Risk Limits

Account Position Limits

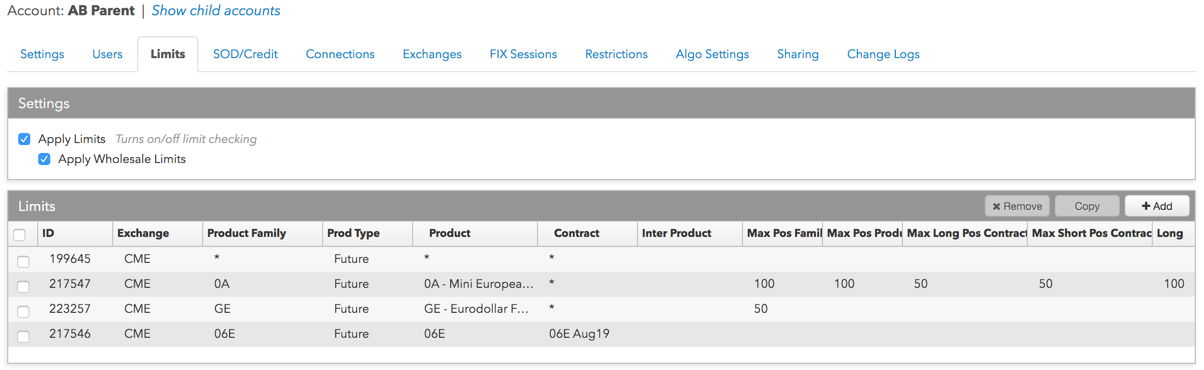

On the Accounts page, select an account and use the Limits tab to define position limits for the account. On this tab you can also configure risk for Block/Cross trades and Spread/Strategy risk limits for an account.

If configured, product limits apply to the aggregate trades of each sub-account (child account), as well as to any trades made using the parent account itself. If a limit is not set, then that limit is not considered as part of pre-trade risk checks.

You can also configure limits for interproduct Spreads and Strategies, which have legs in different products (e.g., GE and GLB) or different product types (e.g., a Future leg and an Option leg).

Maximum position and order quantity limits are set as the number of contracts, lots, ticks, MW/h, etc., based on the product type and/or if it's an energy product that trades in flow.

Position limit settings

Settings are available on the Accounts | Limits tab for the following:

- All products or contracts, including product families

- Outrights for a single contract

- Outrights for all contracts per product

- Spreads and strategies

- Inter-product spreads and strategies

Position limit examples

For more details about how positions are calculated and how limits are set for different risk scenarios, refer to the following related topics: