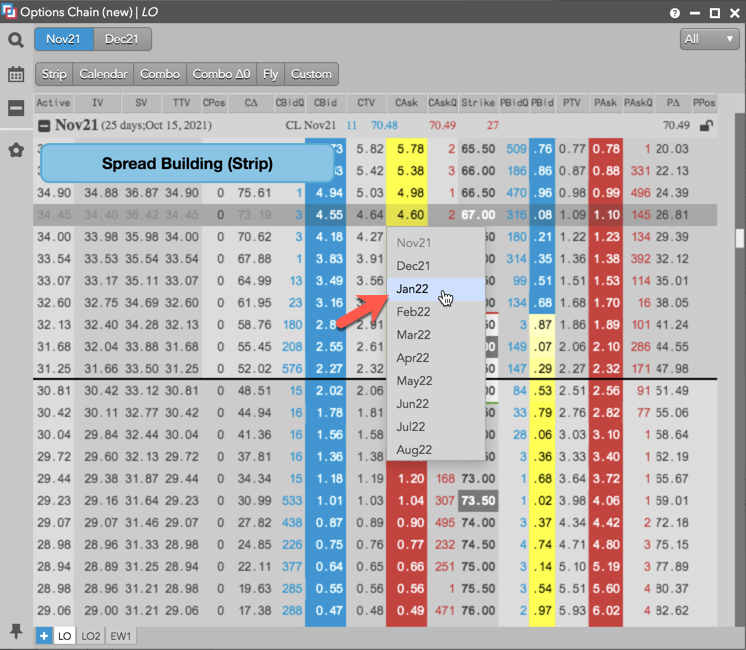

-

In the drop-down menu, select the end of the desired range of expiration months.

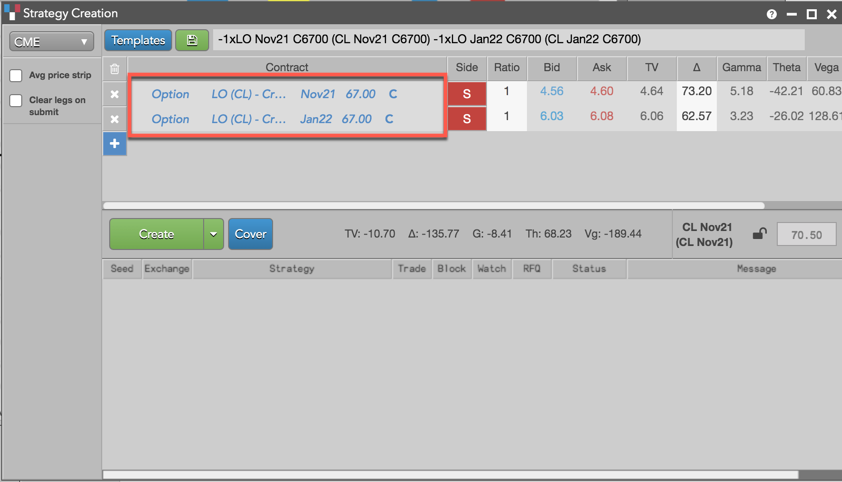

The Strategy Creation widget opens with the legs already added.

Note: To cover your options position with a position in the underlying futures contract, click + to add the futures instrument.

-

In the Strategy Creation widget, modify the strategy as needed and click Create to submit your options strategy to the exchange.

