Users

Setting user risk limits

To set user risk limits:

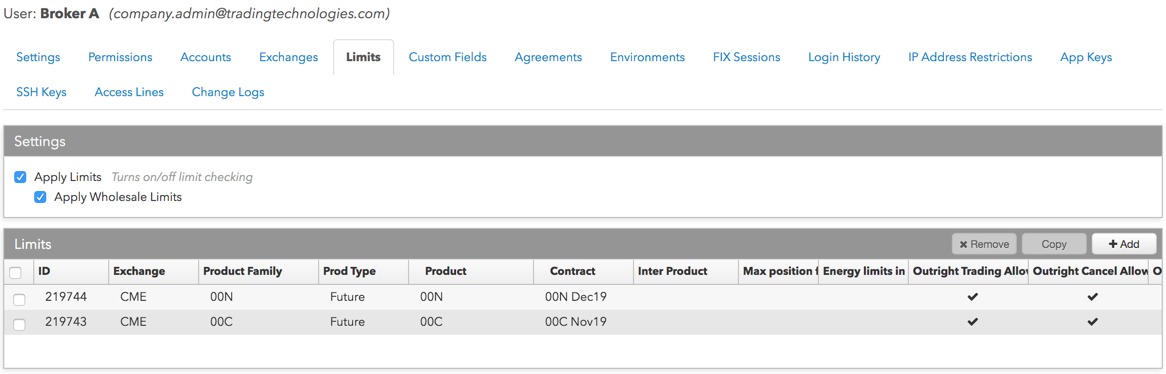

- In the Settings section, click Apply Limits to enable limit checking for the account or user.

Note: If Apply Limits is checked, you must define product or contract limits for each product or contract that the user, parent account or child account is allowed to trade.

Optionally, you can apply risk limits (e.g., Max Order Qty, Price Reasonability) to wholesale orders by checking the Apply Wholesale Limits checkbox. When this checkbox is checked, then the limits configured in the wholesale specific fields are applied.

Note: Position limits do not apply to OTC/wholesale transactions.

- In the Limits section, click +Add to create a new risk limit, or select an existing limit in the Limits section.

If you select an existing limit, you can copy product limits within the selected user's or account's limit tab by clicking the Copy button.

When creating a new risk limit, select the Exchange, Product Type, Product, and/or Contract in the New Limit window and click Add Limit.

Note: If you do not specify a product, then the limit will be the default limit for all products of the selected product type for the selected exchange. If you do not select a contract, the limit will be the default limit for all contracts for the selected product.

The product limit settings are displayed.

- Set the following risk limits as needed:

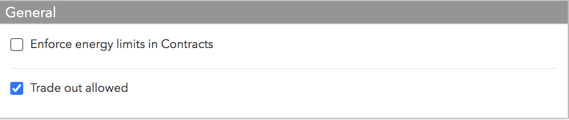

General

- Enforce energy limits in Contracts — Calculates risk limits based on contracts instead of flow for energy products.

- Trade out allowed — Allows the user to exceed the maximum order quantity, maximum long/short position, and credit limit in order to flatten the position in a contract. When this setting is enabled, risk limits at the account level are ignored and the user is allowed to offset their positions. Auto-liquidate works independently of this setting. By default, this checkbox is checked and trade out is allowed.

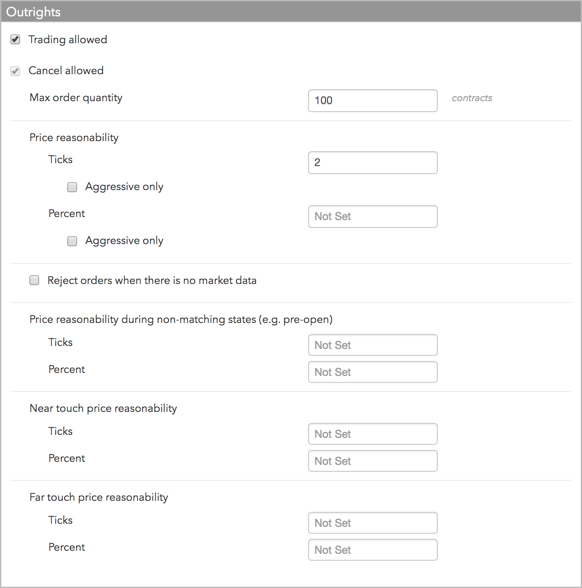

Outrights

- Trading Allowed — Specifies whether outrights can be traded for the selected contract.

- Cancel allowed: Specifies whether orders for these products can be canceled. If you plan to restrict trading in this product but allow only order cancellations, leave this option checked.

- Max order quantity — Specifies a limit on the maximum individual order size that can be entered for the contract. This setting overrides the max order qty setting that might exist at the product or exchange level.

- Price reasonability — Determines how far from the market price a user may enter an order for the contract. You can set a number of ticks away from the market using the Ticks field, and set a percentage away from the current price using the Percent field. If you only want to enforce this setting for buy orders above the limit and sell orders below the market, check the Aggressive only option. This setting overrides the price reasonability setting that might exist at the product or exchange level. For more details refer to Pre-Trade Price Controls.

Note: The following section appears if applying risk limits to all contracts.

Note: When configuring risk for a single contract, the "Trade out allowed" setting is not displayed in the "General" section.

- Reject orders when there is no market data — To reject orders when there is no market data regardless of whether or not the market is in a matching or non-matching state, check this option. By default, orders are allowed when there is no market data.

Price reasonability (ticks) during non-matching states (e.g., pre-open) — Check this setting to apply price reasonability during non-matching exchange states. When applied, the price check uses the indicative open price as the market price, otherwise, the price check uses the first available price from the last/close or settle, in that order. If none of these prices exist, then the algorithm assumes there is no market data at all, and allows or rejects the order based on the Reject orders when there is no market data option.

You can set a number of ticks away from the market using the Ticks field, and set a percentage away from the current price using the Percent field.

- Near touch price reasonability — Allows orders to be placed a set number of ticks or percentage above the best Bid or below the best Ask. For examples, refer to Advanced Pre-trade Price Controls.

- Far touch price reasonability — Allows orders to be placed a set number of ticks or percentage above the best Ask or below the best Bid. For examples, refer to Advanced Pre-trade Price Controls.

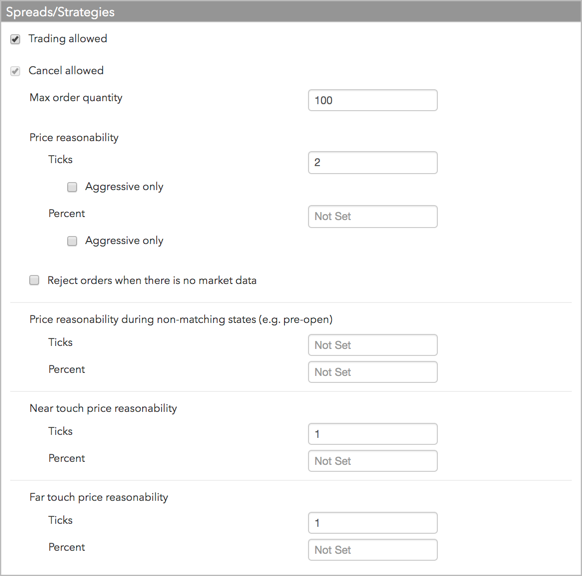

Spread and Strategies

- Trading Allowed — Specifies whether outrights can be traded for the selected contract.

- Cancel allowed: Specifies whether orders for these products can be canceled. If you plan to restrict trading in this product but allow only order cancellations, leave this option checked.

- Max order quantity — Specifies a limit on the maximum individual order size that can be entered for the contract. This setting overrides the max order qty setting that might exist at the product or exchange level.

- Price reasonability — Determines how far from the market price a user may enter an order for the contract. You can set a number of ticks away from the market using the Ticks field, and set a percentage away from the current price using the Percent field. If you only want to enforce this setting for buy orders above the limit and sell orders below the market, check the Aggressive only option. This setting overrides the price reasonability setting that might exist at the product or exchange level. For more details refer to Pre-Trade Price Controls.

- Reject orders when there is no market data — To reject orders when there is no market data regardless of whether or not the market is in a matching or non-matching state, check this option. By default, orders are allowed when there is no market data.

Price reasonability (ticks) during non-matching states (e.g., pre-open) — Check this setting to apply price reasonability during non-matching exchange states. When applied, the price check uses the indicative open price as the market price, otherwise, the price check uses the first available price from the last/close or settle, in that order. If none of these prices exist, then the algorithm assumes there is no market data at all, and allows or rejects the order based on the Reject orders when there is no market data option.

You can set a number of ticks away from the market using the Ticks field, and set a percentage away from the current price using the Percent field.

- Near touch price reasonability — Allows orders to be placed a set number of ticks or percentage above the best Bid or below the best Ask. For examples, refer to Advanced Pre-trade Price Controls.

- Far touch price reasonability — Allows orders to be placed a set number of ticks or percentage above the best Ask or below the best Bid. For examples, refer to Advanced Pre-trade Price Controls.

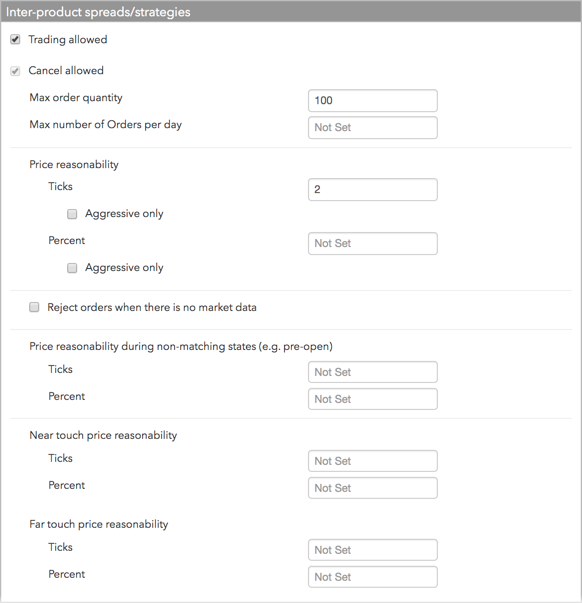

Inter-product Spreads/Strategies

- Trading Allowed — Specifies whether spreads and strategies for the product can be traded. If you plan to restrict trading in this product but allow trading for specific contracts for this product, leave this option unchecked.

- Cancel allowed: Specifies whether orders for these products can be canceled. If you plan to restrict trading in this product but allow only order cancellations, leave this option checked.

- Max order quantity — Specifies a limit on the maximum individual order size that can be entered for the spread/strategy for a particular product, product type, or contract.

- Price reasonability — Determines how far from the market price a user may enter an order for the contract. You can set a number of ticks away from the market using the Ticks field, and set a percentage away from the current price using the Percent field. If you only want to enforce this setting for buy orders above the limit and sell orders below the market, check the Aggressive only option. For more details refer to Pre-Trade Price Controls.

- Reject orders when there is no market data — To reject orders when there is no market data regardless of whether or not the market is in a matching or non-matching state, check this option. By default, orders are allowed when there is no market data.

Price reasonability (ticks) during non-matching states (e.g., pre-open) — Check this setting to apply price reasonability during non-matching exchange states. When applied, the price check uses the indicative open price as the market price, otherwise, the price check uses the first available price from the last/close or settle, in that order. If none of these prices exist, then the algorithm assumes there is no market data at all, and allows or rejects the order based on the Reject orders when there is no market data option.

You can set a number of ticks away from the market using the Ticks field, and set a percentage away from the current price using the Percent field.

- Near touch price reasonability — Allows orders to be placed a set number of ticks or percentage above the best Bid or below the best Ask. For examples, refer to Advanced Pre-trade Price Controls.

- Far touch price reasonability — Allows orders to be placed a set number of ticks or percentage above the best Ask or below the best Bid. For examples, refer to Advanced Pre-trade Price Controls.

