Pre-Trade Portfolio Risk

Credit Check Formula

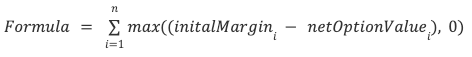

The formula used for the credit check is as follows:

cost = Legacy TT Margin + Portfolio SPAN Margin - Open Trade Equity + Options Premium (filled orders) + Working Long Options Premium

| Cost | Total credit requirement for the account. |

|---|---|

| Legacy TT Margin | Margin requirement for products in a market which is not enabled for Pre-Trade Portfolio Margin. |

| Portfolio SPAN Margin | Margin requirement for Pre-Trade Portfolio Margin enabled markets, this includes Initial Margin Requirements and the Net Option Value (if applicable).

|

| Open Trade Equity | The open trade equity (marked to market P/L) of positions (excluding options margined Equity-Style), is calculated using midpoint. |

| Options Premium (filled orders) | Premium on filled positions for options margined Equity-Style. |

| Working Long Options Premium | Estimated premium for long options margined Equity-Style. |

Note If Net Option Value exceeds the value of Initial Margin for orders and positions, a cost-credit is created within the same exchange.