Risk Administration

Inter-product Margin

For users who execute and maintain large positions in inter-product spreads, TT supports inter-product margin calculations.

In addition to the full margin required to hold a position in a product, margin requirements for inter-product spreads consider a ratio of offsetting positions in each outright product, and a discount of the total outright margin for trading the products as a spread instrument. The ratio and discount are used to determine a fair margin for the inter-product instrument rather than restrict users with full margin requirements for both products.

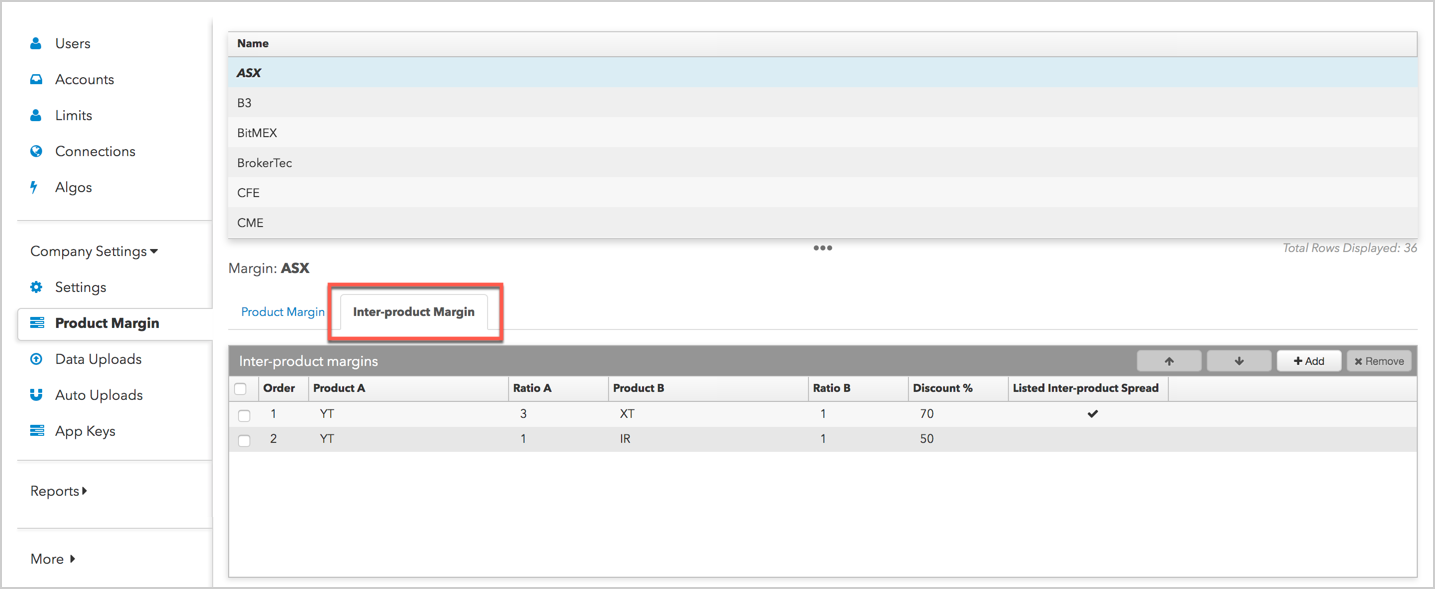

As a company administrator, you can set inter-product margin limits using the Company Settings | Product Margin tab in the left navigation pane. On the Product Margin screen, you can select an exchange and click the Inter-product Margin tab to determine the relationship between pairs of products using ratios and margin discounts.

Inter-product margin calculation examples

The following examples show inter-product spread calculations when one or more inter-product ratios are defined. These examples show commonly used relationships defined by an exchange, but Setup provides you with the flexibility to apply your own ratios and discounts.

Note: The examples refer to margin discount on positions, and not on working orders. In order to get the same discount applied on working orders on exchange-listed inter-product spreads, you must match the legs and ratio of the listed spread. When you do, you will see a check mark applied to the Listed Inter-product Spread column. If that match is made, the same discount specified in the rules will apply to working orders on the listed spread itself. No discount is applied to working outright orders or to working spreads with a non-standard ratio.

If you set up a non-standard ratio on an inter-product spread, the trader will receive no margin discount until orders are filled. Any filled orders, regardless of whether they originated from outright legs or from any spread, will have the inter-product discount applied.

Example: Single inter-product margin ratio

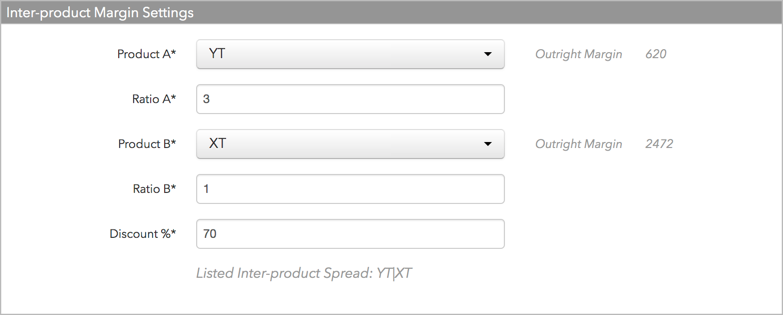

Using the YT-XT inter-product exchange spread on ASX as an example, consider the following:

Outright margin:

- YT: 620

- XT: 2472

In this example, only one inter-product margin ratio is configured: YT/XT, 3:1, with a discount of 70%:

The user has the following position and no working orders:

- YT: -2000

- XT: +600

TT calculates inter-product margin as follows:

- Full outright margin on each leg is calculated first as "outright margin" * "position":

- YT: 2000*620 = 1,240,000

- XT: 600*2472 = 1,483,200

- Total outright margin: 2,723,200

- The applied 3:1 ratio is subtracted from the total position and the discount is applied to as many legs as possible:

- 3:1 = 1800 YT : 600 XT

- (Ratio A * outright margin) + (Ratio B * outright margin)*discount % = (600*2472 + 1800*620)*0.70 = 1,819,440

- 2,723,2000 - 1,819,440 = 903,760 Total Margin

The YT position is -2000, so "1800" is available to match the 3:1 ratio (600*3 : 600*1).

Example: Multiple inter-product margin ratios

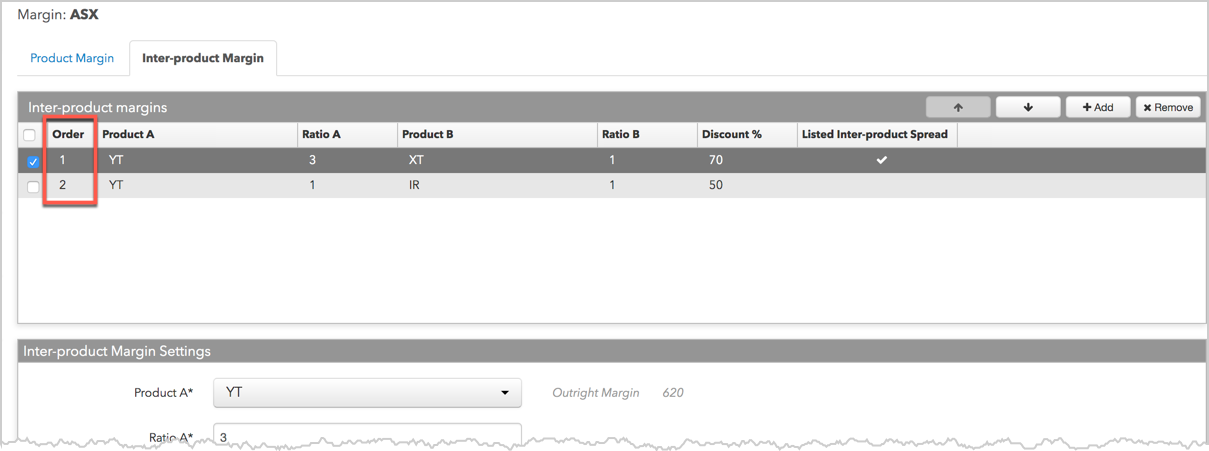

Using the YT-XT and YT-IR inter-product exchange spreads on ASX as an example, consider the following:

Outright margin:

- YT: 620

- XT: 2472

- IR: 299

In this example, two inter-product margin ratios are configured:

- YT/XT, 3:1, with a discount of 70%:

- YT/IR, 1:1, with a discount of 50%

The user has the following position on and no working orders:

- YT: -4000

- XT: +800

- IR: +1000

TT calculates inter-product margin as follows:

- Full outright margin on each leg is calculated first as "outright margin" * "position":

- YT: 4000*620 = 2,480,000

- XT: 800*2472 = 1,977,600

- IR: 1000*299 = 299,000

- Total outright margin: 4,756,600

- The discount on the maximum number of legs of the top listed inter-product ratio (YT:XT) is calculated first:

- 3:1 = 2400 YT : 800 XT

The YT position is -4000, so "2400" is available to match the 3:1 ratio (800*3 : 800*1).

- (Ratio A * outright margin) + (Ratio B * outright margin)*discount % = (800*2472 + 2400*620)*0.70 = 2,425,920

- 3:1 = 2400 YT : 800 XT

- Then, the discount on the maximum number of remaining legs for the next inter-product ratio (YT:IR) is calculated:

- 1000 YT : 1000 IR

- (Ratio A * outright margin) + (Ratio B * outright margin)*discount % = (1000*620 + 1000*299)*0.50 = 459,500

- With no positions left to discount, the discounted margins are subtracted from the total outright margin:

4,756,600 - 2,425,920 - 459,500 = 1,871,180 Total Margin