Charts

Coppock Curve (CC)

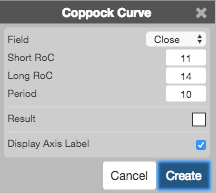

The Coppock Curve indicator tries to identify buy signals in a market by looking at market activity on a monthly time scale. It adds the rates of change for a short and a long period of months and then smooths by another period's weighted moving average. Typically, a potential buy signal occurs when the indicator is below 0 and then rises above it.

Configuration Options

- Field: Price or combination of prices to use as the base for average calculations. Possible values include:

- Open

- High

- Low

- Close

- Adjusted Close

- HL/2 \( \left ( \frac{High + Low}{2} \right ) \)

- HLC/3 \( \left ( \frac{High + Low + Close}{3} \right ) \)

- HLCC/4 \( \left ( \frac{High + Low + Close + Close}{4} \right ) \)

- OHLC/4 \( \left ( \frac{Open + High + Low + Close}{4} \right ) \)

- Short RoC: Number of periods in the short rate-of-change indicator.

- Long RoC: Number of periods in the long rate-of-change indicator.

- Period: Number of bars to use in the calculations.

- Color Selectors: Colors to use for graph elements.

- Display Axis Label: Whether to display the most recent value on the Y axis.

Formula

\[Coppock = WMA_\text{period}\;of\;(ROC_\text{Long RoC periods}+ROC_\text{Short RoC periods})\]

where:

- WMA is the weighted moving average.

- ROC is the rate of change indicator.