Improperly Matched Trade Models

Roundtrip Wash Trading

A roundtrip wash trade is a form of uneconomic trading where a trader buys or sells an instrument then shortly reverses out of that position at the same price. Roundtrip wash trades can be used to generate artificial volume or to generate commissions for a broker.

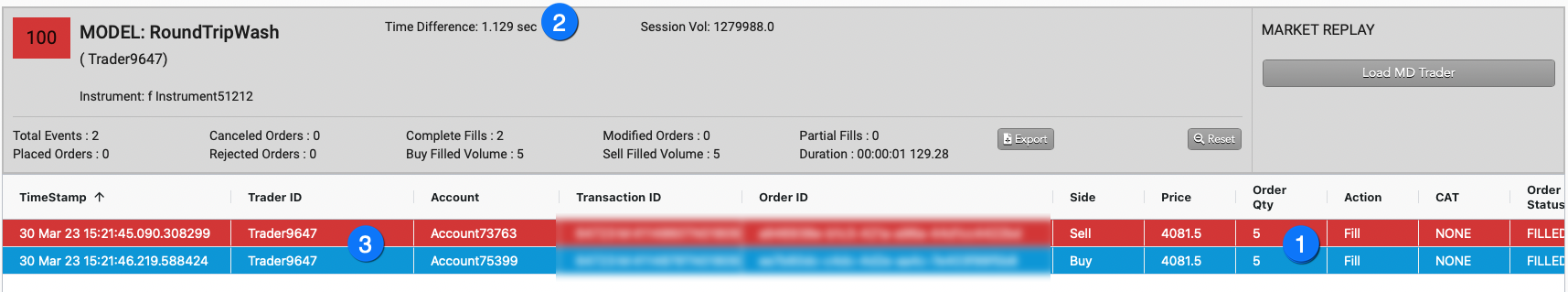

In TT Trade Surveillance, the Roundtrip Wash Model analyzes and scores potential round trip wash trades that occur within a short time period.

Scoring methodology

When evaluating a potential roundtrip wash trade, TT Trade Surveillance reviews each fill received and reviews subsequent fills for an opposite side action that would fully reverse the previous position. For example, if a trader bought 100 contracts of XYZ at $50, then a few seconds later sold 100 contracts of XYZ at $50, this would be flagged as a potential round trip wash. The instrument, volume and price all need to be an exact match within 2 minutes of the initial fill.

Score interpretation

TT Trade Surveillance sets the cluster risk score to 100 if a true roundtrip wash trade is detected; otherwise it sets the score to 0.

Identifying roundtrip wash trading

Use the Cluster Scorecard to get a closer look at the activity that triggered the roundtrip wash trading score. The Cluster Scorecard shows activity that could constitute a roundtrip wash trade.

- Fills were executed on opposite sides of the market for the same order quantity.

- The two or more transactions were executed within a similar time period.

- The two transactions were executed by the same trader ID.