TT Uncovered 3.0

TT Uncovered 3.0 Configuration

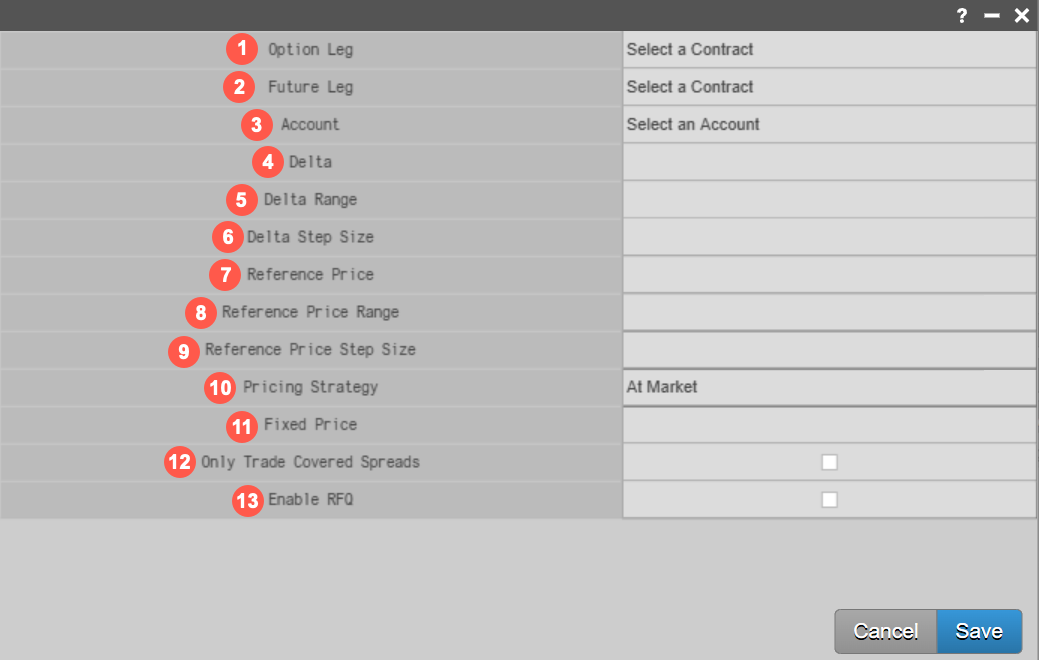

The TT Uncovered 3.0 configuration dialog box provides you with the parameters and settings to configure a synthetic UDS. The dialog box opens after clicking Create or on an existing synthetic UDS that was already created by TT Uncovered 3.0.

- Option Leg — The Outright option or Strategy the user wants to create an uncovered UDS with.

- Future Leg — The expiry of the hedging future leg that will be used to create UDS for the selected option or option strategy.

- Account — Select the account on which to trade an uncovered order and send RFQs.

- Delta — Enter the Delta used to generate the chain of UDS that will comprise the synthetic quote. The delta being specified is the delta of the option, not the center delta of the USD being created.

- Delta Range — Select the range of deltas used when creating the UDS chain.

- Delta Step Size — Select the step size of the delta used when creating the UDS chain.

- Reference Price — Reference Price used when creating the UDS chain. For example, if Center Delta is 0'12 (and the instrument ticks in values of 0'01), Reference Price Step Size is 3, and Reference Price Range is 2, the app will attempt to create UDS for all specified deltas with the following list of reference prices: 0'06, 0'09, 0'12, 0'15, 0'18. Note - Reference Price is prepopulated and can be adjusted by the user.

- Reference Price Range — Select the range of reference price ticks used when creating the UDS chain.

- Reference Price Step Size — Select the step size of the reference price ticks used when creating the UDS chain.

- Pricing Strategy — “At Market” or “Fixed Price”

- Fixed Price — Select the Fixed Hedge Price if “Fixed Price” is selected under Pricing Strategy

- Only Trade Covered Spreads — Determines whether to include the direct option liquidity in the synthetic quote and whether to include it in the execution plan.

- Enable RFQ — If this box is checked, the app will send RFQs on instruments in a synthetic quote that are widely quoted and not being actively traded. RFQs are sent in a conservatively rate-limited manner so that the exchange is not flooded with RFQs in the case that the user is monitoring many synthetic quotes that incorporate a large number of UDS.

For example, if Delta is 3, Delta Step Size is 2, and Delta Range is 2, then the application will attempt to create UDS for all specified reference prices with the following list of delta values: -7, -5, -3, -1, 1.

Note Delta is prepopulated and can be adjusted by the user