Charts

Choppiness Index

The Choppiness Index indicator helps determine whether the market is choppy (trading sideways) or not choppy (trading within a trend in either direction). It shows how long an individual segment of the market outperforms the market in general.

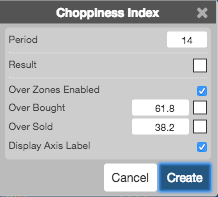

Configuration Options

- Period: Number of bars to use in the calculations.

- Color Selectors: Colors to use for graph elements.

- Over Zones Enabled: Whether to shade the area between the plot and the horizontal overbought and oversold levels.

- Over Bought: Overbought quantity

- Over Sold: Oversold quantity

- Display Axis Label: Whether to display the most recent value on the Y axis.

Formula

CI = 100 * LOG10( SUM(ATR(1), n) / ( MaxHi(n) - MinLo(n) ) ) / LOG10(n)

\[ CI = \frac{\frac{(100 * LOG10(\sum_1^n ATR)}{(MaxHigh(n) - MinLow(n))}}{LOG10(n)} \]

where:

- n = User defined period length.

- LOG10(n) = base-10 LOG of n

- ATR(1) = Average True Range (Period of 1)

- SUM(ATR(1), n) = Sum of the Average True Range over past n bars

- MaxHigh(n) = The highest high over past n bars

- MinLow(n) = The lowest low over past n bars