TT OMS Administration

Night Desk Support

In this example, a sell-side firm has brokerage desks in Chicago and London for executing customer orders during the local trading day, and also operates a separate global support desk or "night desk" that is staffed 24 hours a day.

The firm wants the Chicago and London user groups to only pass orders to the Night Desk, which can accept and pass orders from both groups. All three desks can be assigned to different order passing user groups in Setup by their administrator.

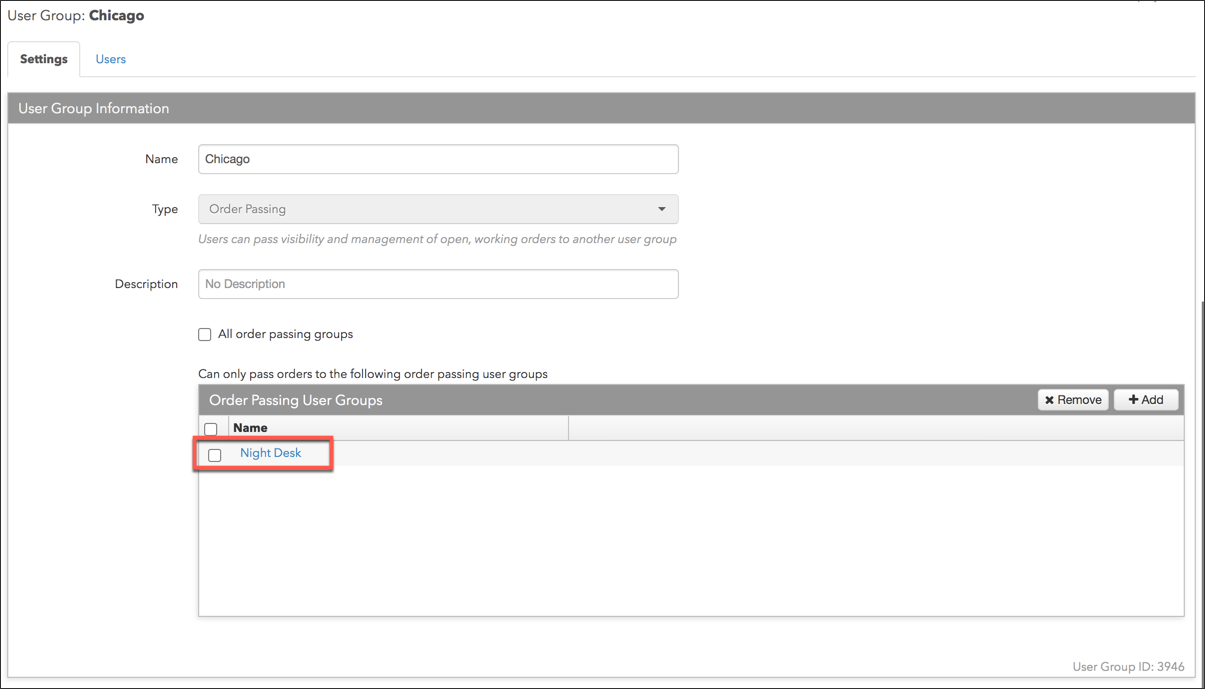

Night desk order passing setup

On the More | User Groups tab in the left navigation pane, the Chicago user group is set up as an "order passing group" that can only pass and accept orders to and from the Night Desk.

On the Users tab, two users (Broker A and Broker B) are added to the group, and both users have been assigned to the same account (Account A) and exchange connections.

Note: Users in the same order passing group are not required to share accounts or connections.

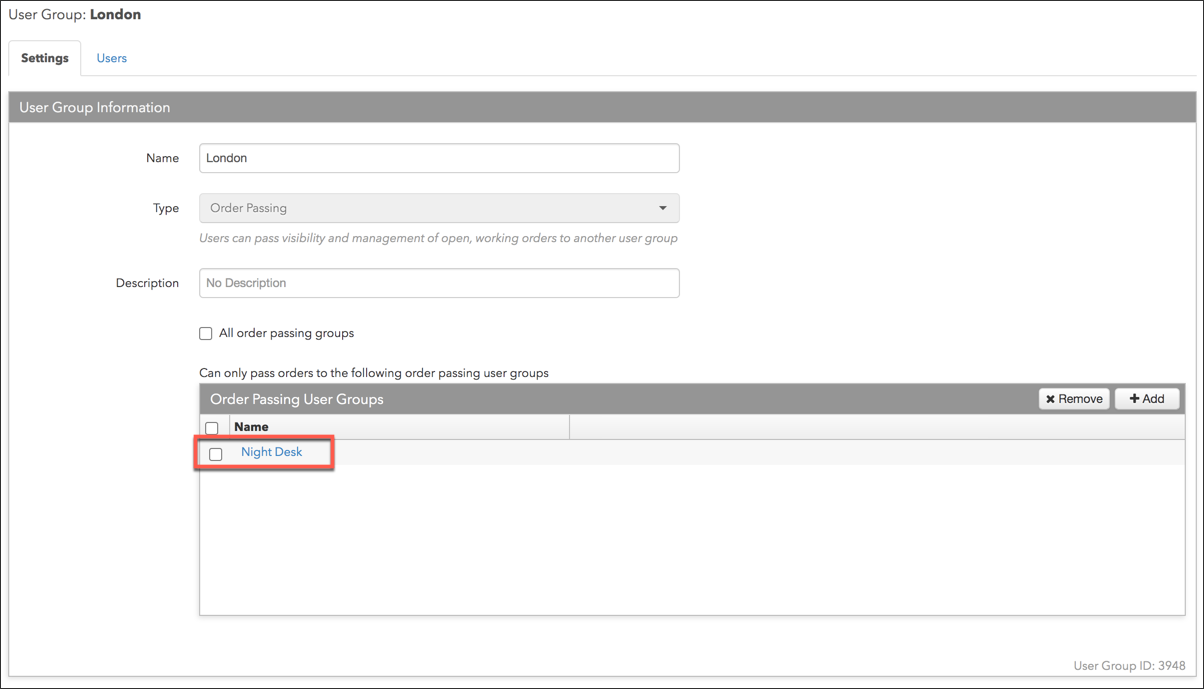

The London order passing group is also set up to only pass and accept orders to and from the Night Desk group.

One user (Broker C) is added to the group and is assigned to a different account (Account 1) with a different connection to the exchange.

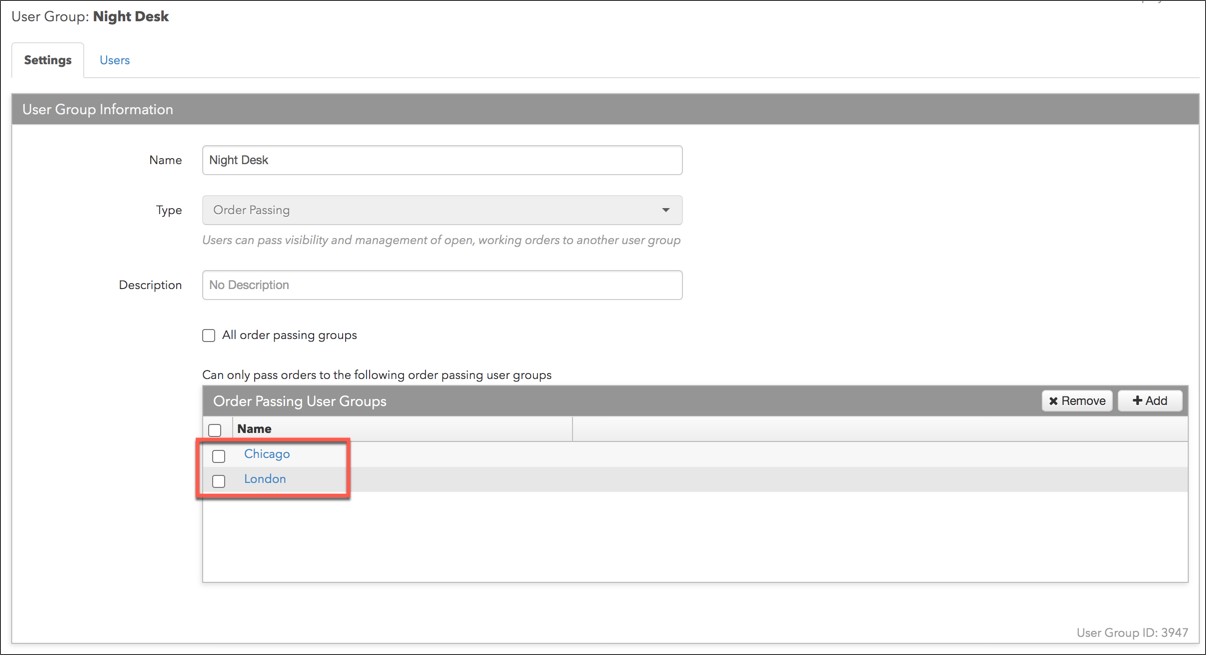

The Night Desk order passing group is set up to pass and accept orders to and from both Chicago and London.

One user (Trader) is assigned to the group and is assigned to their own account and exchange connection that is different from the other users in the group.

