Electronic Eye

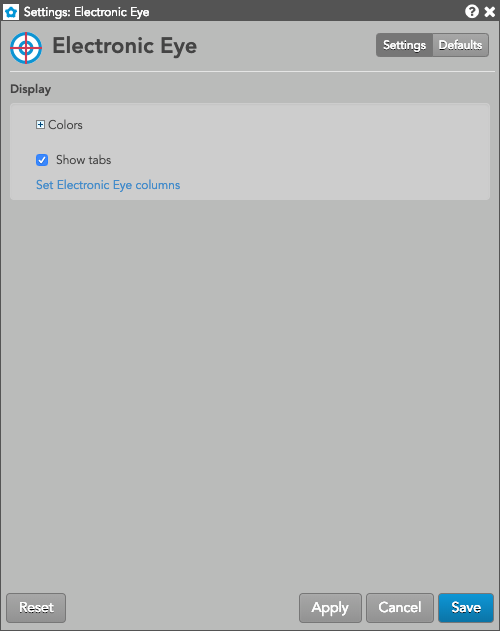

Electronic Eye settings

Available settings

These settings affect only the selected Electronic Eye widget. To update the default settings with these value for newly-opened Electronic Eye widgets, or to apply them to existing opened widgets, click Defaults.

You can customize the Electronic Eye using the following settings:

- Grid font size: Adjust the font size to suit your preferences and use bold text, if desired.

-

Colors: Allows you to customize or change the cell and column colors available in the widget.

- Show tabs: Check to show tabs at the bottom of the widget. Uncheck to hide tabs.

- Set Electronic Eye columns: Select the columns you want shown in the Electronic Eye.

Electronic Eye column descriptions

| Column | Description |

|---|---|

| Instrument | Options instrument |

| C/P | Whether the instrument is a call or put option. |

| Strike | Shows the underlying Futures contract price at which a holder can exercise their option to buy or sell the contract. The strike column reflects the range of the day by shading the strike. The high / low line indicators as seen on MD Trader® are displayed in the strike column relative to their position. |

| DTE | Number of days until the option expires. |

| Expiration Type | Type of expiration (e.g. monthly, weekly) associated with the options instrument. |

| UndPx | The price of the underlying instrument at the time of the fill. |

| BidQty | The total quantity working at the bid. |

| Bid | The best market bid price. |

| Sell Edge | Difference between the best bid and the theoretical value. |

| TV | The theoretical value of the instrument based on the user's volatility curve. |

| ATM Vol | At-the-market volatility. |

| Buy Edge | Difference between the best ask and the theoretical value. |

| Ask | The best market ask price. |

| AskQty | The total quantity working at the ask. |

| UV | User volatility values that are used for calculating theoretical call and put values. These user-defined vols are entered using the Vol Curve Manager, which fits the curve to the control points on the volatility curve. The user volatility values are a result of the fitting process. |

| UΔ | Delta calculated using the user-defined volatility. |

| IV | Implied volatility value. Implied volatilities are calculated using the midpoint of bid and ask prices. |

| IΔ | The delta calculated with the auto-fit volatility curve values provided by TT. |

| SV | Settlement volatility value, which indicates volatility calculated per strike using settlement prices. |

| SΔ | Delta calculated using the settlement volatility. |