Options Trade Monitor

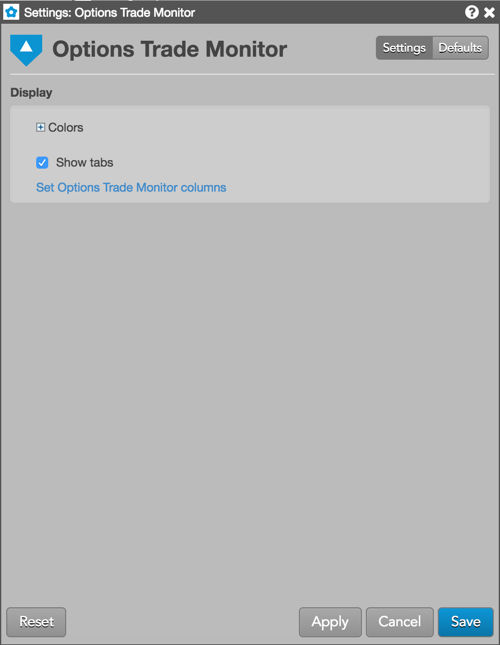

Options Trade Monitor settings

Available settings

These settings affect only the selected Options Trade Monitor widget. To update the default settings with these value for newly-opened Options Trade Monitor widgets, or to apply them to existing opened widgets, click Defaults.

You can customize the Options Trade Monitor using the following settings:

-

Grid font size: Adjust the font size to suit your preferences and use bold text, if desired.

-

Colors: Allows you to customize or change the cell and column colors available in the widget.

-

Show tabs: Check to show tabs at the bottom of the widget. Uncheck to hide tabs.

-

Set Options Trade Monitor columns: Select the columns you want shown in the widget.

Options Trade Monitor column descriptions

| Column | Description |

|---|---|

| Date | Date the trade occurred |

| Time | Time the trade occurred |

| Instrument | The name and contract expiry for the instrument or strategy. |

| C/P | Whether the instrument is a call or put option. |

| Strike | Shows the underlying Futures contract price at which a holder can exercise their option to buy or sell the contract. The strike column reflects the range of the day by shading the strike. The high / low line indicators as seen on MD Trader® are displayed in the strike column relative to their position. |

| Type | The type of instrument or options strategy. |

| Qty | Shows the requested quantity if it's submitted with the RFQ for a contract. |

| Price | Price of the order or fill. |

| TV | The theoretical value of the instrument based on the user's volatility curve. |

| Edge | Edge gained (or lost) with the trade. |

| UndPx | Price of the underlying instrument. |

| IV | Implied volatility value. Implied volatilities are calculated using the midpoint of bid and ask prices. |

| IΔ | The delta calculated with the auto-fit volatility curve values provided by TT. |

| IGamma | Gamma calculated using implied volatility. |

| ITheta | Shows the change in options value per change in time, which is also known as time decay. Based on TT auto-fit volatility curve values. |

| IVega | Shows the change in options value per change in volatility based on the TT auto-fit volatility curve. |

| IRho | Shows the change in options value per change in interest rate. Based on TT auto-fit volatility curve values. |

| Volume | The total traded quantity for the session. |