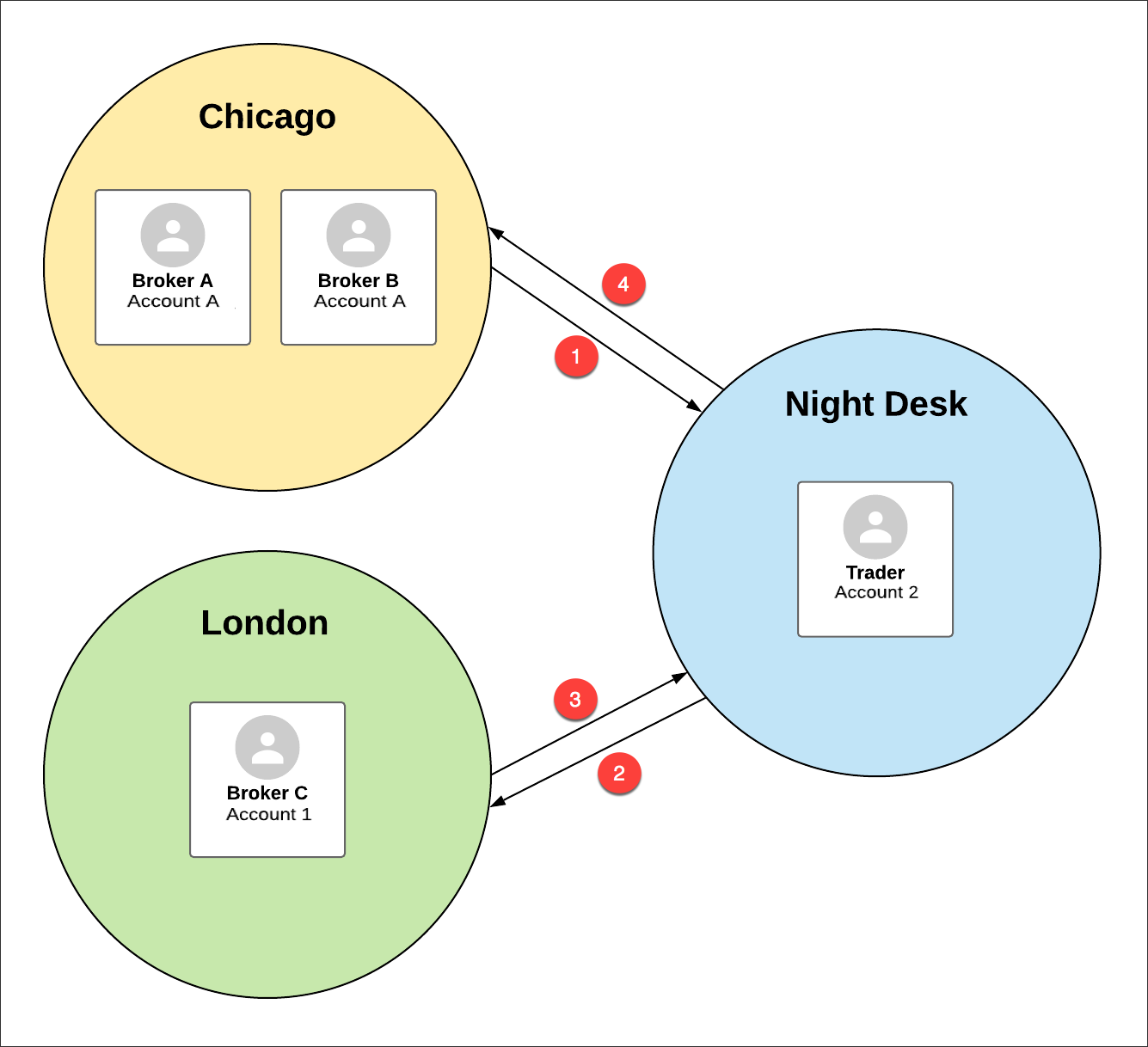

Night desk order passing workflow

The following example shows how the user groups pass orders based on their setup.

- The Chicago user group passes an order to the Night Desk user group, which accepts the order

- Both users added to the Chicago group (Broker A, Broker B) share an account and can view and change the same orders.

- The users in the Chicago group can only pass orders to the Night Desk.

- The Night Desk has visibility of the order and can change the price or quantity of the order. The order is maintained in it's original account and connection when it is passed.

- The user in the Night Desk group (Trader) does not have to be assigned to the same connection or account as the originator of the order.

- The Night Desk user group passes the order to London.

- The user (Broker C) in the London group does not share an account with Chicago or the Night Desk, but has temporary visibility and order management capability since they are in the same order passing group as the Night Desk.

- Broker C does not have to be assigned to the same connection or account as the Trader.

- After Night Desk passes the order to London, the Night Desk user "Trader" no longer has visibility of the order since they do not share accounts and Order Books with Broker A and Broker B in Chicago.

- Broker A and Broker B in Chicago maintain ownership of the order and can view and change the price or quantity of the order.

- London passes the order back to the Night Desk.

- London no longer has visibility of the order.

- The Night Desk now has temporary visibility and can manage the order.

- Users in Chicago still maintain ownership and can view and change the order.

- London cannot pass orders directly to Chicago.

- The Night Desk passes the order back to Chicago.

- Either user in the Chicago order passing group can accept the order.

- After the order is accepted, the Night Desk user no longer has visibility of the order since they do not share accounts with the Chicago users.