TT Premium Order Types

TT Brisk order

Overview

The TT Brisk Premium Order Type attempts to fill the order closer to when the order enters the market based on the order's Start Time. TT Brisk orders use the current day's trades and market data to minimize risk-adjusted slippage relative to the order's arrival price by creating a front-weighted trajectory vs forecast volume profile.

Note At this time, TT Premium Order Types are not available in the Prod-SIM environment.

Prerequisites

Enabling User's Access

Prior to using any TT Premium Order Type, your administrator must enable access by updating the settings at the user level in the User Account Permissions settings or at the account level using the Account Restrictions settings in Setup.

Setting the Order Cross Prevention Rules

TT strongly recommends that accounts both enabled for the TT Premium Order Types and using account-level Order Cross Prevention, should utilize the Cancel Resting (wait for ACK) option to avoid parent orders from being cancelled.

Using the Reject New option may cause parent orders to be cancelled due to excessive rejects preventing the order from progressing.

The Cancel Resting (wait for ACK) option may have child orders receive unsolicited cancels if interacting with Order Cross Prevention, and this will result in new orders being issued in place of those which were cancelled. The unsolicited cancellations will not result in a cancellation of the parent order.

For more information on Order Cross Prevention Rules, refer to the Order Cross Prevention section of the Setup help.

Note Firms may consult with their TT Onboarding representative with any questions regarding how these settings may impact their overall account structure.

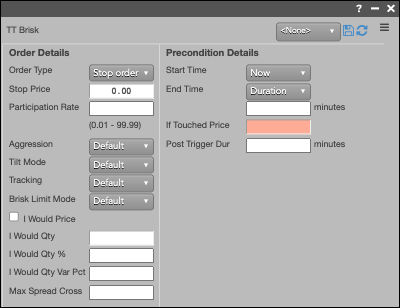

TT Brisk order parameters

Order Details parameters

Note Some of the parameters listed below are optional and provided so you can enhance and customize the execution of your orders in the market.

| Parameter Name | Required/Optional | Description | Default Value |

|---|---|---|---|

| Order Type | Required | Sets the order type for the parent order. Possible values include: | Market |

| Stop Price | Conditional | The desired stop order's price level. Note: Required when Order Type is set to either Stop Market or Stop Limit. |

0 |

| Participation Rate | Optional | Gives the trader the option to set the maximum participation rate with respect to total eligible market activity. |

Null |

| Aggression | Optional | Influences how strongly to tilt order trajectory (TT Close, TT Brisk), how tightly to track max participation (TT POV, TT Scale POV), or how tightly to follow an order schedule (TT TWAP+, TT VWAP+). For TT Brisk orders, this means:

|

5 |

| Tilt Mode | Optional | Determines the methodology used to tilt away from the a normal Volume-Weighted Average Price (VWAP)-based schedule for TT Brisk and TT Close algos.

|

Model Driven |

| Tracking | Optional | Allows trader to select between trend following and reversionary behavior. Supported values include:

|

Null |

| Brisk Limit Mode | Optional | Specifies whether the order should get more aggressive when opposite side quote price is at the limit price. This setting can be used to manage fill rate risk, increasing the expected fill rate if the market is nearing the limit price, at the cost of higher expected slippage on executed quantity. Possible values include:

|

Null |

| I Would Price | Optional | Price at which you would like to aggressively attempt to fill your order, regardless of the algorithm logic. Order aggressively tries to fill if the instrument reaches this price, irrespective of volume based tracking objectives. Should be lower than limit and arrival time ask prices for BUY orders, higher than limit and arrival time bid prices for SELL orders. |

Null |

| I Would Qty | Optional | When set to any value greater than 0, I Would Qty setting equals the minimum top of book quantity required before the order will cross the spread. When used, the I Would Qty parameter behaviors may cause an order to finish materially sooner than base TT Premium Order Type logic would normally determine. |

Null |

| I Would Qty % | Optional | Similar to I Would Qty, but set as a percent of the order quantity. Note The field represents the number as a percent and should not be submitted as a decimal: a value of 70 equals 70%. |

Null |

| I Would Qty Var Pct | Optional | Randomizes the I Would Qty and I Would Qty % thresholds by a specified percent in each direction. Note This field represents the number as a percent and should not be submitted as a decimal. For example, a value of 10 equals 10%. For example, if I Would Qty equals 100 and I Would Qty Variance % equals 20, the I Would Qty behavior will be triggered based on available size being between 80-120, depending on randomized value selected within the variance range. |

|

| Max Spread Cross Ticks | Optional | If greater than 0, an order will not cut or cross a bid-ask spread that is more than the specified amount wide. Note This constraint takes precedence over I Would, With A Tick, Brisk Limit, and Cleanup % behaviors. |

Precondition Details parameters

| Parameter Name | Required/Optional | Description | Default Value |

|---|---|---|---|

| Start Time | Required | Sets the date and time to start executing the synthetic order. Available settings include:

|

Now |

| End Time | Required | Sets the date and time to stop executing the logic of the synthetic order. Used as an alternative to setting Duration |

|

| If Touched Price | Optional | Enables the inverse of Stop Price functionality: if present, a Buy/Sell order activates once the contra price is less/greater than or equal to If Touched Price. Can be used in combination with Stop and Stop Limit orders for One-Cancels-Other (OCO) type behavior, where an order activates when the market reaches either a profit taking or stop loss price. |

|

| Post Trigger Dur | Optional | The Post Trigger Duration in minutes. If set greater than 0, will adjust EndTime once market reaches Stop Price or Trigger Price to earlier of EndTime or current time plus PostTrigger Duration minutes. |

|

| End Time Override | Optional | Overrides End Time, Duration, or the default with one of several product hours related values. Available options are:

Note: If the current time is in the final continuous trading session of the day Next Session Close and Last Session Close reference the same time. |

None |

| Dynamic Duration | Optional | If selected, orders submitted may finish ahead of any defined End Time. If not selected, parent orders will seek to utilize the full trading window as defined by the Start and End Times. |

On |