Options Chain

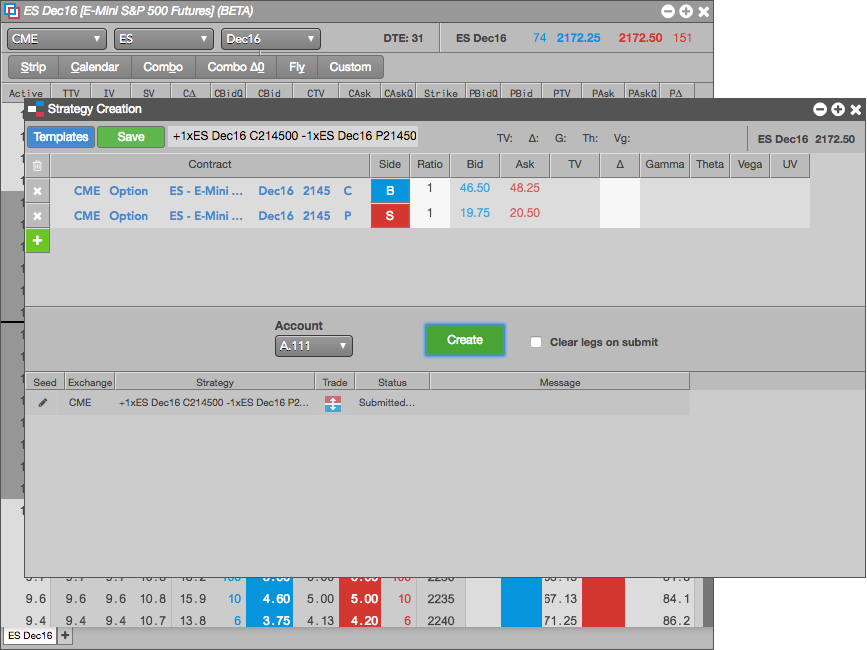

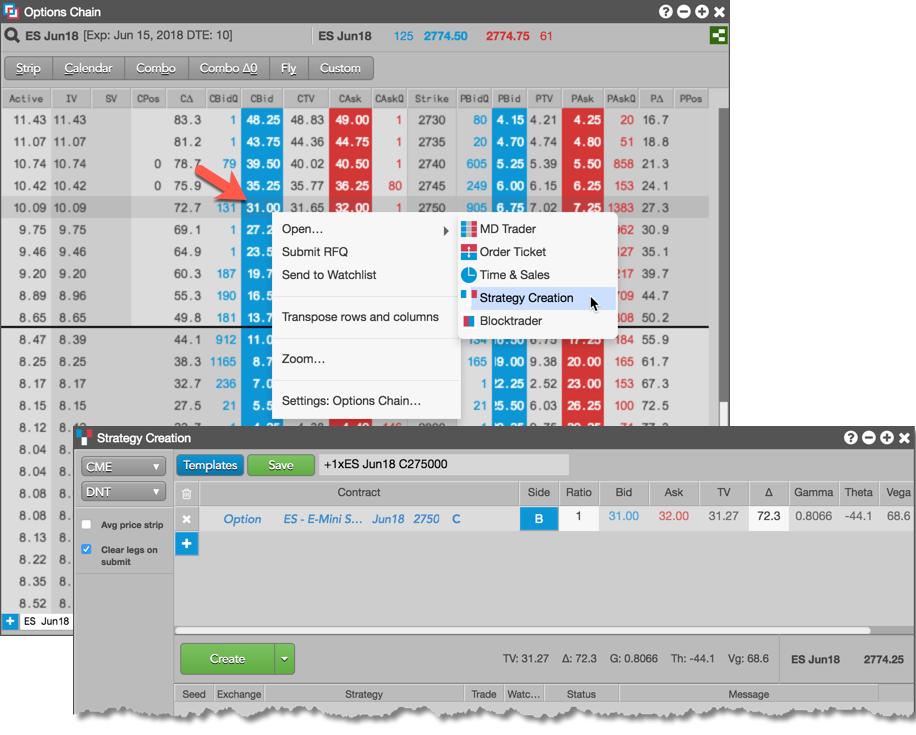

Strategy creation in the options chain

From the Options Chain, you can create a synthetic options spread as a user-defined strategy in the Strategy Creation widget. These spreads can be published to the market by the exchange and made available from trading in the current trading session.

The Options Chain provides quick access to the following commonly-used strategies as well as a custom option to define your own strategies.

- Strip: Series of same-side orders for a range of consecutive months

- Calendar: Two opposite-side orders for different months

- Combo: Orders for both call and put options for the same strike price

- Combo Δ0: Covered combo in which the options are hedged by the underlying instrument with a neutral delta

- Fly: Butterfly strategy with two legs equidistant from leg on the opposite side.

- Custom: User-defined combination of legs, quantities, and ratios

When you select one of the strategies, the Options Chain automatically ensures that strategies contain the proper relationship, quantities, and ratios for the strategy legs. For example, if you select a Combo strategy and select one end of the range, the Options Chain automatically adds all of the intervening legs.

In the Options Chain, you can also send an individual options contract to the Strategy Creation widget to facilitate building a strategy. Right-click the data unique to the Call or Put options contract and select Open | Strategy Creation to open the widget seeded with the selected contract.

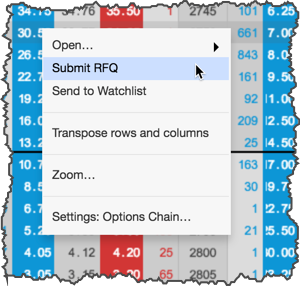

Submitting an RFQ from the Options Chain

Note: Ensure that you have selected an account for the specific exchange where you'll be submitting the RFQ. Account selection for RFQs is set up in Preferences | Accounts.

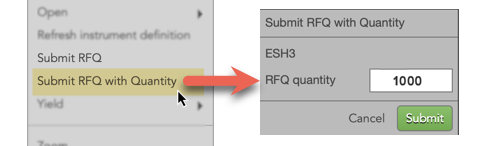

In addition, you can submit an RFQ for a single options contract in the Options Chain. Right-click the data unique to the Call or Put options contract and select Submit RFQ or Submit RFQ with Quantity.

Note Often it is useful to include the quantity on an RFQ for large orders because the larger size may impact the price quotes received back from the marketplace. Some markets are enabled with a Submit RFQ with quantity option in the context menu. When selected, you can override the default RFQ quantity set in General Preferences with a custom quantity before submitting.

Note: If you do not select an RFQ routing account prior to submitting the RFQ, you'll receive the following widget error message: