Strategy Creation

NASDAQ NED strategy creation

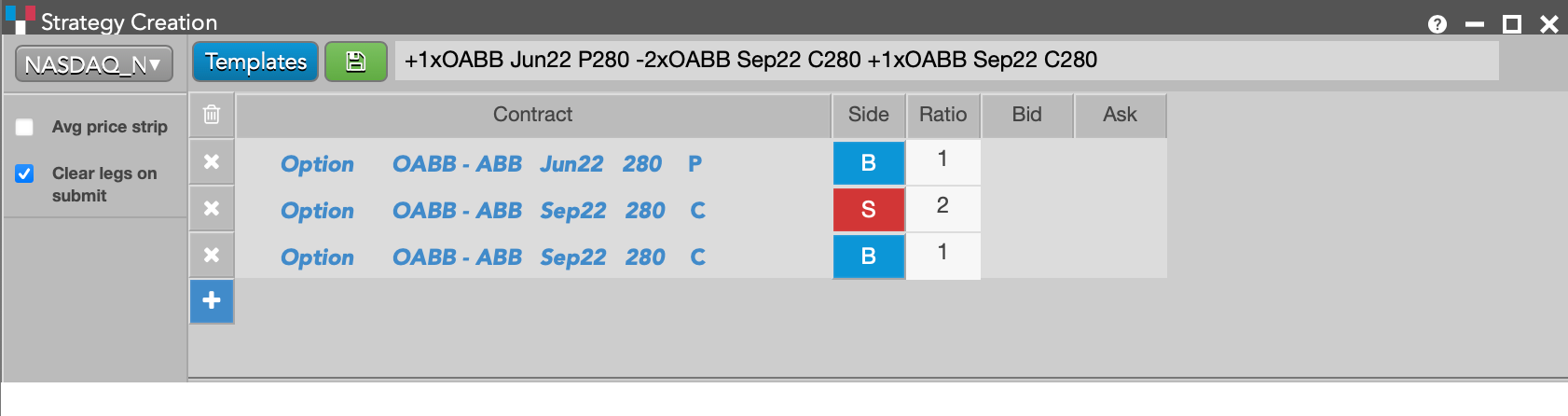

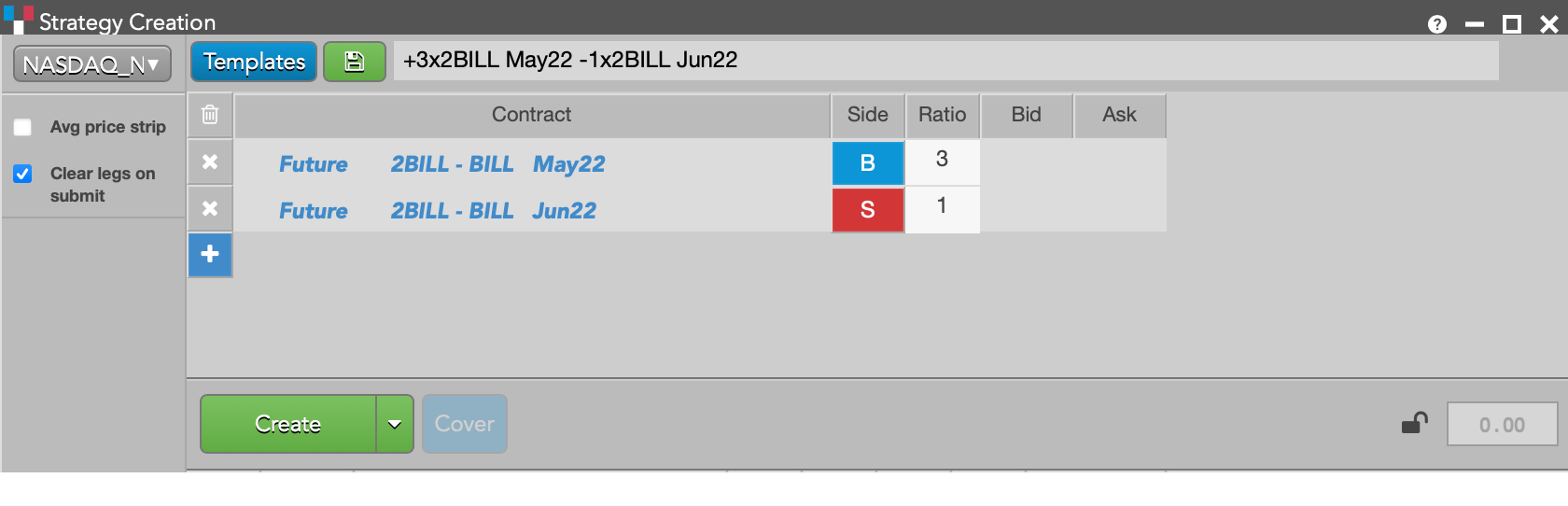

Using the Strategy Creation widget, you can create custom strategies (i.e., NASDAQ NED's User Defined Combinations (UDCs)) for trading on the market. You can create and publish User Defined Combinations with either options or futures instruments for the legs. TT also supports Request for Quote (RFQ) functionality for NASDAQ NED instruments.

Note: At this time, the exchange does not support implied prices for User Defined Combinations.

For more information on NASDAQ NED's User Definied Combinations, refer to their Market Model & Functionality document available through the exchange's Member Portal.

Creating a NASDAQ NED User Defined Combination on TT

User Defined Combinations can be created with a minimum of 2 legs and a maximum of up ten (10) legs for strategies with options or two (2) legs for a strategies with futures. In the Strategy Creation widget, enter an instrument, ratio, and side for each leg.

Leg Ratios

When creating a User Defined Combinations, the exchange requires that the ratio between the largest leg and smallest leg does not exceed 4:1. In addition, each leg ratio must be an integer greater than zero (0) and equal to or less than ten (10).Note: The exchange requires all legs to have the same contract size.

When you click Create in the Strategy Creation widget, the instrument is submitted to NASDAQ NED. When the instrument is created at the exchange, it appears in the execution report panel at the bottom of the widget with a "Status" of "Created".

The exchange assigns the strategy a new instrument ID and returns the ID and definition to the user while also making the new instrument available in the market. If instrument already exists, the exchange instead returns the existing instrument's ID.

Submitting an order for a NASDAQ User Defined Combination instrument on TT

In addition to displaying the NASDAQ User Defined Combination instrument in the Market Grid and opening an Order Ticket, you can click  in the Trade column to open an Order Ticket and submit an order.

in the Trade column to open an Order Ticket and submit an order.