EPEX SPOT

EPEX SPOT Overview

Overview

Operating out of Paris, EPEX SPOT is an independent subsidiary of the European Energy Exchange (EEX) covering power markets in Austria, Belgium, Denmark, Germany, Finland, France, Luxembourg, the Netherlands, Norway, Poland, Sweden, the UK and Switzerland. Clients trading EPEX SPOT intraday markets on TT will be able to leverage the platform’s sophisticated algorithmic and other automated trading tools, as well as its risk management capabilities across the trade lifecycle. EPEX power instruments display prices in Euros (with two digit decimal precision) and quantities in MWh (with one digit decimal precision).

EPEX SPOT Exchange API

TT® supports the following:

- Prices: M7 v6.15 / AMQP

- Orders: M7 v6.15 / AMQP

Matching Algorithms

EPEX offers two types of matching algorithms. The exchange uses price-time priority when matching orders meaning that it first matches the oldest buy and sell orders submitted at the same price limit.

XBID (Cross-Border Intra-Day Matching)

Provides matching for continuous trading of cross border energy contracts. The XBID system provides a shared order book functionality which allows for consistent prices in the market regardless of the region.

EPEX SPOT Matching Engine

EPEX SPOT's trade matching engine is hosted by Equinix GmbH in Frankfurt, Germany.

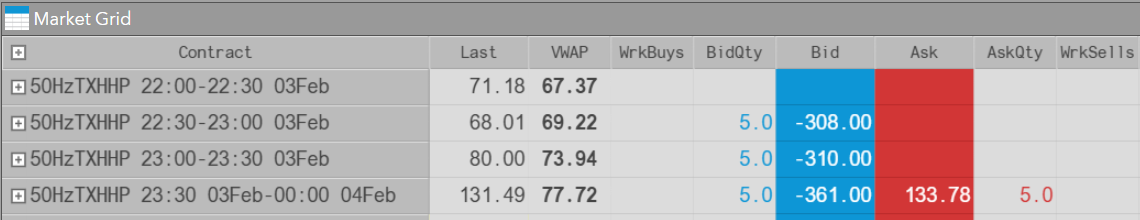

Market Grid

The Market Grid provides an optional VWAP column that is populated for instruments on the EPEX exchange. Right-click the column header and add this column from the Edit Columns menu.

Market Depth

Currently, the exchange provides a maximum of twenty (20) levels of market depth for all products. TT receives market depth directly from the exchange and forwards it to the client trading applications.

EPEX SPOT Trading Hours

TT will support EPEX Continuous Intraday Trading, which is made up of both XBID and Local phases across all EPEX Delivery Areas. At any time during a 24-hour period, there will be contracts that are tradable. Please see the Product List below for more detail.

For more information, refer to the EPEX Supported Products section.

Supported Exchange Functionality

-

Real-Time Market Data

-

Reference Data

-

Basic Order Entry

-

Shared Order Book

-

FIX Drop Copy

-

Order Throttling messages

-

Basket Orders (via FIX)

-

Position in Queue

Connectivity Options

Trading members must contact EPEX and contract separately for connectivity.

Note Only connectivity through co-location is possible with TT.