Risk Limits

Price Drift Checks

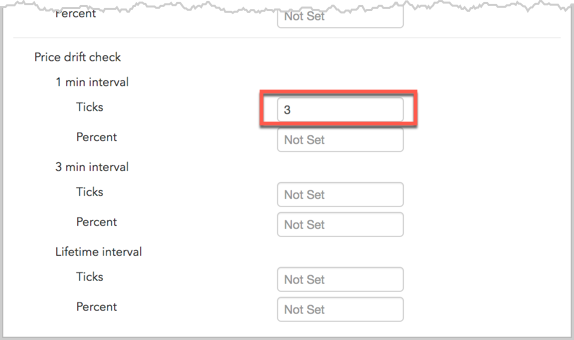

As an administrator you can configure price drift checks for child orders of any TT slicer order type. The configured price drift settings constrain order entry by either the number of ticks or a percentage price move over a specified time interval.

Note Price drift checks are only applied to child orders of TT Iceberg, TT Time Sliced, TT Time Duration, TT Volume Sliced, TT Volume Duration, and TT TWAP.

The price drift checks are configured as part of the account position limits settings for outrights (single or all contracts), spreads/strategies, and inter-product spreads. The checks are applied to an order based on the price of the previous order within a one or three minute rolling time interval (1 min interval and 3 min interval settings), or based on the price of the initial order (Lifetime interval setting).

Price drift check example

In the following example, Ticks are set to "3" for a 1 min interval for trading CME ES Sep 19 contracts using account "ABCDEF", and a user submits submits a 100 lot TT Time Sliced order configured to disclose one 10 lot order every 30 seconds with a relative price using this account.

Based on the price drift check, the price of the newly submitted order is checked against the price of the earliest order submitted within the last minute:

- For the first order submitted, there are no previous orders so the check is ignored.

- For the second order submitted, the price of the previous order is compared.

- For the third order, the price of the 1st order is compared (earliest child order submitted within the last one minute interval).

If the difference between the price of the earliest submitted order and the new order price is outside the "3" tick range, the new order will be rejected and the TT Time Sliced parent order will fail.