Market Abuse Models

Influencing the Open

The Influencing the Open model detects indirect wash trades that occur before open trading in violation of exchange rules, and looks for patterns of submitted and canceled orders that may be attempts to manipulate the indicative open price during the Pre-Open trading period.

The model is designed to identify disruptive trading practices during Pre-Open trading as defined by the CME Group.

Scoring methodology

When scoring clusters, the Influencing the Open model analyzes the following trading activity during the Pre-Open trading period:

- Potential indirect wash trades

- A large volume of submitted and canceled orders.

- Submitted and canceled orders at off-market prices.

Score interpretation

The score assigned to a cluster is based on a sliding scale between 0-100 using a weighted calculation. A score of 75 and above is a good indication that the suspect trading activity occurred.

Based on TT Trade Surveillance best practices, clusters that score over 75 are deemed to be “high risk” and should be the primary focus of users during their compliance reviews.

Scorecard metrics

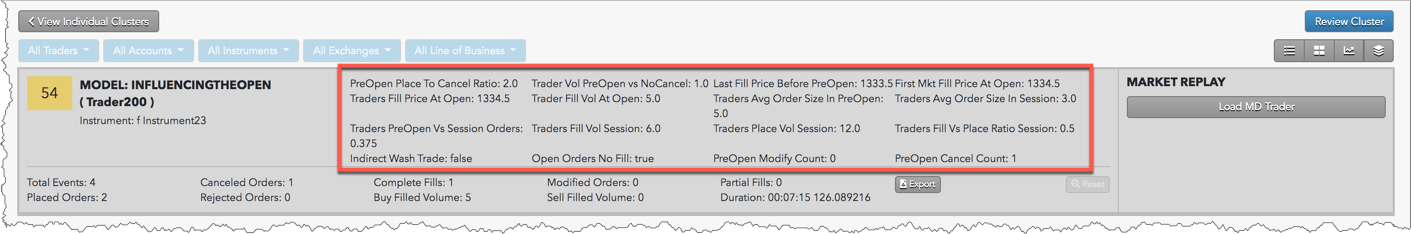

The Influencing the Open cluster scorecard metrics can help you determine if price manipulation may have occurred during the Pre-Open trading period.

The scorecard metrics are gathered during the following market states:

- Pre-Open — Earliest phase of the Opening market state. Orders can be added, modified, and canceled, and no matching occurs. Accepted orders are used to determine the indicative open price for the instrument.

- No Cancel — The end of the Pre-Open phase prior to open trading. Orders can be added but not modified or canceled, and no matching occurs. Accepted orders are used to determine the indicative open price for the instrument.

- Opening — A brief intermediate state. Pre-Open orders are resolved following indicative open price determination.

- Open — Regular trading hours and the start of continue trading. Orders can be added, modified, and canceled, and matching occurs.

The following metrics are provided:

- PreOpen Place to Cancel Ratio — The percent of the trader’s submitted orders that were canceled during Pre-Open.

- Trader Vol PreOpen Vs NoCancel — Shows the percentage of the trader's volume that was not canceled prior to regular trading hours.

- First Mkt Fill Price at Open — Displays the price of the first fill in the market at the Open.

- Traders Fill Price at Open — Displays the price of the trader's first fill during regular trading hours.

- Trader Fill Vol at Open — Shows the trader's total volume at Open.

- Traders Avg Order Size in PreOpen — Average size of orders submitted during Pre-Open.

- Traders Avg Order Size in Session — Average size of orders submitted during the regular trading hours session.

- Traders PreOpen Vs Session Orders — The ratio of the trader's PreOpen and regular trading hours volume.

- Traders Fill Volume Session — The trader's filled volume during regular trading hours.

- Traders Place Volume Session — The trader's submitted order volume during regular trading hours.

- Traders Fill Vs Place Ratio Session — The ratio of submitted order volume to filled volume during the regular trading hours session.

- Indirect Wash Trade — Indication of an indirect wash trade: True or False.

- Open Orders No Fill — Indication of unfilled working orders during regular trading hours: True or False.

- PreOpen Modify Count — Total number of changed working orders during Pre-Open.

- PreOpen Cancel Count — Total number of canceled orders during Pre-Open.

- Indicative Opening Prices — A list of all indicative open prices provided by the exchange and their related timestamps during Pre-Open.

Analyzing data for Influencing the Open

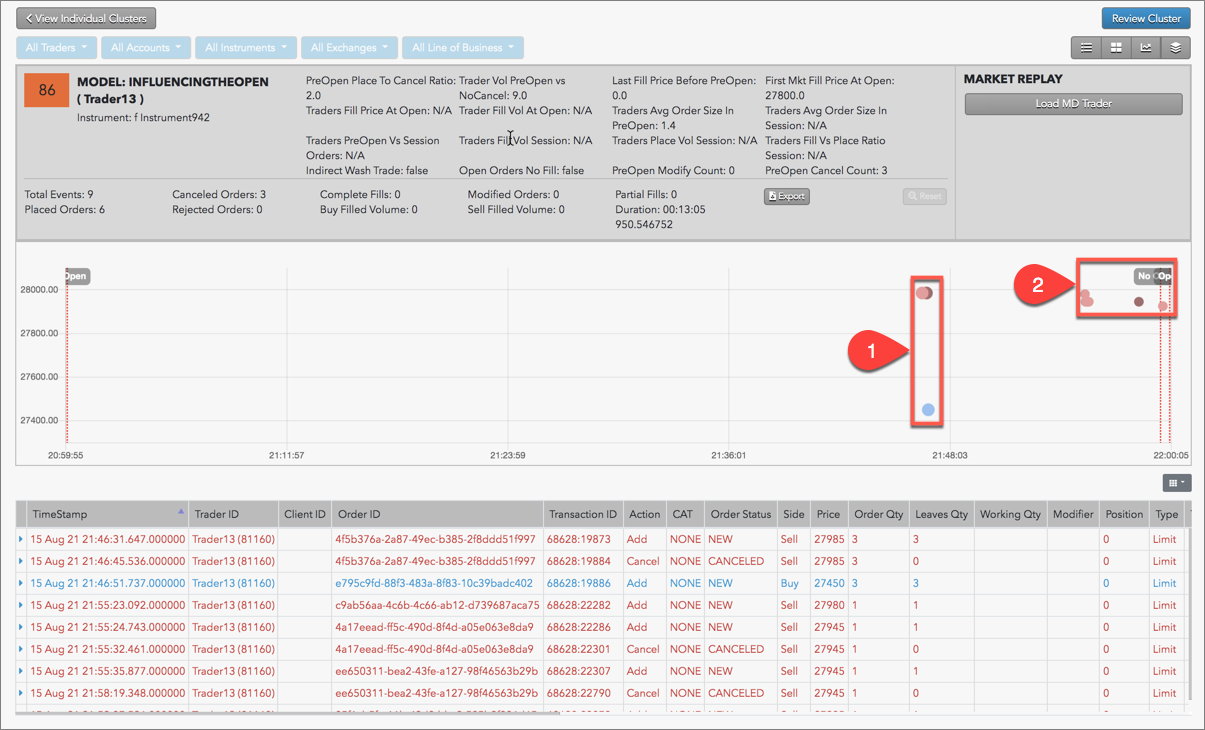

In addition to the scorecard metrics, the chart and audit trail on the scorecard can also help identify suspect Identifying the Open trading activity. The following images show results from inspecting clusters for this model.

The example above shows the following:

- The same trader submitted Buy and Sell orders for the same instrument, which may be an indication of an indirect wash trade during the Pre-Open trading period.

- The example also shows that the trader submitted and canceled multiple orders during Pre-Open, which may be an indication that the orders were never meant to be exposed to the market and were only submitted to increase volume for the instrument being traded.

