Charts

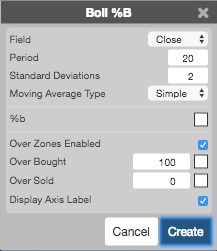

Boll %B

The Boll %B indicator finds the position of a security within Bollinger Bands. BBoll %B is simply a percentage measure of a security’s location between the bands. Boll %B can be lower than 0 or higher than 100 if price moves outside the bands.

Generally speaking, a Boll %B near or above 100 can suggest an overbought market, while a value near or below 0 can indicate an oversold market.

Configuration Options

- Field: Price or combination of prices to use as the base for average calculations. Possible values include:

- Open

- High

- Low

- Close

- Adjusted Close

- HL/2 \( \left ( \frac{High + Low}{2} \right ) \)

- HLC/3 \( \left ( \frac{High + Low + Close}{3} \right ) \)

- HLCC/4 \( \left ( \frac{High + Low + Close + Close}{4} \right ) \)

- OHLC/4 \( \left ( \frac{Open + High + Low + Close}{4} \right ) \)

- Period: Number of bars to use in the calculations.

- Standard Deviations: Number of standard deviations above and below the average to draw the bands.

- Moving Average Type: Type of moving average to use in the calculations:

- Simple: Mean (average) of the data.

- Exponential: Newer data are weighted more heavily geometrically.

- Time Series: Calculates a linear regression trendline using the “least squares fit” method.

- Triangular: Weighted average where the middle data are given the most weight, decreasing linearly to the end points.

- Variable: An exponential moving average with a volatility index factored into the smoothing formula. The Variable Moving average uses the Chande Momentum Oscillator as the volatility index.

- VIDYA: An exponential moving average with a volatility index factored into the smoothing formula. The VIDYA moving average uses the Standard Deviation as the volatility index. (Volatility Index DYnamic Average).

- Weighted: Newer data are weighted more heavily arithmetically.

- Welles Winder:The standard exponential moving average formula converts the time period to a fraction using the formula EMA% = 2/(n + 1) where n is the number of days. For example, the EMA% for 14 days is 2/(14 days +1) = 13.3%. Wilder, however, uses an EMA% of 1/14 (1/n) which equals 7.1%. This equates to a 27-day exponential moving average using the standard formula.

- Hull: The Hull Moving Average makes a moving average more responsive while maintaining a curve smoothness. The formula for calculating this average is as follows: HMA[i] = MA( (2*MA(input, period/2) – MA(input, period)), SQRT(period)) where MA is a moving average and SQRT is square root.

- Double Exponential: The Double Exponential moving average attempts to remove the inherent lag associated to Moving Averages by placing more weight on recent values.

- Triple Exponential: TBD

- Simple

- Exponential

- Time Series

- Triangular

- Variable

- VIDYA

- Weighted

- Welles Winder

- Hull

- Double Exponential

- Triple Exponential

- Color Selectors: Colors to use for graph elements.

- Display Axis Label: Whether to display the most recent value on the Y axis.

Typically, bandwidth parameters will match the user’s preferred Bollinger Band parameters.

Formula

Boll %B = (Price – Lower Band) / (Upper Band – Lower Band)

\[Boll\;\%B = \frac{(Price - Lower\;Band)}{(Upper\;Band - Lower\;Band)} \]