Pre-Trade Portfolio Risk

Configuring an Account or Risk Group for Pre-Trade Portfolio Risk

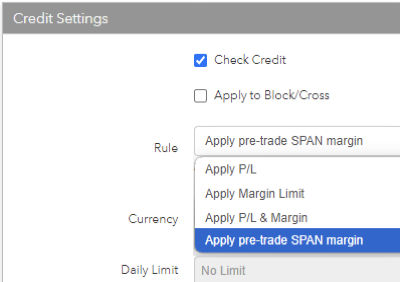

When a TT Company has been enabled for TT Pre-Trade Portfolio Risk, an additional menu item will appear within the Rule dropdown found on the SOD/Credit tab for Accounts and Risk Groups named Apply pre-trade SPAN margin.

Note TT Onboarding or Service Management teams can enable this feature.

This setting behaves similarly to the option Apply P/L & Margin; however, the difference is the Margin values calculated for exchanges supported by the Pre-Trade Portfolio Risk service are done so using the risk array files sourced from the exchange.

When this option is set, the field Liquidating Value, which is found within Cash Balances on the SOD/Credit tab for the Account or Risk Group, determines the allowed credit limit or purchasing power.

A checkbox setting for Gross Margin can optionally be enabled when Apply pre-trade SPAN margin is configured.

When enabled on a Parent Account, the Gross Margin setting will restrict positions netting between Child Accounts.