Autospreader

Autospreader Configuration Interface

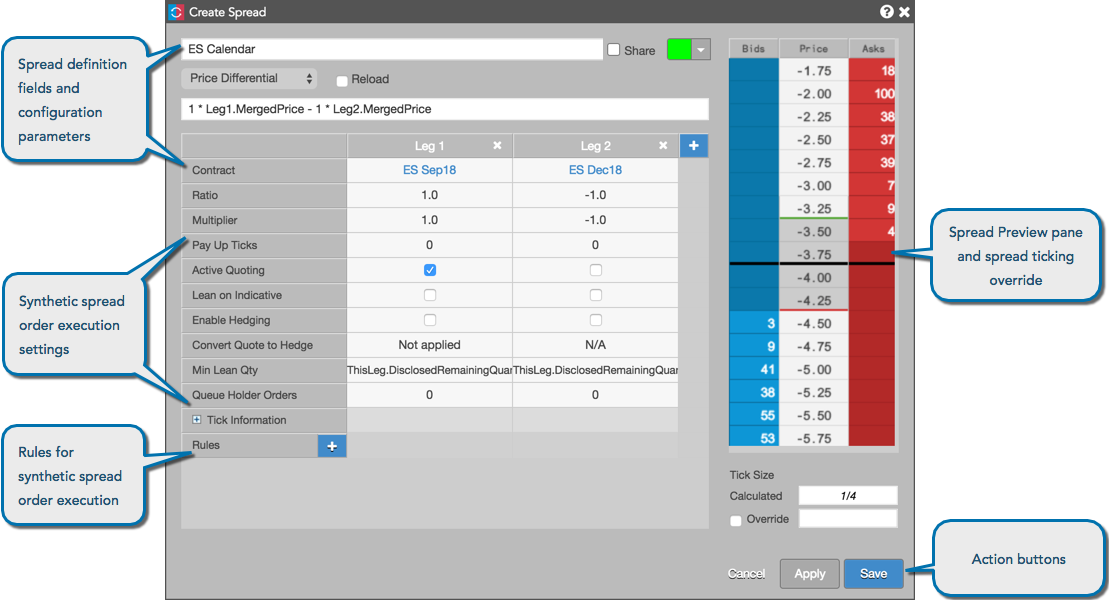

The Autospreader Configuration dialog box provides you with the parameters and settings to configure a synthetic spread and control its behavior as it trades. The dialog box opens after clicking Create or Edit in the Autospreader Manager.

In these panes you can configure the legs of your spread, indicate how to build the synthetic book, configure trade ratios, and preview your spread before launching it into the market. You can also view the calculated tick size based on the contract tick size and Spread Multiplier of the legs, or override it with your own. Use the ticking fields to review the ticking relationship between the selected products and the effect on the spread with a one-tick move in an outright leg. You can also add available quoting and hedging rules to the legs of your spread using the Rules field.

The Autospreader Configuration dialog box consists of the following:

- Spread configuration and definition — Includes fields for defining a spread name, selecting a spread formula, defining a custom spread formula editor, and setting a color to identify spread orders. Configuration settings provide the ability to select a contract and set the ratio and multiplier for each leg of the synthetic spread. Click the + to add legs to the spread.

- Order execution settings — Order execution settings provide the ability to configure quoting behavior (active quoting, queue holder orders) and hedging behavior (payup ticks, min lean qty).

- Order execution rules — Add quoting and hedging rules to each leg.

- Spread preview ladder — Provides the ability to view a synthetic spread definition and configuration before launching it into the market. The tick override adjusts the ticking of the synthetic spread instrument and the changes to the synthetic market are displayed in the preview ladder.

- Action buttons — Allow you to cancel or apply changes, and save your spread definitions and configurations.