TT Uncovered 3.0

Submitting an Uncovered Order with TT Uncovered 3.0

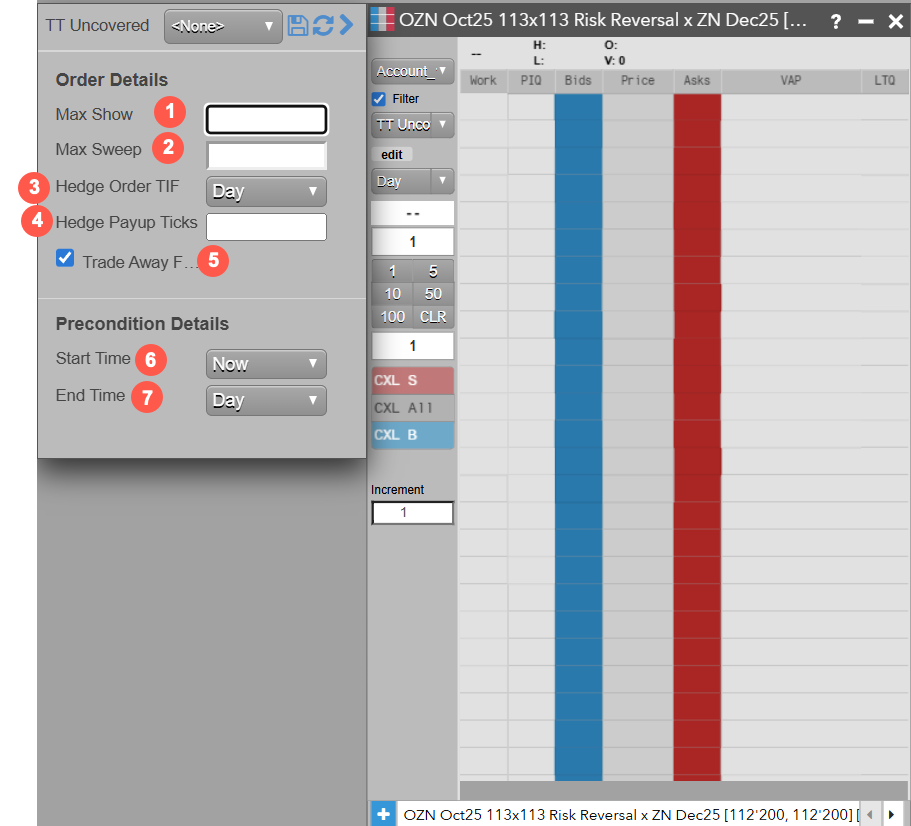

You can submit TT Uncovered synthetic spread orders the same way you submit orders for exchange-traded instruments. You can submit the spread order in MD Trader or Order Ticket by specifying the order type, TIF and quantity and price level.

- Max Show — Enter or edit the maximum quantity a parent order can passively rest on the option or UDS books. For example, if Max Post is set to 100, the algo will passively work the parent order in slices of 100 at a time. Once a slice is fully executed and all resulting futures allocations are hedged away, the algo will work the next slice of the order. If this field is left blank, it will default to the value in the Order Quantity field.

- Max Sweep — Enter or edit the maximum quantity a parent order can execute while sweeping resting synthetic quantity. For example, if Max Sweep is set to 100, the algo will trade the parent order in slices of 100 and hedge away all future allocations before trading the next slice of 100. If this field is left blank, it will default to the value in the Order Quantity field.

- Hedge Order TIF — Select the TIF (Time-in-Force) of the orders used to hedge away futures allocations resulting from trading UDS contracts. Hedge orders with a TIF of DAY will rest on the futures book until they execute. Hedge orders with a TIF of IOC will cancel back if they cannot immediately execute on the futures book. In the event a futures order with a TIF of IOC cancels back for this reason, the parent order will also cancel back to minimize the risk of the parent order becoming more unhedged.

- Hedge Payup Ticks — Enter a number of ticks to add to hedging futures orders to price them more aggressively. The default value for this field is 0, meaning that futures hedging orders will be priced so that the overall parent order aims to trade within the Soft Limit Price. However, by incrementing PayUp Ticks, these hedging orders can be priced more aggressively (thereby reducing leg risk) at the expense of the parent order potentially trading past the Soft Limit Price.

- Trade Away Futures — Leave this box checked to have the app trade away all futures allocations it receives from trading UDS contracts. If this box is unchecked, the app will not trade away futures allocations, though it will still calculate synthetic quotes and decide where to execute parent orders based on where the app would receive the most advantageous futures allocations.

- Start Time — Set Start Time to NOW to start working the parent order as soon as it is submitted. Alternatively, set Start Time to TIME and select a time to begin working the order in the field below.

- End Time — Set end time to DAY to work the parent order until the end of the current trading session. Alternatively, set End Time to TIME and select a time for the parent order to cancel if it has not already finished executing.