Options Risk

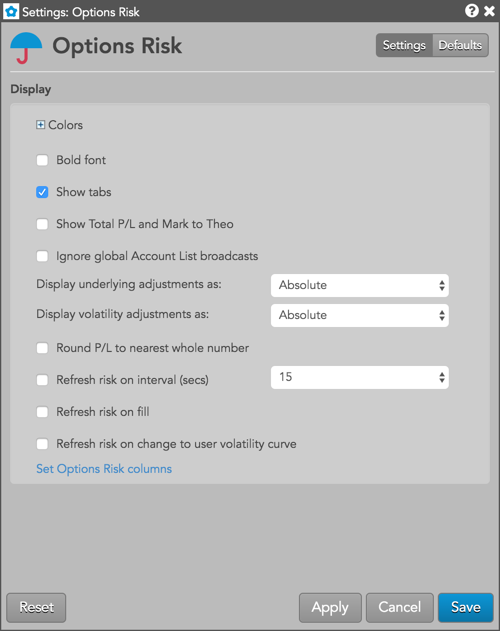

Options Risk Settings

Context Menu settings

- Open — Opens an order entry widget for a selected instrument. You can also open a Time and Sales widget or Charts widget seeded with the selected instrument.

- Create Manual Fill — Opens the Position Manager widget in Manual Fill mode for an instrument.

- Modify SOD — Opens the Position Manager widget in SOD mode for an instrument.

- Zoom — Allows you to zoom the widget between 50% and 150% percent of the default widget view using a slider control.

- Settings: Options Risk — Opens the local settings menu.

-

Colors: Allows you to customize or change the cell and column colors available in the widget.

-

Show tabs — Check to show tabs at the bottom of the widget. Uncheck to hide tabs.

-

Show Total P/L and Mark to Theo — Shows total P/L in the entire account for all product families with open positions.

-

Ignore global Account List broadcasts — Configures the widget to ignore account selections made in an Account List. When checked (enabled), the widget ignores account selections broadcast by an Account List widget.

-

Display underlying adjustments as — Select an absolute value or percentage adjustment to the price of the underlying. Used for estimating options risk.

-

Display volatility adjustments as — Select an absolute value or percentage adjustment to global volatility. Used for estimating options risk.

-

Round P/L to nearest whole number — Rounds P/L and Mark to Theo to the nearest whole number.

Refresh risk on interval — Sets an interval to automatically refresh options risk. When checked, the refresh button will be highlighted and flash three times before risk values are refreshed.

Refresh on fill — Sets the widget to refresh options risk when a fill is received.

Refresh on change to user volatility curve — Sets the widget to refresh options risk when user volatility is changed.

Local settings

These settings affect only the selected Options Risk widget. To update the default settings with these value for newly-opened Options Risk widgets, or to apply them to existing opened widgets, click Defaults in the Settings: Options Risk menu.

The following settings are available:

Options Risk column descriptions

| Column | Description |

|---|---|

| Expander | Shows/hides the expander icon, which is used to expand/collapse each product family in the Bucket column. |

| Active | Volatility value currently used for calculating theoretical call and put values. By default, it uses the automatically calculated vol curve for a contract. If user-defined vols are entered using the Vol Curve Manager, which fits the curve to the control points on the volatility curve, this column contains the user volatility values that are a result of the fitting process. |

| Bucket | Displays the product family, contract expiry, underlying futures contracts, and options contracts per expiry for which you have a position. |

| Position | Shows the open position in the underlying futures contract or options contract. |

| P/L | Displays your open P/L in the account for the underlying futures contract and expiry or options contract and expiry. |

| Mark to Theo | Open P/L calculated with the theoretical options value. |

| Delta | Call or put delta calculated using "user volatility" if it is provided by the user, or "fit volatility" if it is not. |

| Delta Decay | Measures the rate of change of an option's Delta with respect to the passage of time. |

| Gamma | Shows the change in delta per change in the underlying. |

| Vega | Shows the change in options value per change in volatility. |

| Theta | Shows the change in options value per change in time. Also known as time decay. |

| Rho | Shows the change in options value per change in interest rate. |

| Color | The rate of change in Gamma over a one day change in time (i.e., Gamma decay). |

| PctGamma | Percent Gamma is the rate of change in Delta for a 1% move in the underlying instrument. |

| OEV | Vega based option equivalence. Shows the equivalent number of ATM (at the money) options based on Vega. |

| UndPx | The price of the underlying futures contract. |