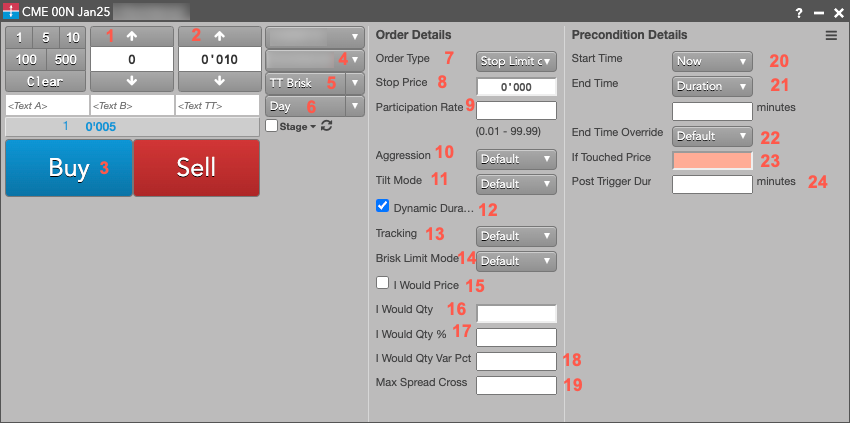

TT Brisk

A TT Brisk order attempts to fill the order closer to when the order enters the market based on the order's Start Time. TT Brisk orders use the current day's trades and market data to minimize risk-adjusted slippage relative to the order's arrival price by creating a front-weighted trajectory vs forecast volume profile.

For more information, refer to the TT Brisk Order section of the Trade help.

| Number |

Name FIX Tag |

Type |

Required

|

Updatable

|

FieldLocation | Description |

| (constructor variable) | Instrument | TRUE | FALSE | OrderProfile | Instrument for synthetic parent order | |

| 1 |

OrderQty |

Quantity | TRUE | TRUE | OrderProfile | Order quantity for synthetic parent order |

| 2 |

LimitPrice |

Price | TRUE | TRUE | OrderProfile | Limit price for synthetic parent order |

| 3 |

OrderSide |

TRUE | FALSE | OrderProfile | Side for synthetic parent order | |

| 4 |

Account |

Account | TRUE | FALSE | OrderProfile | Account for synthetic parent order |

| 5 | strategyIdentifierTag Tag9100 |

String_t | TRUE | FALSE | UserParameters | Set to "BRISK" |

| ParentVendorAlgoType | String_t | FALSE | FALSE | UserParameters | ||

| ParentVendorAlgoID | String_t | FALSE | FALSE | UserParameters | ||

| 6 |

TIF |

TRUE | FALSE | UserParameters | Only supports Day orders | |

| 7 |

OrderType |

TRUE | TRUE | OrderProfile | Order Type for synthetic parent order. | |

| 8 |

StopPx |

Price | FALSE | TRUE | OrderProfile | Synthetic parent order stop price |

| 9 | Participation Rate Tag9103 |

Float_t | FALSE | TRUE | UserParameters | If provided, sets an optional cap on the parent orders participation rate during the life of the order |

| 10 | Aggression Tag9111 |

Int_t | FALSE | TRUE | UserParameters | Influences how strongly to tilt order trajectory (TT Close, TT Brisk), how

tightly to track max participation (TT POV, TT Scale POV), or how tightly to follow an order

schedule (TT TWAP+, TT VWAP+). For TT Brisk orders, this means: Lower aggression (e.g. 0) trades close to a normal VWAP curve. Mid/Default aggression (e.g. 5) trades faster upfront than VWAP based upon product-specific optimizations to balance the risk of market impact vs price drift. High aggression (e.g. 10) trades most quickly with respect to a standard VWAP, expressing greater preference for minimizing price drift. Valid enums 0-10 |

| 11 | Tilt Mode Tag9112 |

Int_t | FALSE | TRUE | UserParameters | Determines the methodology used to tilt away from the a normal Volume-Weighted

