Blocktrader

MX Committed 1-Sided Orders

The Blocktrader widget supports entering committed (1-sided) orders using the committed order functionality at MX. A committed trade occurs when two exchange-approved parties pre-arrange a transaction and their committed orders are matched at an equal price and quantity on opposite sides of the trade.

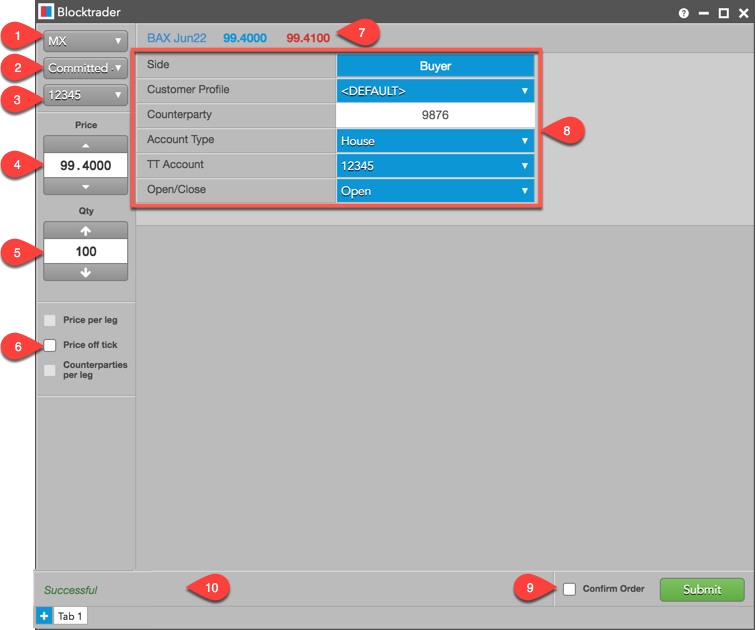

Blocktrader display for MX Committed 1-Sided Orders

The Blocktrader widget includes the following fields for submitting committed orders on MX.

The widget includes:

- Exchange selector — Lists the exchanges with trade reporting supported on TT.

- Trade Type selector — Lists the trade types supported for the selected exchange.

- Account selector — Sets the account used to route the trade to the exchange.

- Price — Sets the price for the transaction You can also use the up and down arrows to set the price.

- Quantity — The total trade quantity. The exchange requires a minimum quantity threshold based on product type.

- Price off tick — When checked, allows you to enter an off tick price per leg for instruments that support tick sizes smaller than what is displayed.

- Instrument Picker — Opens the Market Explorer to search for and select the instrument being traded.

- MX Trade fields — Trade fields required by the exchange. Fields are displayed based on the selected trade type.

- Confirm Order and Submit — Allows you to confirm the order before submitting. When Confirm Order is checked, clicking confirm will allow the user to check the details of the trade before clicking Submit.

- Message indicator — Indicates whether the trade was successfully sent to the exchange. Also shows if the order needs to be confirmed before submitting.

Submitting MX Committed 1-Sided Orders on TT

Before submitting a committed trade, consider the following:

- Exchange rules state that each side of a committed trade must contain a required minimum quantity and is priced inside the bid and ask posted at the time the order is submitted. Note: MX will reject any committed orders that do not meet these requirements.

- Both sides of the trade must have the same price and quantity.

- A committed order must contain the exchange-defined counterparty code.

To submit a MX committed 1-sided orders on TT:

- Open the Blocktrader widget and select MX from the exchange selector.

- Select "Committed 1-Sided" from the trade type selector:

- Find and select an instrument using the Instrument Picker at the top of the widget.

- Set the quantity and price for the trade.

- Select an account for routing the order to the exchange.

- Complete the common and required fields in Blocktrader.

- Click the Submit button.

If Confirm order is checked, confirm the order before submitting it to the exchange.

The following is an example of a committed order submitted on MX.

Blocktrader fields for MX Committed 1-Sided Trades

The following fields are common in Blocktrader when submitting committed orders on MX.

- Side — Sets the Buyer or Seller. Click the Buyer or Seller cell to set each side of the trade.

- Customer Profile — A drop-down list of available Order Profiles. This is an optional field. Only customers with Order Profiles defined in Setup appear in the Customer Profile list.

- Counterparty — Sets the exchange-provided counterparty participant code and is mandatory for MX committed orders. Maps to ex_customer_s in the exchange API. This is a required field.

- Account Type — Sets the exchange account code for the trade. Maps to Account Type in the exchange API as one of the following valid values:

- Customer: Account Type=1

- Customer Insider: Account Type=I

- Customer Shareholder: Account Type=H

- Pro: Account Type=4

- Pro Insider: Account Type=S

- Pro Shareholder: Account Type=L

- House: Account Type=2

- House Insider: Account Type=N

- House Shareholder: Account Type=O

- Non-Client: Account Type=5

- Non-Client Insider: Account Type=R

- Non-Client Shareholder: Account Type=D

- TT Account — Sets an optional account to execute the trade for the Buyer or Seller. All accounts assigned to the Buyer or Seller are listed in the drop-down menu.

- Open/Close — Sets whether the order opens or closes a position.