Charts

Vortex Indicator

The Vortex Indicator consists of two oscillators (VI+ and VI-) used for identifying the start and direction of a market trend. When the VI+ and VI- cross, it generally indicates a market trend. The trend is up when VI+ stays above VI-, and the market trend is down when VI- crosses below VI+.

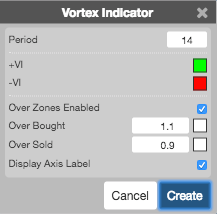

Configuration Options

- Period: Number of bars to use in the calculations.

- Color Selectors: Colors to use for graph elements.

- Over Zones Enabled: Whether to shade the area between the plot and the horizontal overbought and oversold levels.

- Over Bought: Overbought quantity

- Over Sold: Oversold quantity

- Display Axis Label: Whether to display the most recent value on the Y axis.

Formula

The calculation for the indicator is divided into three parts:

-

Uptrend and downtrend movement:

- \( VM+ = {Current High} - {Prior Low} \)

- \( VM- = CurrentLow - PriorHigh \)

- \( \sum_{n=1}^{x} VM\verb "+" \)

- \( \sum_{n=1}^{x} {VM\verb "-"} \)

-

True Range (TR) is the greatest of:

- \( CurrentHigh - CurrentLow \)

- \( \left | CurrentHigh - PrevioiusClose \right | \)

- \( \left | CurrentHigh - CurrentLow \right | \)

- \( \left | CurrentHigh - CurrentLow \right | \)

-

Normalize uptrend downtrend movement:

- \( VIx+ = \frac{VMx+}{TRx} \)

- \( VIx- = \frac{VMx-}{TRx} \)