チャート

負の取引高指数 (NVI)

NVI (負の取引高指数)、および PVI (正の取引高指数) は、銘柄の取引数の変更や取引出来高を追跡します。減少の取引高での価格変化は、正の取引高指数と見なされ、増加の取引高での価格変化は負の取引高指数と見なされます。この指標の意図として、取引高が減少すると、情報に通じたトレーダーが関わっているということを示し、取引高が増加すると、大勢に従うという心理を示しています。

MVI は、「賢いお金」がどう動いているかを表し、PVI は「賢くないお金」がどう動いているかを追跡します。

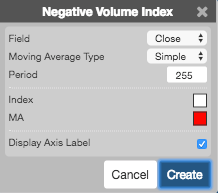

Configuration Options

- 欄: 平均計算のベースに使用する価格、または価格の組み合わせ。以下の値があります。

- Open (始値)

- High (高値)

- Low (安値)

- Close (終値)

- Adjusted Close (調整終値)

- HL/2 \( \left ( \frac{High + Low}{2} \right ) \)

- HLC/3 \( \left ( \frac{High + Low + Close}{3} \right ) \)

- HLCC/4 \( \left ( \frac{High + Low + Close + Close}{4} \right ) \)

- OHLC/4 \( \left ( \frac{Open + High + Low + Close}{4} \right ) \)

- Moving Average Type: Type of moving average to use in the calculations:

- Simple: Mean (average) of the data.

- Exponential: Newer data are weighted more heavily geometrically.

- Time Series: Calculates a linear regression trendline using the “least squares fit” method.

- Triangular: Weighted average where the middle data are given the most weight, decreasing linearly to the end points.

- Variable: An exponential moving average with a volatility index factored into the smoothing formula. The Variable Moving average uses the Chande Momentum Oscillator as the volatility index.

- VIDYA: An exponential moving average with a volatility index factored into the smoothing formula. The VIDYA moving average uses the Standard Deviation as the volatility index. (Volatility Index DYnamic Average).

- Weighted: Newer data are weighted more heavily arithmetically.

- Welles Winder:The standard exponential moving average formula converts the time period to a fraction using the formula EMA% = 2/(n + 1) where n is the number of days. For example, the EMA% for 14 days is 2/(14 days +1) = 13.3%. Wilder, however, uses an EMA% of 1/14 (1/n) which equals 7.1%. This equates to a 27-day exponential moving average using the standard formula.

- Hull: The Hull Moving Average makes a moving average more responsive while maintaining a curve smoothness. The formula for calculating this average is as follows: HMA[i] = MA( (2*MA(input, period/2) – MA(input, period)), SQRT(period)) where MA is a moving average and SQRT is square root.

- Double Exponential: The Double Exponential moving average attempts to remove the inherent lag associated to Moving Averages by placing more weight on recent values.

- Triple Exponential: TBD

- Simple

- Exponential

- Time Series

- Triangular

- Variable

- VIDYA

- Weighted

- Welles Winder

- Hull

- Double Exponential

- Triple Exponential

- Period (ピリオド): 計算で使用されるバー数。

- Color Selectors (配色セレクター): グラフ要素に使用する配色。

- Display Axis Label (軸ラベルの表示): Y 軸に最新値を表示するかどうか。

数式

負の出来高指数は以下のように計算されます。

- 今日の出来高が前日の出来高より少ない場合: \[ NVI = NVI_\text{yesterday} + \left( \frac {FieldPrice - FieldPrice_\text{yesterday}}{FieldPrice_\text{yesterday}} \times NVI_\text{yesterday} \right )\]

- それ以外: \[ NVI = NVI_\text{yesterday} \]