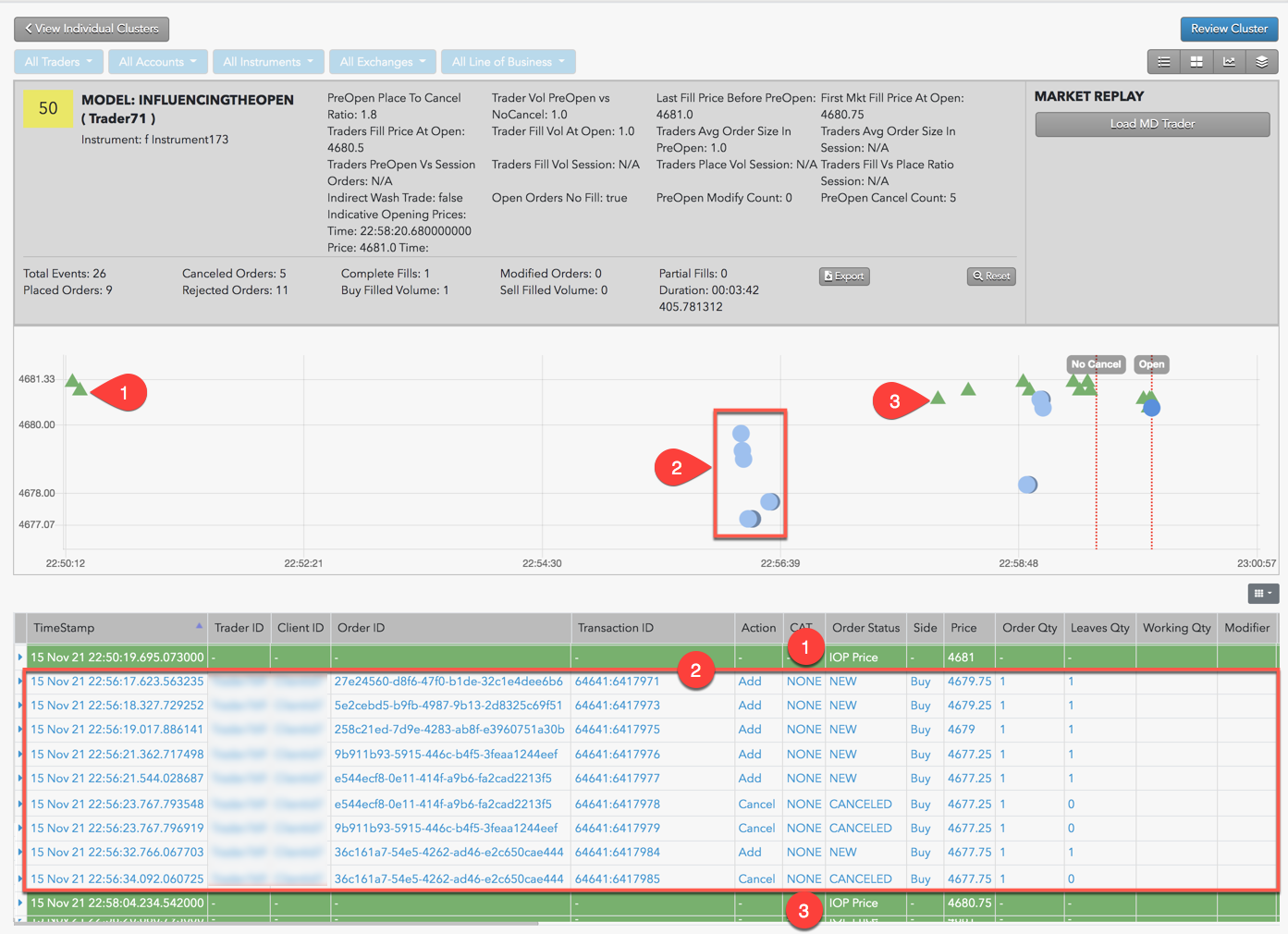

This next example shows how the chart and audit trail for the Influencing the Open model displays indicative open prices.

In this example:

- The exchange displays an indicative open price during their Pre-Open market state.

- The same trader submitted and canceled multiple orders during Pre-Open, which may be an indication that the orders were not entered for the purpose of being filled but were submitted for the purpose of altering the indicative open price.

- The exchange displays an updated indicative open price based on the latest trading activity during Pre-Open.