Strategy Creation

CME strategy creation

The CME Group accepts the following strategy types:

- Combo — Any options spread where the legs are a combination of outright options, exchange-defined options strategies, or listed user-defined options strategies.

- Covered — A strategy where options and futures are traded as a spread. The legs of the spread also can be spreads or exchange-defined and user-defined strategies. These strategies require a futures contract price and delta.

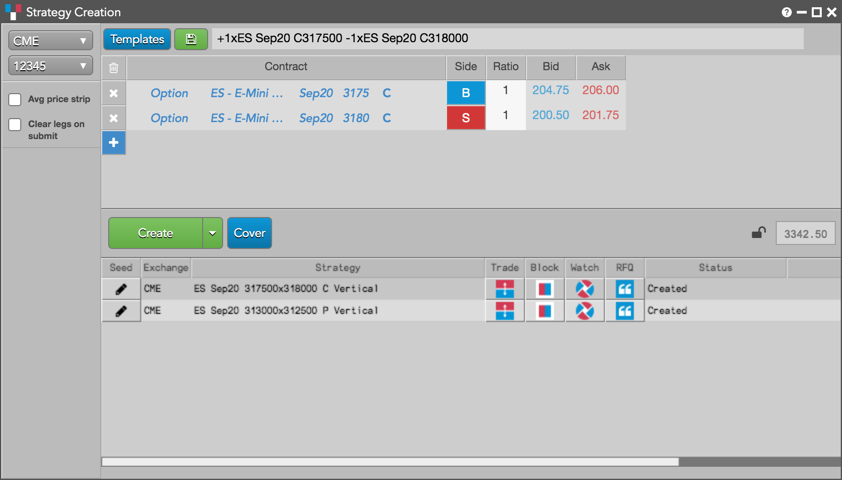

The following is an example of a CME combo strategy.

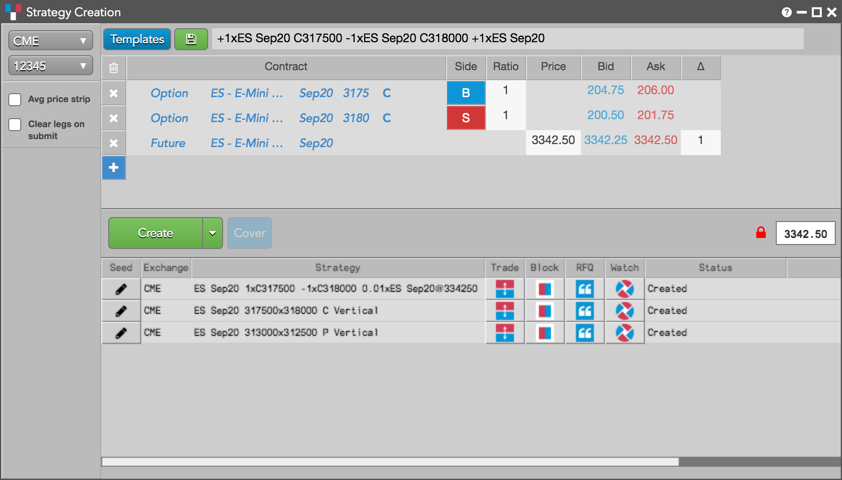

The following is an example of a CME covered options strategy. TT allows up to three different underlying futures legs to cover the options spread.

Note: Even though you submit either a Combo or Covered strategy, the CME Group validates the strategy against one of their supported CME user defined spread and CME options spread strategy types. If the legs match one of the CME strategy types, CME publishes the strategy to all market participants, but with their CME strategy name. For example, if you submit a three-legged Combo option strategy to CME, the exchange will accept and validate the strategy and send it back to you and all participants as a Butterfly strategy.

The following CME order types are supported for Covered and Combo user-defined strategies:

- Limit

- Iceberg

When submitting orders for user-defined strategies, TT synthetic order types (algos) are supported. Orders for Covered strategies are submitted as Day orders, only. However, Combo strategies can be submitted with Day, GTC, FOK, IOC, or GTDate order qualifiers. Strategies expire at the end of each trading session.