Session Dominance

Session dominance is when a user trades a high percentage of the total volume for an instrument over an entire trading session. The Session Dominance Model in TT Trade Surveillance analyzes and scores clusters that may indicate when a single trader is dominating the filled volume of an instrument for the entire session.

Scoring methodology

TT Trade Surveillance computes a cluster score based on how similar the activity in the cluster matches trading activity that has drawn regulatory attention in other situations.

Higher scores indicate the trading activity within a cluster is more likely to risk regulatory concern. A company's risk monitors can use these scores to prioritize resources for investing which users' trading activity poses the most regulatory risk.

Session Dominance score interpretation

Each cluster is assigned a risk score on a sliding scale between 0-100. This score represents the probability that session dominance occurred during the duration of the cluster's trading activity.

Based on TT Trade Surveillance best practices, clusters that score over 75 are deemed to be “high risk” and should be the primary focus of users during their compliance reviews.

Session Dominance scorecard metrics

The Scorecard Metrics section measures the following statistics related to session dominance:

- Session Vol — Total traded volume for the instrument during the entire session.

- Trader Buy Filled Vol — Total Buy orders filled.

- Trader Sell Filled Vol — Total Sell orders filled.

- Trader Session Fill Vol — Total Buy and Sell orders filled for the session.

- Trader Vs Session — Ratio of the trader's session fill volume and total traded volume.

- Trader Buy Vs Total Fill Vol — Percentage of total session volume that are Buy orders.

- Trader Sell Vs Total Fill Vol — Percentage of total session volume that are Sell orders.

- Min Session Vol — Minimum traded volume for the session.

- Max Session Vol — Minimum traded volume for the session.

- LTP Session — Session Last traded price for the instrument.

- OpenPrice Session — Session opening price for the instrument.

- ClosePrice Previous Session — Previous closing price for the instrument.

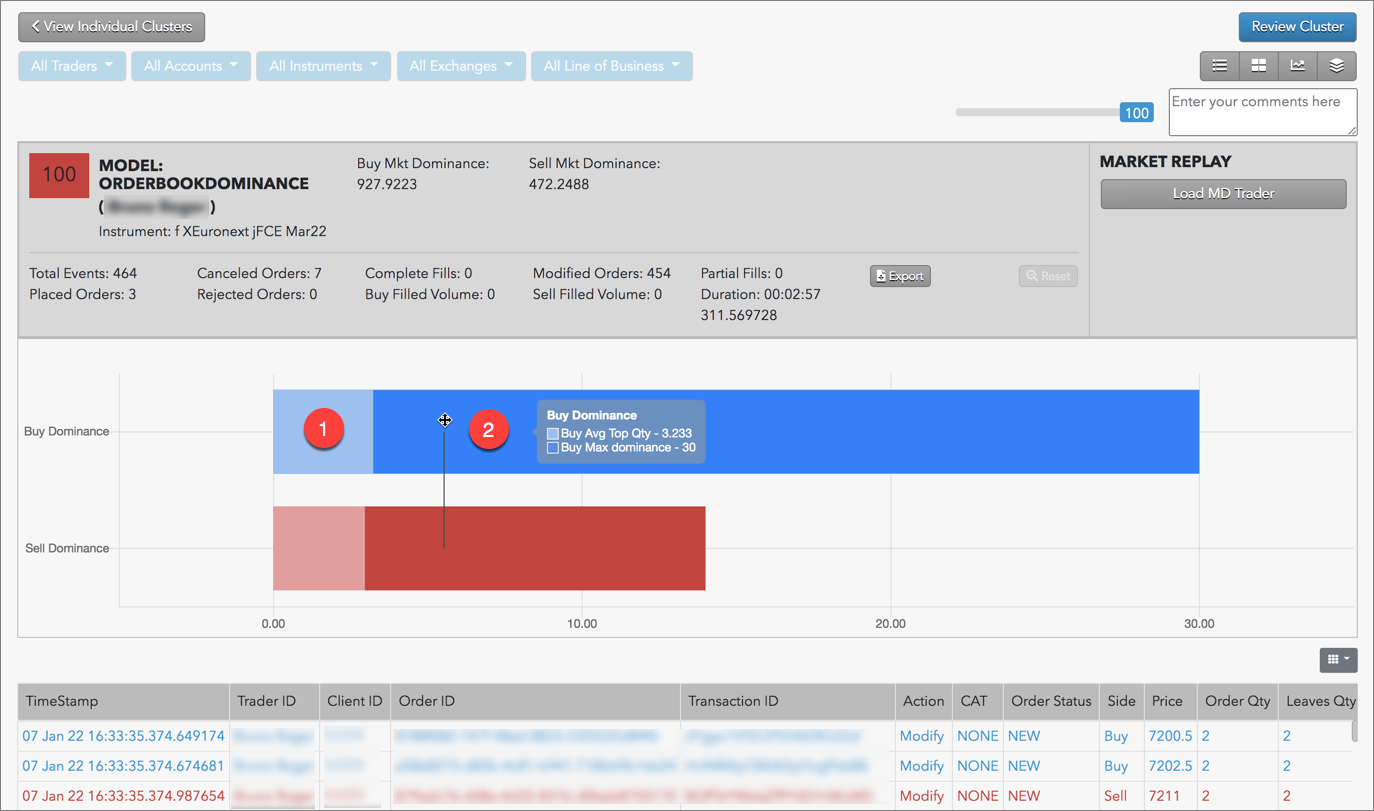

Identifying Session Dominance

Use the Cluster Scorecard to get a closer look at the activity that triggered the session dominance score. The audit trail at the bottom of the scorecard can provide an indication of a trader dominating the volume traded for an instrument.

In this example:

- The trader added volume on the Sell side to create the appearance of Sell-side pressure.

- The same trader submits Buy orders, which immediately fill.