Average Price (VWAP)-based schedule for TT Brisk and TT Close algos. 1: - Model Driven: Uses the instrument's liquidity and volatility profile to determine the strength of the tilt. This setting results in the tilt, compared to a normal VWAP schedule, being more pronounced with higher Aggression setting, higher instrument liquidity, higher instrument volatility, and longer order duration. 2: Simple - The strength of the tilt is determined by the Aggression level and applied as a simple, linear shift vs a VWAP+ order trajectory. Higher Aggression levels will result in the order being shifted further away from VWAP+. |

| 12 | DynamicDuration Tag9302 |

Boolean_t | FALSE | TRUE | UserParameters | If set to True, orders submitted may finish ahead of any defined End Time. If not selected, parent orders will seek to utilize the full trading window as defined by the EffectiveTime and ExpireTime/DurationRCM. |

| 13 | Tracking Tag9145 |

Int_t | FALSE | TRUE | UserParameters | Allows trader to select between trend following and reversionary

behavior. Supported values include: 1: AP-Revert-Low 2: AP-Revert-Med 3: AP-Revert-High 4: AP-Trend-Low 5: AP-Trend-Med 6: AP-Trend-High |

| 14 | Brisk Limit Mode Tag9115 |

Int_t | FALSE | TRUE | UserParameters |

Specifies whether the order should get more aggressive when opposite side quote price is at the limit price. This setting can be used to manage fill rate risk, increasing the expected fill rate if the market is nearing the limit price, at the cost of higher expected slippage on executed quantity. Possible values include: 0: Default (Off) 1: Aggressive More At Limit - When the opposite side quote price is equal to the limit price, the order will monitor liquidity conditions tick by tick and send extra IOC (Immediate or Cancel) orders to opportunistically take additional liquidity before the market runs away. 2-4: Faster Near Limit (Mild, Medium, Strong) - In addition to the above behavior, the order will dynamically strengthen the tilt and trade faster as the market price approaches the limit price. |

| 15 | I Would Price Tag9106 |

Price_t | FALSE | TRUE | UserParameters | Price at which you would like to aggressively attempt to fill your order,

regardless of the algorithm logic. Order aggressively tries to fill if the instrument reaches this price, irrespective of volume based tracking objectives. Should be lower than limit and arrival time ask prices for BUY orders, higher than limit and arrival time bid prices for SELL orders. |

| 16 | IWouldQty Tag9215 |

Int_t | FALSE | TRUE | UserParameters | When set to any value greater than 0, I Would Qty setting equals the minimum top of book quantity required before the order will cross the spread. |

| 17 | IWouldQtyPct Tag9216 |

Float_t | FALSE | TRUE | UserParameters | Similar to I Would Qty, but set as a percent of the order quantity. Note: The field represents the number as a percent and should not be submitted as a decimal: a value of 70 equals 70%. |

| 18 | IWouldQtyVariancePct Tag9225 |

Float_t | FALSE | TRUE | UserParameters | Randomizes the I Would Qty and I Would Qty % thresholds by a specified percent in each direction. Note: This field represents the number as a percent and should not be submitted as a decimal. For example, a value of 10 equals 10%. For example, if I Would Qty equals 100 and I Would Qty Variance % equals 20, the I Would Qty behavior will be triggered based on available size being between 80-120, depending on randomized value selected within the variance range. |

| 19 | MaxSpreadCrossTicks Tag9221 |

Int_t | FALSE | TRUE | UserParameters | If greater than 0, an order will not cut or cross a bid-ask spread that is more than the specified amount wide. |

| 20 |

Start Time |

UTCTimstamp_t | FALSE | TRUE | UserParameters | If not set, defaults to Now |

| 21 |

End Time |

UTCTimstamp_t | FALSE | TRUE | UserParameters | End Time and Duration are mutually exclusive and only one should be

set; if neither value is set the parent order will default to the market close time of the

Instrument. The duration is interpreted as the number of minutes the parent order should be active from Start Time. |

| Duration Tag9202 |

Int_t | FALSE | TRUE | UserParameters | ||

| 22 | EndTimeOverride Tag9203 |

Int_t | FALSE | TRUE | UserParameters | Overrides End Time, Duration, or the default with one of several product hours related values. Available options are: 0: None (Default) 1: Last Session Close 2: Next Session Close 3: Settlement Note: If the current time is in the final continuous trading session of the day Next Session Close and Last Session Close reference the same time. |

| 23 | IfTouchedPrice Tag9190 |

Price_t | FALSE | TRUE | UserParameters | Price at which parent order is triggered If Touched |

| 24 | PostTriggerDuration Tag9191 |

Int_t | FALSE | TRUE | UserParameters | If utilizing OrderType Stop or Stop Limit, or if utilizing IfTouchedPrice, PostTriggerDuration should be utilized in lieu of End Time or Duration. Defines the number of minutes from the point a parent order is triggered to begin working the order should be active. |