Improperly Matched Trade Models

Cross Trading

A cross trade occurs when a buy order and a sell order for the same instrument are entered for different accounts under the same management, such as a broker or portfolio manager. To ensure that all market participants have a fair chance to trade at a price, exchanges impose minimum delays between such transactions. A cross trade is potentially illegal when both sides of the trade occur within the delay period.

Note: The “resting period” (delay period) for Cross Trades is 5 seconds.

Scoring methodology

TT Trade Surveillance identifies opposing buy and sell orders placed for the same instrument at the same price. When it finds a matching set of orders, TT Trade Surveillance determines the length of time between the orders.

Score interpretation

TT Trade Surveillance assigns the following risk scores for cross trades:

- 100 — Delay is insufficient (less than 5 seconds) and Transaction ID (“TID”)/TradeMatchID match (if either field is reliable - this is exchange dependent), or no reliable TID/TradeMatchID and fills occur within 300 microseconds.

- 95 — No reliable TID/TradeMatchID, but meets all other matching criteria, same trader, delay insufficient, fills more than 300 microseconds apart.

- 75 — Delay is sufficient and TID/tradeMatchID match or fills occur within 300 microseconds

- 70 — No usable TID/TradeMatchID, but meets all other matching criteria, same trader, delay sufficient

- 70 — TID/TradeMatchID don’t match, but meets all other matching criteria, different trader, delay insufficient

- 62 — No usable TID, but meets all other matching criteria, different traders, delay sufficient

- 0 — Not a match on TID/tradeMatchID or it is a block trade

Identifying cross trading

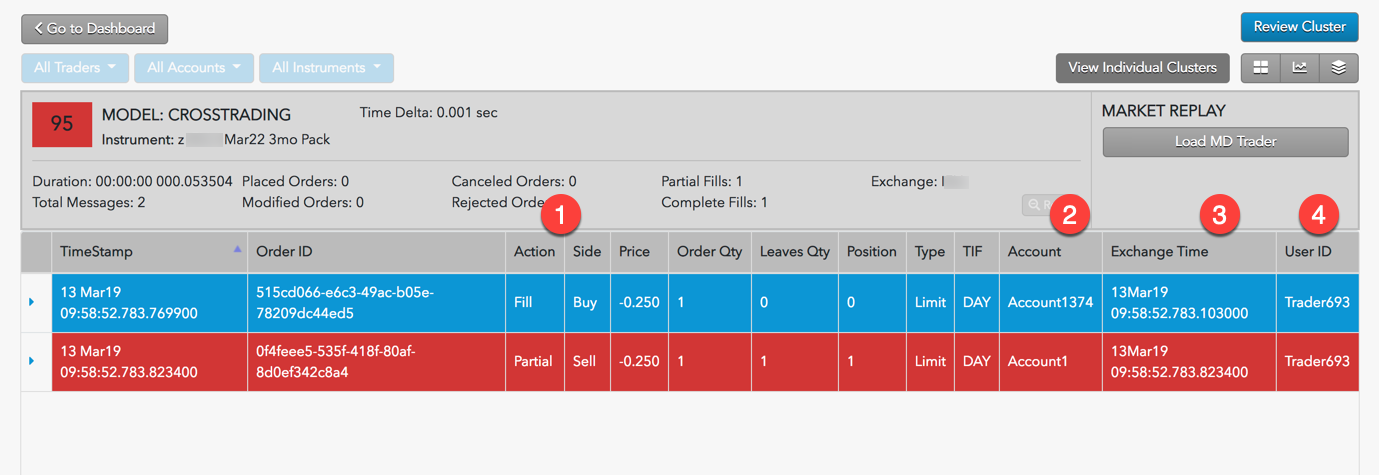

The Cluster Scorecard shows activity that could indicate a cross trade. Use this scorecard to get a closer look at the activity that triggered the cross trading score. The following image shows results from inspecting a cross trading cluster.

When reviewing Audit Activity for cross trading, check if:

- Fills were executed on opposite sides of the market for the same order quantity.

- The two transactions were executed using different accounts.

- The two transactions were executed within the same millisecond.

- The two transactions were executed with different trader IDs or the same trader ID.