Charts

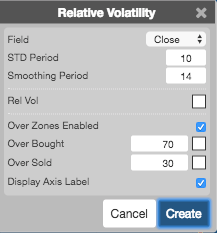

Relative Volatility

The Relative Volatility indicator measures the standard deviation of price changes within a defined range of lookback periods to determine market direction. The indicator value is normalized as a percentage between 0 and 100.

Configuration Options

- Field: Price or combination of prices to use as the base for average calculations. Possible values include:

- Open

- High

- Low

- Close

- Adjusted Close

- HL/2 \( \left ( \frac{High + Low}{2} \right ) \)

- HLC/3 \( \left ( \frac{High + Low + Close}{3} \right ) \)

- HLCC/4 \( \left ( \frac{High + Low + Close + Close}{4} \right ) \)

- OHLC/4 \( \left ( \frac{Open + High + Low + Close}{4} \right ) \)

- STD Period: Number of standard deviation periods to use in the calculation.

- Smoothing Period: Number of smoothing periods to use in the calculation.

- Color Selectors: Colors to use for graph elements.

- Over Zones Enabled: Whether to shade the area between the plot and the horizontal overbought and oversold levels.

- Over Bought: Overbought quantity

- Over Sold: Oversold quantity

- Over Bought:

- Over Sold:

- Display Axis Label: Whether to display the most recent value on the Y axis.

Formula

\[ RVI = 100 \times \frac{Usum}{(Usum + Dsum)} \]

where:

- Usum is the averaged sum of STD for positive days

- Dsum is the averaged sum of STD for negative days