Market Abuse Models

Dominating the Close

Dominating the Close occurs when a single trader's fills make up the majority of

the market volume of an instrument during the final two (2) minutes of the market

session. The Dominating the Close model in TT Trade Surveillance analyzes and scores clusters

that may indicate that a single trader is dominating the total traded volume

for an instrument during the market close.

When a single trader's resting orders make up the majority of the fill volume

for an instrument, they have control over the pricing of that instrument. The

Dominating the Close model can alert your firm to this behavior, which may be an

indication of potential market manipulation.

Note: The Dominating the Close model only identifies potentially

suspicious trading behavior. This model does not necessarily reflect an actual

rule violation.

Scoring methodology

Scores are based on the percent of trader volume compared to the total market volume and a measure of how aggressive

that trading was.

Dominating the Close score interpretation

Each cluster is assigned a risk score on a sliding scale between 0-100. This

score represents the probability that Dominating the Close occurred during the

duration of the cluster's trading activity.

Based on TT Trade Surveillance best practices, clusters that score over 75 are deemed to be “high risk” and should be the primary focus of users during their compliance reviews.

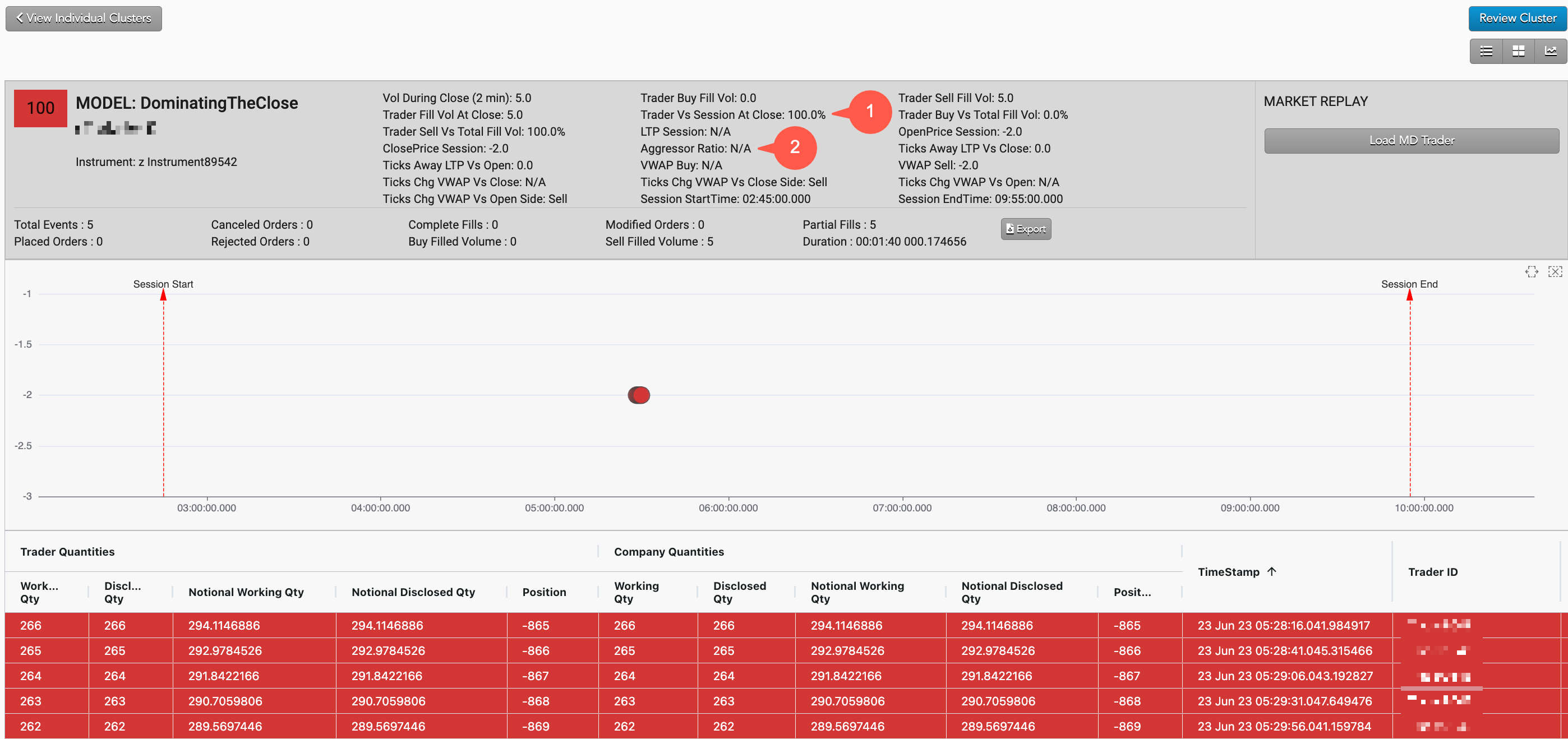

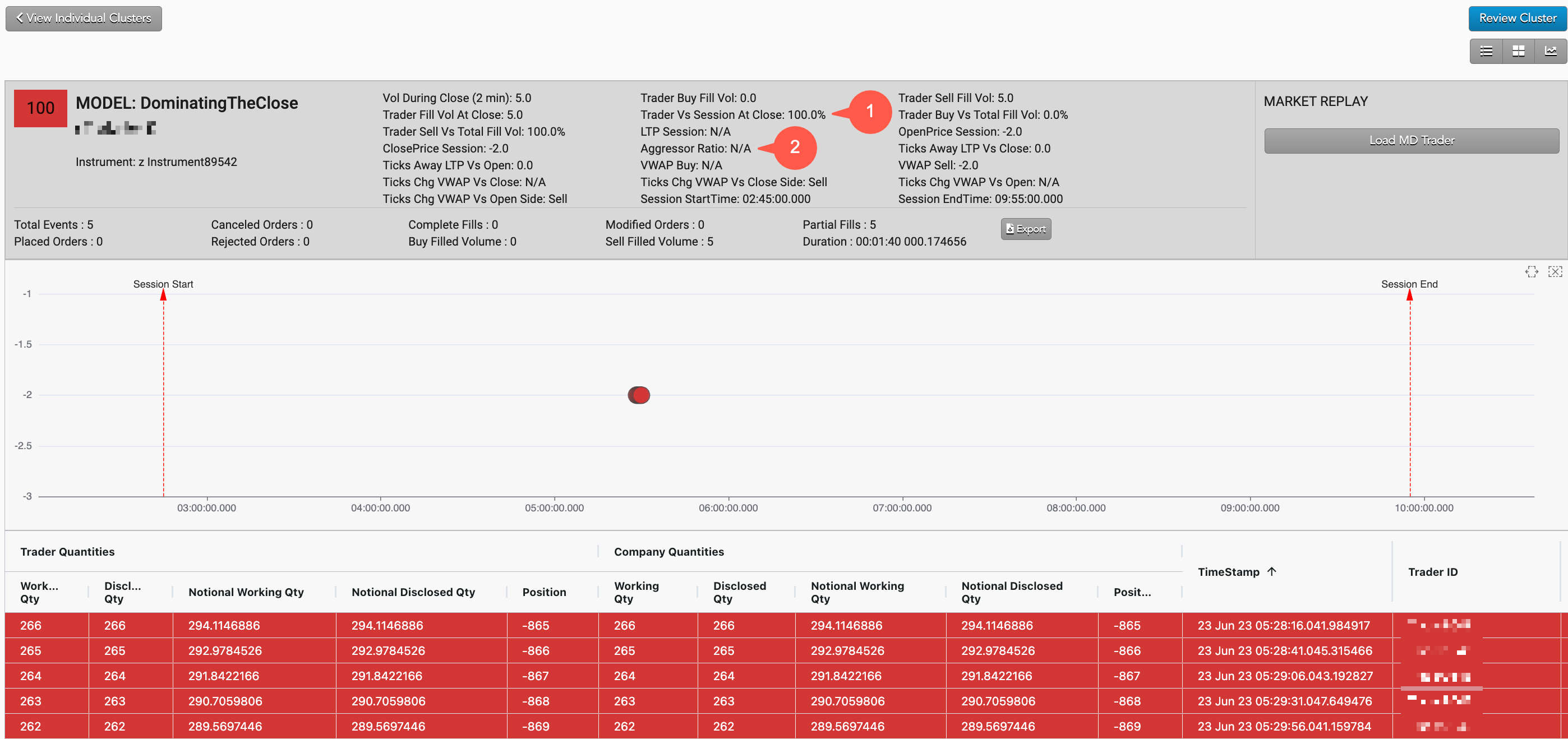

Dominating the Close scorecard metrics

The Scorecard Metrics section measures the following statistics related to

market close dominance:

Vol During Close (2 min) — Total traded volume in the final 2 minutes of the session.

Trader Buy Fill Vol — The trader's total volume of buy side fills for the current trading session.

Trader Sell Fill Vol — The trader's total volume of sell side fills for the current trading session.

Trader Fill Vol At Close — The trader's total volume of both buy and sell side fills for the final 2

minutes of the session.

Trader Vs Session At Close — The ratio of the trader's fill quantity and the total fill quantity for an