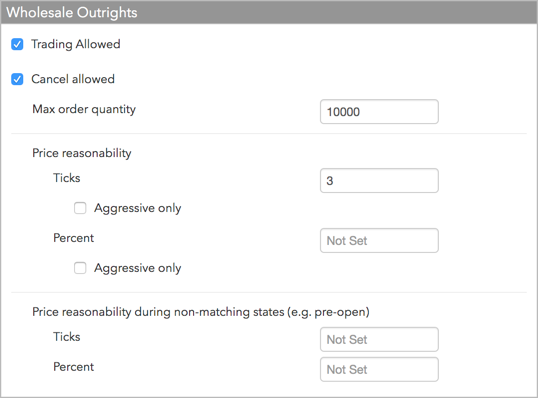

- Set limits for Wholesale Outrights as needed.

- Trading Allowed: Specifies whether spreads and strategies for the product can be traded. If you plan to restrict trading in this product but allow trading for specific contracts for this product, leave this option unchecked.

- Cancel allowed: Specifies whether orders for these products can be canceled. If you plan to restrict trading in this product but allow only order cancellations, leave this option checked.

- Max order quantity: Specifies a limit on the maximum individual order size that can be entered for the spread/strategy for a particular product, product type, or contract.

- Price reasonability: Determines how far from the market price a user may enter an order for the spread/strategy. You can set a number of ticks away from the market using the Ticks field, and set a percentage away from the current price using the Percent field. If you only want to enforce this setting for buy orders above the limit and sell orders below the market, check the Aggressive only option.

- Price reasonability (ticks) during non-matching states (e.g., pre-open): Check this setting to apply price reasonability during non-matching exchange states. When applied, the price check uses the indicative open price as the market price, otherwise, the price check uses the first available price from the last/close or settle, in that order. If none of these prices exist, then the algorithm assumes there is no market data at all, and allows or rejects the order based on the Reject orders when there is no market data option.

You can set a number of ticks away from the market using the Ticks field, and set a percentage away from the current price using the Percent field.

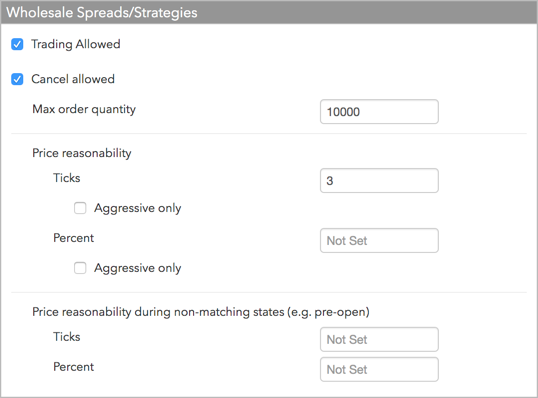

- Set limits for Wholesale Spreads/Strategies as needed.

- Trading Allowed: Specifies whether spreads and strategies for the product can be traded. If you plan to restrict trading in this product but allow trading for specific contracts for this product, leave this option unchecked.

- Cancel allowed: Specifies whether orders for these products can be canceled. If you plan to restrict trading in this product but allow only order cancellations, leave this option checked.

- Max order quantity: Specifies a limit on the maximum individual order size that can be entered for the spread/strategy for a particular product, product type, or contract.

- Price reasonability: Determines how far from the market price a user may enter an order for the spread/strategy. You can set a number of ticks away from the market using the Ticks field, and set a percentage away from the current price using the Percent field. If you only want to enforce this setting for buy orders above the limit and sell orders below the market, check the Aggressive only option.

- Price reasonability (ticks) during non-matching states (e.g., pre-open): Check this setting to apply price reasonability during non-matching exchange states. When applied, the price check uses the indicative open price as the market price, otherwise, the price check uses the first available price from the last/close or settle, in that order. If none of these prices exist, then the algorithm assumes there is no market data at all, and allows or rejects the order based on the Reject orders when there is no market data option.

You can set a number of ticks away from the market using the Ticks field, and set a percentage away from the current price using the Percent field.

- Click Save Changes

- To remove a user's limit, select the limit in the Limits section and click Remove.

Note: The following section appears if applying risk limits to all products or all contracts for a single product.

Note: The following section appears if applying risk limits to all products or for a single interproduct spread/strategy product:

By default, this setting is blank and no maximum order limit is enforced on the account.

Note: Position limits cannot be configured for inter-product strategies. They can be configured for the outright products.