Improperly Matched Trade Models

Wash Trading

A wash trade is a form of market manipulation in which a trader simultaneously buys and sells the same instrument using the same trader ID or account. Wash trades are typically used to generate artificial volume or to generate commissions for a broker.

In TT Trade Surveillance, the Wash Trader Model analyzes and scores wash trading per user, while the Wash Account Model scores wash trading events per account.

Scoring methodology

When evaluating a potential wash trade based on Trader IDs, TT Trade Surveillance uses two checks. First, it determines if opposing orders for the same exchange-traded instrument were executed against each other at the same time and price. If so, TT Trade Surveillance then determines whether both trades were made with the same trader ID or same account.

Score interpretation

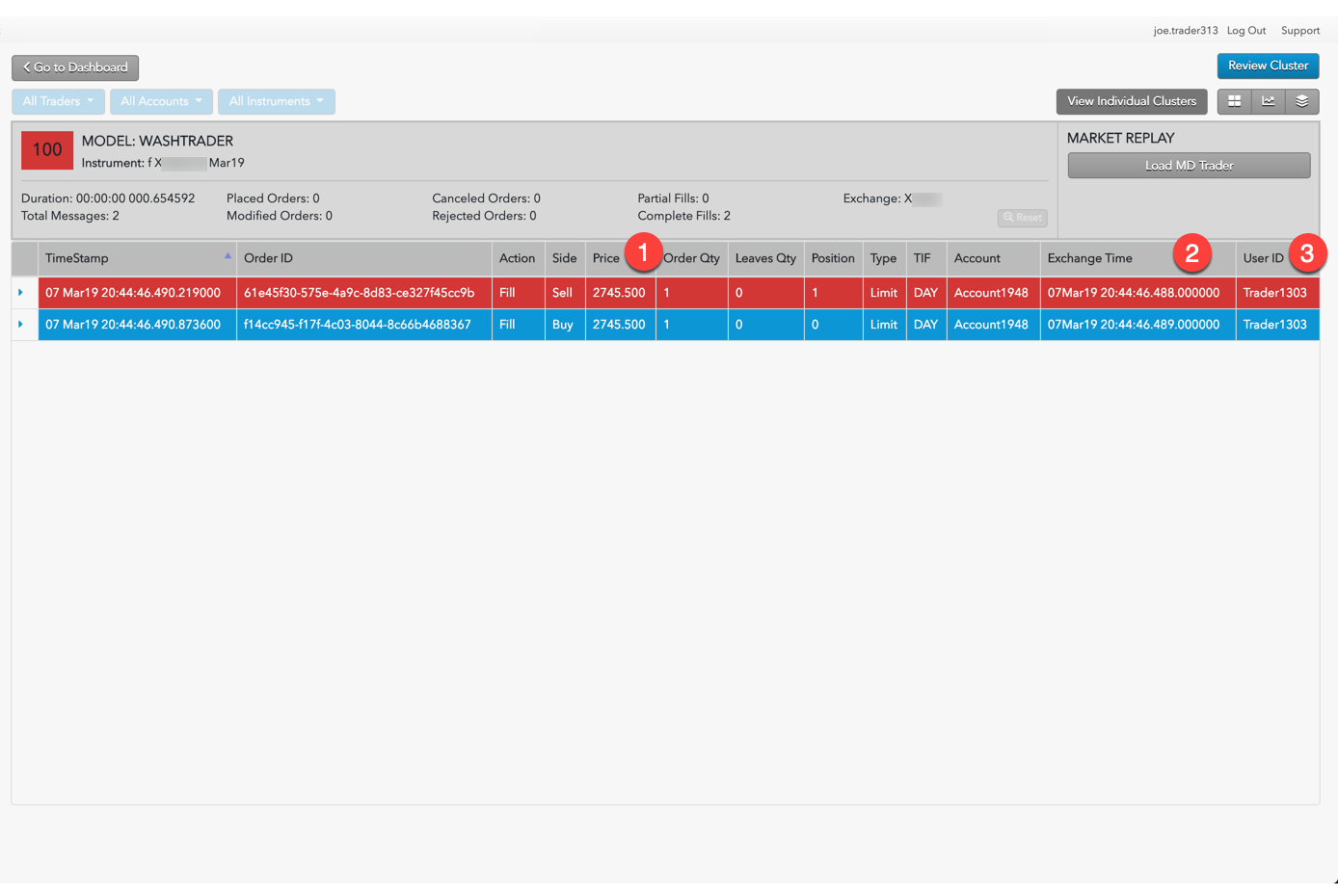

TT Trade Surveillance sets the cluster risk score to 100 if a true wash trade is detected; otherwise it sets the score to 0.

Identifying wash trading

Use the Cluster Scorecard to get a closer look at the activity that triggered the wash trading score. The Cluster Scorecard shows activity that could constitute a wash trade.

- Fills were executed on opposite sides of the market for the same order quantity.

- The two transactions were executed within the same millisecond.

- The two transactions were executed by the same trader ID.