instrument in the final 2 minutes of the session.

Trader Buy Vs Total Fill Vol — The ratio of the trader's total volume of buy side fills and the total

fill volume for the trading session.

Trader Sell Vs Total Fill Vol — The ratio of the trader's total volume of sell side fills and the total

fill volume for the trading session.

LTP Session — The instrument's last traded price for the current session.

OpenPrice Session — The instrument's opening price at the start of the current session.

Closeprice Previous Session — The instrument's closing price at the end of the previous session.

Aggressor Ratio — The ratio of aggressive to passive orders.

This is a key metric in determining the overall cluster's score.

Ticks Away LTP Vs Close — The number of ticks between the last traded price and the close price.

Ticks Away LTP Vs Open — The number of ticks between the last traded price and the open price.

VWAP Buy — The volume-weighted average price for buy orders for the session.

VWAP Sell — The volume-weighted average price for sell orders for the session.

Ticks Chg VWAP Vs Close — The difference, in ticks, between the volume-weighted average price and the

close price for the session.

Ticks Chg VWAP Vs Close Side — The side of the market used to calculate the Ticks Chg VWAP Vs Close

value.

Ticks Chg VWAP Vs Open — The difference, in ticks, between the volume-weighted average price and the

open price for the session.

Ticks Chg VWAP Vs Open Side — The side of the market used to calculate the Ticks Chg VWAP Vs Open

value.

Session StartTime — The start time for the trading session.

Session EndTime — The end time for the trading session.

Identifying Dominating the Close

Using the

Cluster Scorecard, you

can view the details of the activity that triggered the market open dominance

score.

For example:

-

The Trader Vs Session at Close shows the trader submitted a high

percentage of the session orders during the final 2 minutes of trading.

-

The Aggressor Ratio reflects a high ratio (more that 50%) between

aggressive and passive orders.

The Trader Vs Session at Open shows the trader submitted a high

percentage of the session orders during the final 2 minutes of trading.