Strategy Creation

CEDX strategy creation

The TT® platform supports CBOE Derivatives Europe (CEDX) complex orders functionality. Using the Strategy Creation widget on TT, you can create and trade complex instruments for all options and futures products at CEDX. The widget also supports sending an RFQ for the instruments you create.

Note: TT supports CEDX complex instruments with both options and futures legs.

Creating a CEDX complex instrument on TT

When creating a CEDX complex instrument on TT, consider the following:

- CEDX reduces strategy ratios to the common denominator (e.g., 2x4 is sent to CEDX as 1x2).

- The exchange creates complex instruments with the Buy leg first regardless of the leg order submitted using the Stratey Creation widget. If a strategy is submitted with all Sell legs, CEDX creates the strategy with all Buy legs.

- CEDX allows user-defined strategies with all Options legs or Futures and Options legs (e.g., multiple Options with only one Futures leg for the same underlying product). CEDX currently does not support inter-product spreads and strategies.

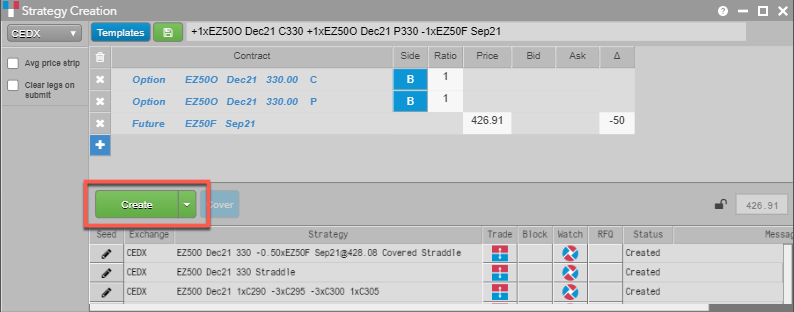

Complex instruments can be created with a minimum of 2 legs and a maximum of up to 12 legs using the Strategy Creation widget. Select a Contract, Ratio, and Side for each leg.

When you click Create, the complex instrument is submitted to CEDX. When the instrument is created at the exchange, it appears in the execution report panel at the bottom of the widget with a "Status" of "Created".

Note: Complex instruments are purged at the end of the trading day.

Submitting an order for a CEDX complex instrument on TT

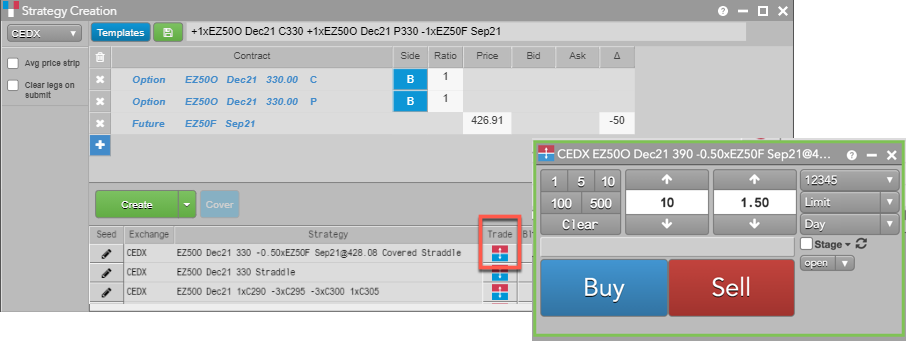

In addition to displaying the CEDX complex instrument in the Market Grid, you can click  in the Trade column to open an Order Ticket and submit an order.

in the Trade column to open an Order Ticket and submit an order.

When submitting an order for a complex instrument, consider the following

- Orders for complex instruments support the following TIFs: Day, IOC, GTD, and Opening.

- Complex orders are quoted in net price terms by combining the price and ratio of each leg.