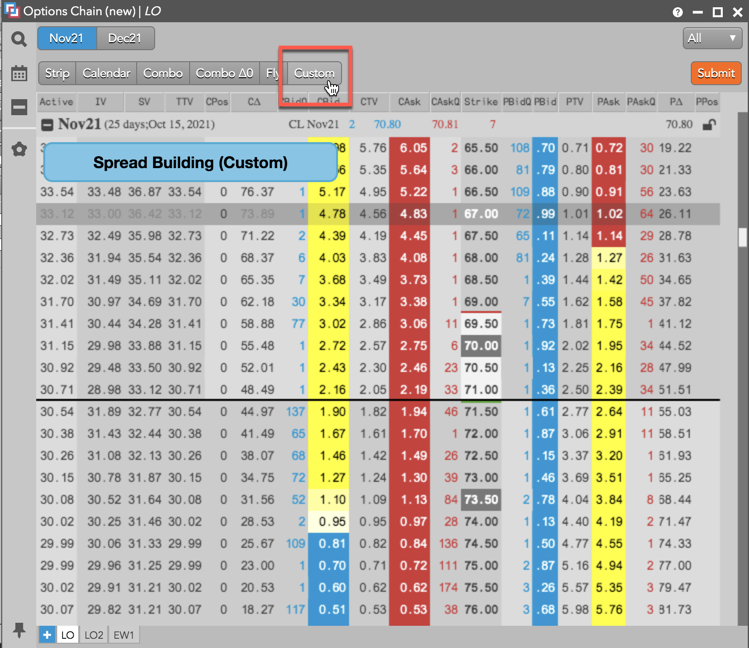

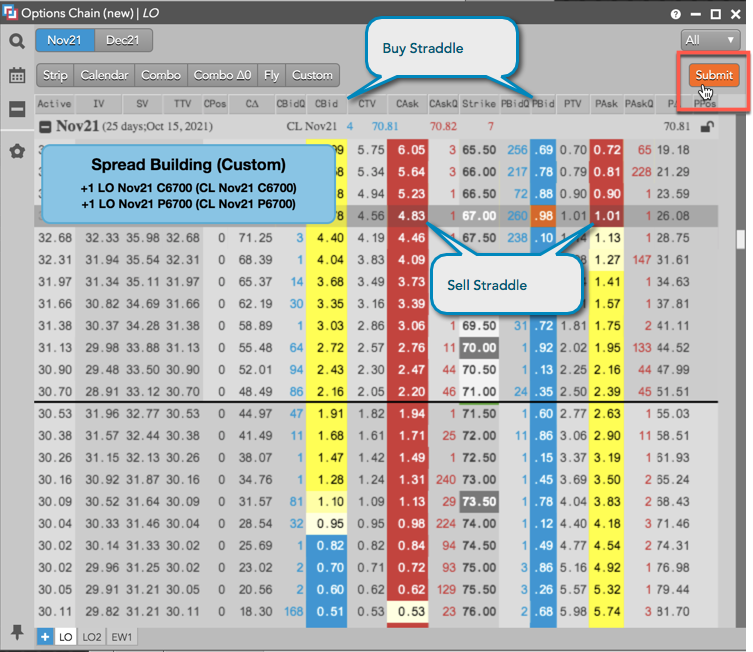

Example: Creating a custom Straddle strategy

This example shows how to create a Buy or Sell straddle options strategy at the 67.00 strike price for the underlying CL Nov21 futures contract.

-

In the Options Chain widget, click Custom.

-

Click a price in the CBid and PBid columns for a Buy straddle or CAsk and PAsk columns for a Sell straddle, and click Submit.

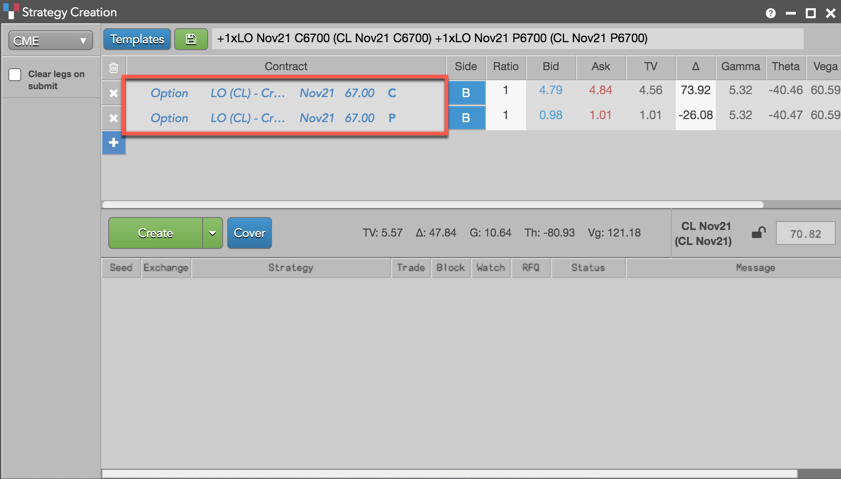

The Strategy Creation widget opens with the legs already added.

Note: To cover your options position with a position in the underlying futures contract, click + to add the futures instrument.

-

In the Strategy Creation widget, modify the strategy as needed and click Create to submit your options strategy to the exchange.